FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Prepare a budgeted balance sheet at June 30th

Transcribed Image Text:earch results for 'You have ju X b Answered: Case 8-33 (Algo) X

C

ezto.mheducation.com/ext/map/index.html?_con=con&external_browser=0&launch

nner 15 Google Calendar A Google Drive Florida Gulf Coast... Gulfline Canvas

Assets

Cash

Accounts receivable

Inventory

Buildings and equipment, net of depreciation

Total assets

3

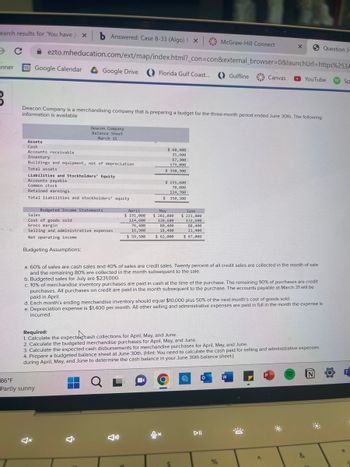

Deacon Company is a merchandising company that is preparing a budget for the three-month period ended June 30th. The following

information is available

Deacon Company

Balance Sheet

March 31

Liabilities and Stockholders' Equity

Accounts payable

Common stock

Retained earnings

Total liabilities and stockholders' equity

Budgeted Income Statements

Sales

Cost of goods sold

Gross margin

Selling and administrative expenses

Net operating income

Budgeting Assumptions:

86°F

Partly sunny

April

$191,000

114,600

76,400

16,900

$ 59,500

$ 68,400

35,600

67,300

179,000

$ 350, 300

$ 155,600

70,000

124,700

$ 350,300

May

$ 201,000

120,600

80,400

18,400

$ 62,000

ox

June

$ 221,000

132,600

88,400

21,400

$ 67,000

McGraw-Hill Connect

a. 60% of sales are cash sales and 40% of sales are credit sales. Twenty percent of all credit sales are collected in the month of sale

and the remaining 80% are collected in the month subsequent to the sale.

b. Budgeted sales for July are $231,000.

c. 10% of merchandise inventory purchases are paid in cash at the time of the purchase. The remaining 90% of purchases are credit

purchases. All purchases on credit are paid in the month subsequent to the purchase. The accounts payable at March 31 will be

paid in April.

d. Each month's ending merchandise inventory should equal $10,000 plus 50% of the next month's cost of goods sold.

e. Depreciation expense is $1,400 per month. All other selling and administrative expenses are paid in full in the month the expense is

incurred.

TO

Required:

1. Calculate the expectercash collections for April, May, and June.

2. Calculate the budgeted merchandise purchases for April, May, and June.

3. Calculate the expected cash disbursements for merchandise purchases for April, May, and June.

4. Prepare a budgeted balance sheet at June 30th. (Hint: You need to calculate the cash paid for selling and administrative expenses

during April, May, and June to determine the cash balance in your June 30th balance sheet.)

Q

O

DII

%

X

W

ő

A

Url=https%253F

YouTube

&

Question 3

N

Sp

T

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required: Prepare Shadee's budgeted income statement for the months of May and June. Note: Do not round your intermediate calculations. Round your answers to 2 decimal places. Budgeted Gross Margin SHADEE CORPORATION Budgeted Income Statement Budgeted Net Operating Income May Junearrow_forwardThe income statement for the first quarter of 2019 was as follows: Income Statement For the Quarter Ended March 31, 2019 Sales Cost of goods sold Gross profit Operating expenses ales salaries Rent expense Depreciation Utilities Miscellaneous Total operating expenses Net income $52,000 24,000 12,000 3,600 12,800 $720,000 396,000 324,000 104,400 $219,600 Prepare a budgeted quarterly income statement in tabular form for the first quarter of 2020.arrow_forwardToday is November 1, 2021. A continuous budget for the period from November 1, 2021 through October 31, 2022 is more reflective of current operating conditions than an operating budget for calendar year 2021 that was compiled in November 2020. True or false?arrow_forward

