ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Femi _______ increase production from 4 to 5 fire engines because the _______ dominates in this scenario.

Blank 1 options:

should

should not

Blank 2 options:

output effect

price effect

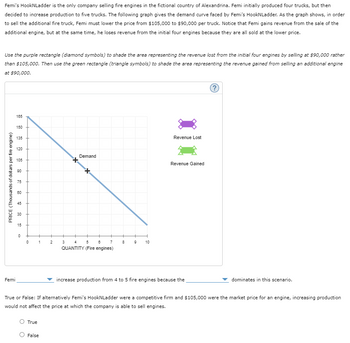

Transcribed Image Text:Femi's HookNLadder is the only company selling fire engines in the fictional country of Alexandrina. Femi initially produced four trucks, but then

decided to increase production to five trucks. The following graph gives the demand curve faced by Femi's HookNLadder. As the graph shows, in order

to sell the additional fire truck, Femi must lower the price from $105,000 to $90,000 per truck. Notice that Femi gains revenue from the sale of the

additional engine, but at the same time, he loses revenue from the initial four engines because they are all sold at the lower price.

Use the purple rectangle (diamond symbols) to shade the area representing the revenue lost from the initial four engines by selling at $90,000 rather

than $105,000. Then use the green rectangle (triangle symbols) to shade the area representing the revenue gained from selling an additional engine

at $90,000.

PRICE (Thousands of dollars per fire engine)

Femi

165

150

135

120

105

90

75

60

45

30

15

0 + + +

0

1 2

True

Demand

False

3 4 5 6 7

QUANTITY (Fire engines)

8

9

10

Revenue Lost

Revenue Gained

increase production from 4 to 5 fire engines because the

(?)

True or False: If alternatively Femi's HookNLadder were a competitive firm and $105,000 were the market price for an engine, increasing production

would not affect the price at which the company is able to sell engines.

dominates in this scenario.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- question 11 please.arrow_forward5. The relationship between marginal and average costs Consider the following scenario to understand the relationship between marginal and average values. Suppose Kenji is a professional basketball player, and his game log for free throws can be summarized in the following table. Fill in the columns with Kenji's free-throw percentage for each game and his overall free-throw average after each game. Game Result Season Total Game Free-Throw Percentage Average Free-Throw Percentage Game 1 80 2 UAWN 8/10 4/10 2/8 2/4 6/8 8/10 12/20 14/28 16/32 22/40 80arrow_forwardplease correctly explains each option correct or incorrct not copy pastearrow_forward

- Question 29arrow_forwardent-4.docx cetumentGrp Assignment 4. Saved to this Pd v Layout References Mailings A A™ | Aa- | Ap -I A. DA = = = |- |- B demand. daho Review if necessary. Paragraph View ENT Help For a particular video game, the company sells 160 (thousand) copies of the game when the (thousand) copies of the game. price of the game is $55. However, when they change the price to $45, the company sells 240 1 AaBhCcDdi AaBbCcDdi AalbC Đới 1 List Para... Normal 1 No Spac.... Styles a. As part of the process of finding the price elasticity of demand, what is the percent change in quantity using the midpoint method? Round your answer to 4 decimal places ECON 150: Microeconomics b. As part of the process of finding the price elasticity of demand, what is the percent change in price using the midpoint method? Round your answer to 4 decimal places if necessary. C. Using parts a and b, calculate the price elasticity of demand. Round your answer to 2 decimal places if necessary. Fourarrow_forwardPlease give me full explanation Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism.Answer completely.You will get up vote for sure.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education