Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

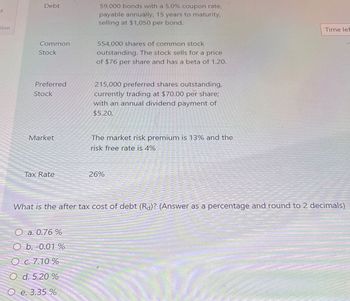

Transcribed Image Text:Debt

of

tion

Common

Stock

Preferred

Stock

59,000 bonds with a 5.0% coupon rate,

payable annually, 15 years to maturity,

selling at $1,050 per bond.

554,000 shares of common stock

outstanding. The stock sells for a price

of $76 per share and has a beta of 1.20.

215,000 preferred shares outstanding,

currently trading at $70.00 per share;

with an annual dividend payment of

$5.20,

Market

The market risk premium is 13% and the

risk free rate is 4%

Tax Rate

26%

Time lef

What is the after tax cost of debt (Rd)? (Answer as a percentage and round to 2 decimals)

Oa. 0.76 %

Ob. -0.01 %

O c. 7.10%

O d. 5.20%

O e. 3.35 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardThe IPO Investment Bank has the following financing outstanding. Debt: 20,000 bonds with a coupon rate of 12 percent and a current price quote of 110; the bonds have 20 years to maturity. 190, 000 zero coupon bonds with a price quote of 20.5 and 30 years until maturity. Both bonds have a par value of $1,000 and semiannual coupons. Preferred stock: 110,000 shares of 10 percent preferred stock with a current price of $85, and a par value of $100. Common stock: 2,200, 000 shares of common stock; the current price is $71, and the beta of the stock is 1.45. Market: The corporate tax rate is 21 percent, the market risk premium is 5 percent, and the risk - free rate is 2 percent. What is the WACC for the company? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.)arrow_forwardHarnett Computing has 10-year, non-callable, 9.0% semi-annual coupon bonds outstanding. The bonds have a par value of $1,000 and a nominal YTM of 9.42%. What is the bonds' current market price? $937.69 $961.38 $1,038.62 $950.33 $973.17arrow_forward

- A 16. Subject:- financearrow_forwardA firm issues preferred stock that has $70 par value abs pays a 15% annual dividend each year. Firms bankers willing to lay $84/share. Flotation costs equal to $8.45 per share. Determine difference between investors required rate of return and fursns cost of preferred stock.arrow_forward6. The semi-annual, 10% coupon bonds of Australis Inc. are selling at par. The effective annual rate of these bonds must be equal to: A. 5% B. (1.05)2 - 1 C. 10% D. (1.10)2 - 1 ALPHO Inc. has paid annual dividends of $1.25 and $1.62, over the past two years. Dividends in the future are expected to be $2.00 and $2.45 over the next two years, then grow at a constant rate of 4%. Which one of the following formulas should be used to compute the value of the stock today? P0= D1/(1+k)1+ D2/(1+k)2 + ... + Dn/(1+k)n + Pn/(1+k)n P0= D/k P0= D1/(1+k)n+ g P0= D1/(k-g)arrow_forward

- please give me answer in relatablearrow_forward17. Preferred Stock and WACC The Saunders Investment Bank has the following financing outstanding. What is the WACC for the company? Debt: 40,000 bonds with a coupon rate of 4.9 percent and a current price quote of 106.5; the bonds have 15 years to maturity and a par value of $1,000. 40,000 zero coupon bonds with a price quote of 21.8, 30 years until maturity, and a par value of $10,000. Both bonds have semiannual compunding. 135,000 shares of 3.5 percent preferred stock with a current price of $87 and a par value of $100. 1,900,000 shares of common stock; the current price is $73 and the beta of the stock is 1.15. The corporate tax rate is 23 percent, the market risk premium is 7 percent, and the risk-free rate is 3.6 percent. Preferred stock: Common stock: Market:arrow_forwardAssume that Almond Milk Company has a $1,000 face value bond with a stated coupon rate of 8.18 percent that is convertible into its common stock at $35.77. The bond is selling at $1,096.27 in the market. The common stock is selling for $33.84 and pays a dividend of 0.62 per share. Calculate the payback premium period.arrow_forward

- A $1,000 face value, 6.4% coupon bond pays interest semi-annually and matures in ten years. It has a yield-to-maturity of 7.1325%. The bond's price is closest to $920 $1,203 $1,061 $948 2. Pilgrim Corp. stock currently sells for $25 per share? The annual dividend payment is $1.00 per share and earnings per share are $3.00. What is the dividend payout ratio?arrow_forwardMacro Corporation issued 50-year $80 million of face value bonds that have a coupon rate of 6% paid semi-annually. The bonds were issued at 97. Given this information, calculate the yield to maturity. Multiple Choice 6.30% 6.00% 6.20% 6.10% 6.40% Show all the calculation process and formulas if necessaryarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education