- Month ($) Wages ($) From the following information, prepare a monthly cash budget for the three months ending 31st December 2019. Sales ($) Materials Other Expenses ($) Jun. (A) 3,000 1,800 650 385 Jul. (A) 3,250 2,000 750 385 Aug. (A) 3,500 2,400 750 425 Sep.(A) 3,750 2,250 .750 475 Oct. (E) 4,000 2,300 800 500 Nov. (E) 4,250 2,500 900 550 Dec. (E) 4,500 2,600 1,000 575 (A) Actual; (E) - Estimated. = The credit terms are as follows: • Sales -10% of sales are in cash. On average, 50% of credit sales are paid in the next month, while the other 50% are paid two months after the sale. • Creditors for material are paid 2 months after purchase. • Wages and other expenses are paid the same month. The cash and bank balance on 1st October is expected to be $1,500. Other information is given as follows: • Plant and machinery are to be installed in August at a cost of $24,000. This sum will be paid in monthly installments of $500 each from 1st October. • Dividends from investments amounting to…arrow_forwardB. Another team member who is preparing the Budgeted Balance Sheet for the business forthe same quarter ending September 30, 2022, has asked you to furnish him with the figuresfor the expected trade receivables and payables to be included in the statement. Is that areasonable request? If yes, what should these amounts be? C. Upon receipt of the budget, the team manager, Dannie Bruce, has now informed you that, inkeeping with industry players, the management of Sallat Household Furnishings haveindicated an industry requirement to maintain a minimum cash balance of $155,000 eachmonth. He has also noted that management is very keen on keeping the gearing ratio of thebusiness as low as possible and would therefore prefer to cushion any gaps internally usingequity financing. Based on the budget prepared, will the business be achieving this desired industry target?Suggest three (3) internal strategies that may be employed by management to improve theorganization’s monthly cash flow and…arrow_forwardSubject: acountingarrow_forward

- Perez Pointers Corporation expects to begin operations on January 1, year 1; it will operate as a specialty sales company that sells laser pointers over the Internet. Perez expects sales in January year 1 to total $210,000 and to increase 20 percent per month in February and March. All sales are on account. Perez expects to collect 68 percent of accounts receivable in the month of sale, 24 percent in the month following the sale, and 8 percent in the second month following the sale. Required Prepare a sales budget for the first quarter of year 1. Determine the amount of sales revenue Perez will report on the year 1 first quarterly pro forma income statement. Prepare a cash receipts schedule for the first quarter of year 1. Determine the amount of accounts receivable as of March 31, year 1. Complete this question by entering your answers in the tabs below. Prepare a sales budget for the first quarter of year 1.arrow_forward(b) Another team member who is preparing the Budgeted Balance Sheet for the business for the same quarter ending September 30, 2022, has asked you to furnish him with the figures for the expected trade receivables and payables to be included in the statement. Is that a reasonable request? If yes, what should these amounts be?arrow_forwardRequired information [The following information applies to the questions displayed below.] Lamonte Company reports the following budgeted December 31 adjusted trial balance. Debit $ 50,000 120,000 64,000 125,000 Cash Accounts receivable Merchandise inventory Equipment Accumulated depreciation-Equipment Accounts payable Loan payable Common stock Retained earnings (beginning year balance) Sales Cost of goods sold Loan interest expense Depreciation expense Salaries expense Totals 360,000 8,000 10,000 122,000 $ 859,000 Credit $ 25,000 34,000 22,000 200,000 58,000 520,000 $ 859,000 The ending year balance of Retained earnings was $78,000 on December 31. Prepare Lamonte Company's budgeted balance sheet as of December 31.arrow_forward

- Can you show how you got the numbers for question 6? Can you show me how to prepare the following: Prepare a selling and administrative expenses budget for January Prepare a budgeted income statement for Januaryarrow_forwardPrepare a production budget for the months of April, May, and June.arrow_forward1.Prepare a tuition revenue budget for the upcoming academic year. 2. Determine the number of faculty members needed to cover classes.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education