FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please help me find the

Thanks,

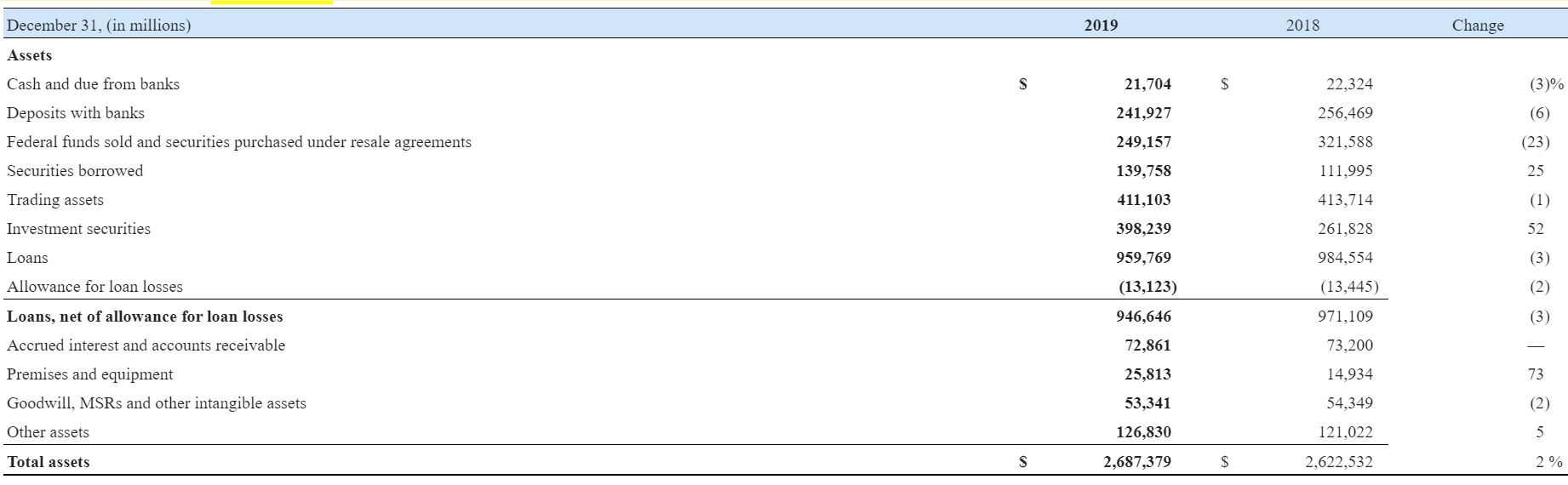

Transcribed Image Text:December 31, (in millions)

2019

Change

2018

Assets

Cash and due from banks

Deposits with banks

Federal funds sold and securities purchased under resale agreements

21,704

22,324

(3)%

241,927

256,469

(6)

249,157

321,588

(23)

Securities borrowed

139,758

111,995

25

Trading assets

411,103

413,714

(1)

Investment securities

398,239

261,828

52

Loans

959,769

984,554

(3)

Allowance for loan losses

(13,123)

(13,445)

(2)

Loans, net of allowance for loan losses

Accrued interest and accounts receivable

Premises and equipment

946,646

971,109

(3)

72,861

73,200

25,813

14,934

73

Goodwill, MSRS and other intangible assets

53,341

54,349

(2)

Other assets

121,022

126,830

Total assets

2,687,379

2,622,532

2%

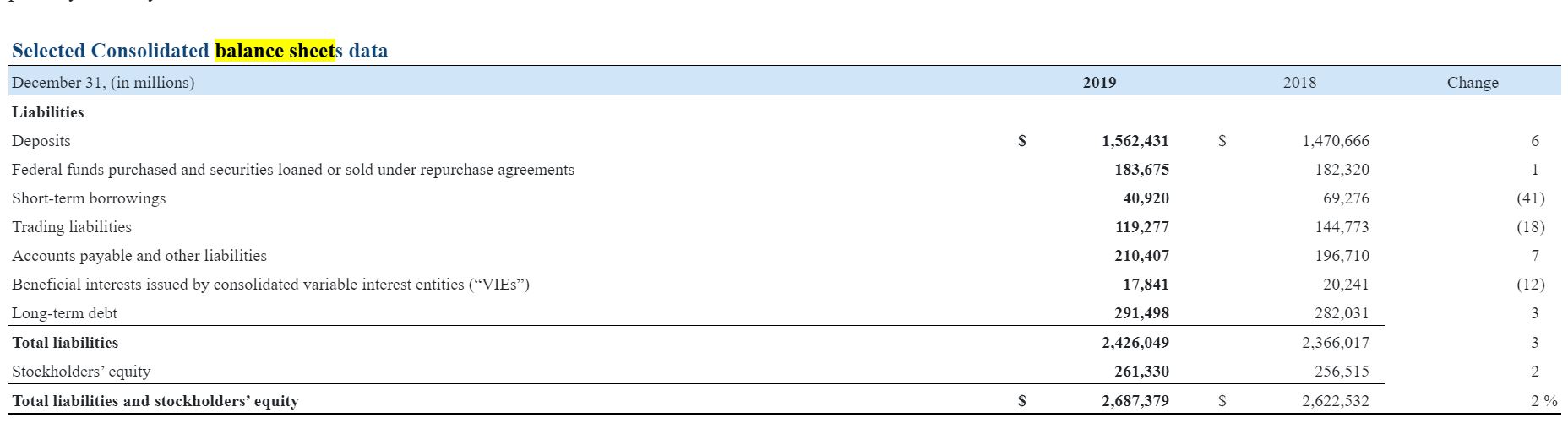

Transcribed Image Text:Selected Consolidated balance sheets data

December 31, (in millions)

2019

2018

Change

Liabilities

2$

1,470,666

Deposits

Federal funds purchased and securities loaned or sold under repurchase agreements

Short-term borrowings

Trading liabilities

1,562,431

183,675

182,320

40,920

69,276

(41)

144,773

119,277

(18)

Accounts payable and other liabilities

Beneficial interests issued by consolidated variable interest entities ("VIES")

210,407

196,710

17,841

20,241

(12)

291,498

Long-term debt

Total liabilities

282,031

2,426,049

2,366,017

Stockholders' equity

261,330

256,515

Total liabilities and stockholders' equity

2,687,379

2,622,532

2%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Discuss one dimension of financial statement analysis. Explain one technique for analyzing financial statements. Describe the importance of the accounts receivable turnover ratio to a service-based business such as a hospital.arrow_forwardPlease analyze, assess, and synthesize the Annual Report or Form 10-K or Form 20 - F (whatever they call it in that jurisdiction) of the company you choose. You can usually find it on the Company's website in Investor R. Introduction 2. Industry situation and company plans A. Management Letter B. B. Review Company's Products and Services 3. Financial Statements A. Income Statement B. Cash Flow Statement C. Balance Sheet D. Accounting Policies 4. Financial Analysis & Ratio A. Financial Analysis B. Ratio C. Market Indicator Financial Ratios 5. References 6. Complete Calcuation of Part 4 in excelLimiarrow_forwardHello, could you explain to me what is a decimal place when calculating financial ratios. thank you.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education