FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Davis kitchen supply produces stoves for commerical kitchens.

Help with Req. B, Req C, Reg D

Transcribed Image Text:e-1. A proposal is received from an outside contractor who will make and ship 2,000 stoves per month directly to Davis's customers as

orders are received from Davis's sales force. Davis's fixed marketing costs would be unaffected, but its variable marketing costs would

be cut by 20 percent for these 2,000 units produced by the contractor. Davis's plant would operate at two-thirds of its normal level,

and total fixed manufacturing costs would be cut by 25 percent. What in-house unit cost should be used to compare with the quotation

received from the supplier? Assume the payment to the outside contractor is $216.

e-2. Should the proposal be accepted for a price (that is, payment to the outside contractor) of $216 per unit?

f-1. A proposal is received from an outside contractor who will make and ship 2,000 stoves per month directly to Davis's customers as

orders are received from Davis's sales force. Davis's fixed marketing costs would be unaffected, but its variable marketing costs would

be cut by 20 percent for these 2,000 units produced by the contractor. The idle facilities would be used to produce 1,600 modified

stoves per month for use in extreme climates. These modified stoves could be sold for $451 each, while the costs of production would

be $276 per unit variable manufacturing expense. Variable marketing costs would be $51 per unit. Fixed marketing and manufacturing

costs would be unchanged whether the original 6,000 regular stoves were manufactured or the mix of 4,000 regular stoves plus 1,600

modified stoves were produced. What in-house unit cost should be used to compare with the quotation received from the outside

contractor? Assume the payment to the outside contractor is $216.

f-2. Should the proposal be accepted for a price of $216 per unit to the outside contractor?

Complete this question by entering your answers in the tabs below.

Reg A1

Req A2

Reg B

Reg C

Reg D

Reg E1

Reg E2

Reg F1

Reg F2

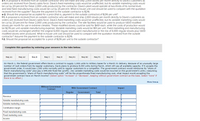

On March 1, the federal government offers Davis a contract to supply 1,000 units to military bases for a March 31 delivery. Because of an unusually large

number of rush orders from its regular customers, Davis plans to produce 8,000 units during March, which will use all available capacity. If it accepts the

government order, it would lose 1,000 units normally sold to regular customers to a competitor. The government contract would reimburse its "share of

March manufacturing costs" plus pay a $49,000 fixed fee (profit). (No variable marketing costs would be incurred on the government's units.) Assuming

that the government's "share of March manufacturing costs" will be the proportionate fixed manufacturing cost, what impact would accepting the

government contract have on March income? (Select option "increase" or "decrease", keeping without government contract as the base. Select "none" if

there is no effect.)

Show less A

Without Government

With Government Contract

Impact

Contract

Regular

Government

Total

Revenue

Variable manufacturing costs

Variable marketing costs

Contribution margin

Fixed manufacturing costs

Fixed marketing costs

Income

Transcribed Image Text:Davis Kitchen Supply produces stoves for commercial kitchens. The costs to manufacture and market the stoves at the company's

normal volume of 6,000 units per month are shown in the following table.

Unit manufacturing costs

Variable materials

$ 51

Variable labor

76

Variable overhead

26

Fixed overhead

61

$ 214

Total unit manufacturing costs

Unit marketing costs

Variable

26

Fixed

71

Total unit marketing costs

97

Total unit costs

$ 311

Unless otherwise stated, assume that no connection exists between the situation described in each question; each is independent.

Unless otherwise stated, assume a regular selling price of $372 per unit. Ignore income taxes and other costs that are not mentioned

in the table or in the question itself.

Required:

a. Market research estimates that volume could be increased to 7,000 units, which is well within production capacity limitations if the

price were cut from $372 to $327 per unit. Assuming that the cost behavior patterns implied by the data in the table are correct.

a-1. What would be the impact on monthly sales, costs, and income?

a-2. Would you recommend taking this action?

b. On March 1, the federal government offers Davis a contract to supply 1,000 units to military bases for a March 31 delivery. Because of

an unusually large number of rush orders from its regular customers, Davis plans to produce 8,000 units during March, which will use

all available capacity. If it accepts the government order, it would lose 1,000 units normally sold to regular customers to a competitor.

The government contract would reimburse its "share of March manufacturing costs" plus pay a $49,000 fixed fee (profit). (No variable

marketing costs would be incurred on the government's units.) Assuming that the government's "share of March manufacturing costs"

will be the proportionate fixed manufacturing cost, what impact would accepting the government contract have on March income?

c. Davis has an opportunity to enter a highly competitive foreign market. An attraction of the foreign market is that its demand is

greatest when the domestic market's demand is quite low; thus, idle production facilities could be used without affecting domestic

business. An order for 2,000 units is being sought at a below-normal price to enter this market. For this order, shipping costs will total

$41 per unit; total (marketing) costs to obtain the contract will be $6,000. No other variable marketing costs would be required on this

order, and it would not affect domestic business. What is the minimum unit price that Davis should consider for this order of 2,000

units?

d. An inventory of 460 units of an obsolete model of the stove remains in the stockroom. These must be sold through regular channels

(thus incurring variable marketing costs) at reduced prices or the inventory will soon be valueless. What is the minimum acceptable

selling price for these units?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hh Module 1-30691202003 * My Home CengageNOWv2 | Online teachir x Cengage Learning v2.cengagenow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker%3D&takeAssignmentSessionLocator=&inprogress%3Dfalse Entries for Flow of Factory Costs for Process Cost System Radford Inc. manufactures a sugar product by a continuous process, involving three production departments-Refining, Sifting, and Packing. Assume that records indicate that direct materials, direct labor, and applied factory overhead for the first department, Refining, were $585,800, $205,000, and $134,700, respectively. Also, work in process in the Refining Department at the beginning of the period totaled $32,800, and work in process at the end of the period totaled $40,400. a. Journalize the entries to record the flow of costs into the Refining Department during the perlod for (1) direct materials, (2) direct labor, and (3) factory overhead. If an amount box does not require an entry, leave it blank. Work In Process-Refining…arrow_forwardView Policies Current Attempt in Progress In which of the following categories do indirect materials belong? Product Cost Manufacturing Overhead Period Cost No No Yes Yes No No Yes Yes No Yes Yes Yes eTextbook and Media Save for Later O Attempts: 0 of 3 used Submit Answerarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- please help and provide solution for all requirements or just skip/leave for other experts please answer with all working answer in text please remember need answer all requirements.upvote if complete and correct downvote if incomplete or incorrectarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardAll of the following would be considered a direct material for a kitchen cabinet except A. wood. OB. sandpaper. OC. stain. OD. hinges.arrow_forward

- please answer with explanation , computation , formulation and steps thanks for help in advance please no copy paste from other answer need complete and correct answer for all or skip / leave answer in text not image please remember answer all clearlyarrow_forwardI want last three requirement with detail working I want last three requirement with detail working I want last three requirement with detail working please answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education