FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Hello-

Please help me to the Return on assets.

Thanks,

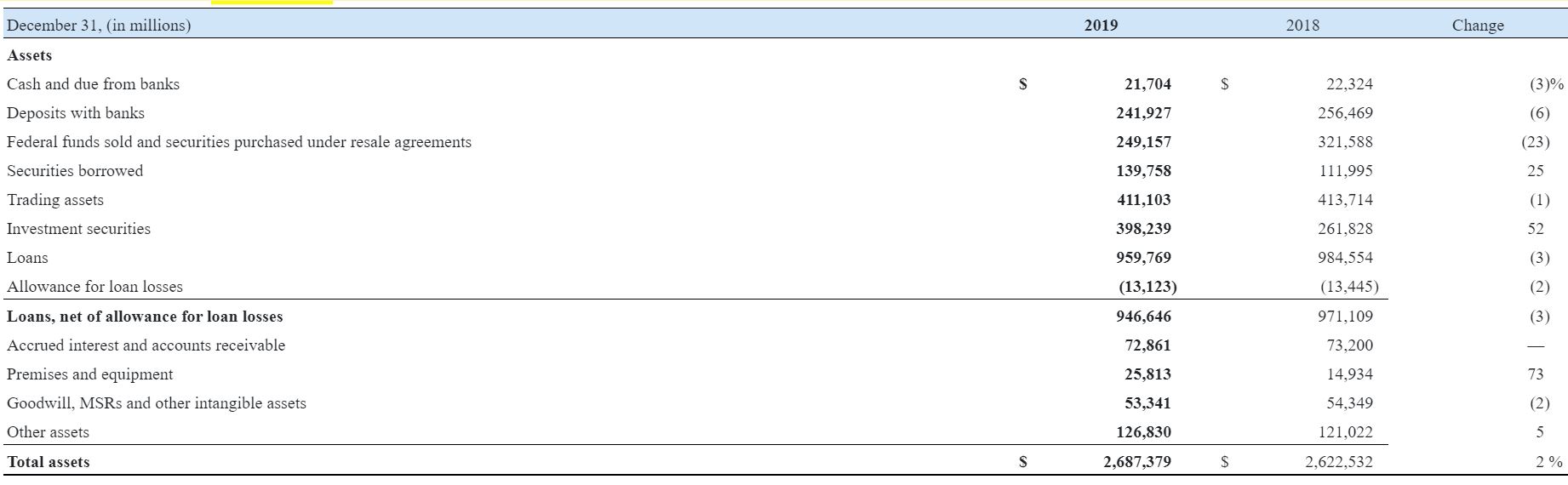

Transcribed Image Text:December 31, (in millions)

2019

Change

2018

Assets

Cash and due from banks

Deposits with banks

Federal funds sold and securities purchased under resale agreements

21,704

22,324

(3)%

241,927

256,469

(6)

249,157

321,588

(23)

Securities borrowed

139,758

111,995

25

Trading assets

411,103

413,714

(1)

Investment securities

398,239

261,828

52

Loans

959,769

984,554

(3)

Allowance for loan losses

(13,123)

(13,445)

(2)

Loans, net of allowance for loan losses

Accrued interest and accounts receivable

Premises and equipment

946,646

971,109

(3)

72,861

73,200

25,813

14,934

73

Goodwill, MSRS and other intangible assets

53,341

54,349

(2)

