Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

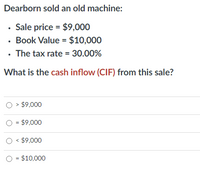

Transcribed Image Text:Dearborn sold an old machine:

• Sale price = $9,000

· Book Value = $10,000

• The tax rate = 30.00%

What is the cash inflow (CIF) from this sale?

> $9,000

O = $9,000

O < $9,000

O = $10,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Need helparrow_forwardWhat will be the annual cash outflows for Mimi Inc. if it leased a milling machine for $8, 200 per year for 5 years. Assume that the new machine cost $ 42,000 and will depreciate on a straight line basis over the 5 years and that Mimi has a tax rate of 32 percent. Question 15Select one: a. - $5,576 b. $42,000 C. -$8,264 d. $33,800 e. - $2,688arrow_forward13arrow_forward

- Firm X is considering the replacement of an old machine with one that has a purchase price of $100,000. The current market value of the old machine is $23,000 but the book value is $38,000. The firm's combined tax rate is 30%. What is the net cash outflow for the new machine after considering the sale of the old machine? Disregard the effect of depreciation of the new machine if acquired. Multiple Choice $72,500 $78, 370 $84, 850 $69, 100arrow_forwardAssume a machine was purchased 5 years ago for $800,000 and has been 75% depreciated. The firm decides to sell this machine for $350,000. The firm's tax rate is 20%. Calculate how much net cash the sale of this equipment will generate for the firm. Answer rounded to the nearest whole dollar; for example 42,345 for your answer.arrow_forwardEstimating Incremental Cash flow After- Tax 1. Galaxy Fans is considering a proposal to buy a new fixing machine. The price of the machine is $108,000, and shipping and installation costs would add another $12,500. The machine falls into the MACRS 3-year class, and it would be sold after 4 years for $65,000. The applicable depreciation rates are 33.33%, 44.45%, 14.81%, and 7.41%. There would be no effect on revenues, but pretax labor costs would decline by $44,000 per year hence it is net saving by the new machine. The firm falls in 40% tax bracket. Required: Calculate the initial cash out flow at Year 0 What are the project’s annual net incremental cash flows during Years 1, 2, and 3? Find out the terminal cash flow of the new machine at year four.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education