Other assets

121,022

126,830

Total assets

2,687,379

2,622,532

2%

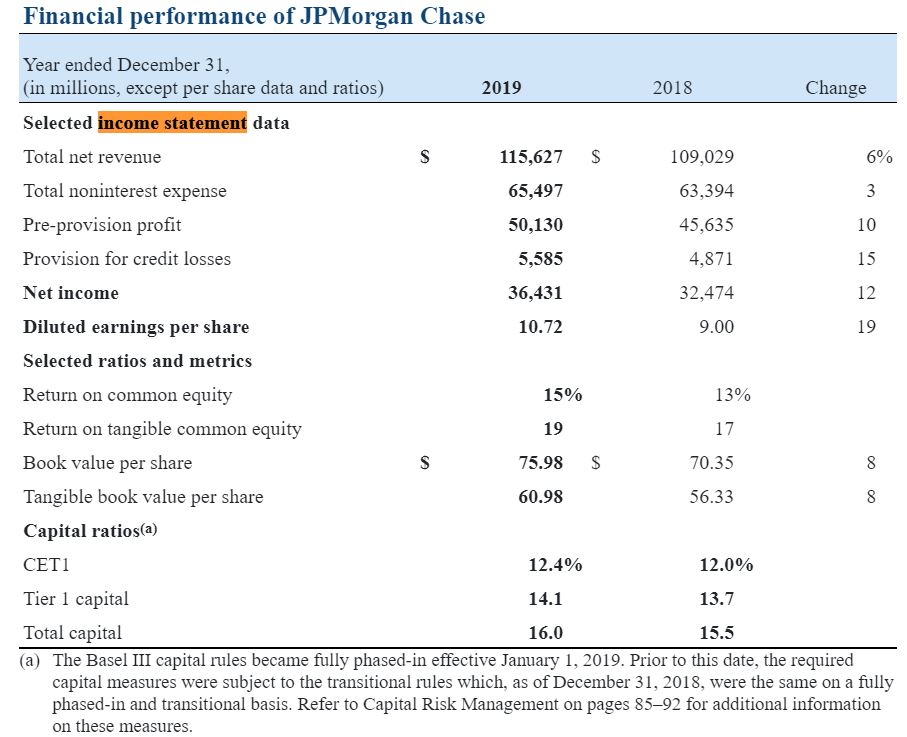

Transcribed Image Text:Financial performance of JPMorgan Chase

Year ended December 31,

(in millions, except per share data and ratios)

2019

2018

Change

Selected income statement data

Total net revenue

115,627

109,029

6%

Total noninterest expense

65,497

63,394

Pre-provision profit

50,130

45,635

10

Provision for credit losses

5,585

4,871

15

Net income

36,431

32,474

12

Diluted earnings per share

10.72

9.00

19

Selected ratios and metrics

Return on common equity

15%

13%

Return on tangible common equity

19

17

Book value per share

75.98

70.35

Tangible book value per share

60.98

56.33

Capital ratios(a)

CET1

12.4%

12.0%

Tier 1 capital

14.1

13.7

Total capital

16.0

15.5

(a) The Basel III capital rules became fully phased-in effective January 1, 2019. Prior to this date, the required

capital measures were subject to the transitional rules which, as of December 31, 2018, were the same on a fully

phased-in and transitional basis. Refer to Capital Risk Management on pages 85-92 for additional information

on these measures.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 4. **In which section of the balance sheet would you find "goodwill"?** A) Current Assets B) Non-current Assets C) Current Liabilities D) Long-term Liabilitiesarrow_forwardWhich of the following is a current asset? Question 3 options: goodwill prepaid expenses accrued liabilities deferred revenuearrow_forwardThe purpose of this forum is to challenge you to define, explain, and provide examples of noncurrent assetsarrow_forward

- The form I need help with is attachedarrow_forwardExplain how long-lived assets are reported and analyzed.arrow_forwardValuation is applied to this specific object sothat a proper computation of rental chargescan be made. a. Real Propertyb. Debt Instrumentsc. Donations and giftsd. Inheritancearrow_forward

- Gains and Losses results from realization events such as: a. sales, purchases, exchanges, or other disposition of property. b. sales, exchanges, or other disposition of property. c. Disposition , sales and donations. d. all of the above.arrow_forwardWhat are the various types of short term assets? Name them.arrow_forwardWhat are both the short-term and long-term assets related to a "TUTORING CENTER"?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education