FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Don't give answer in image

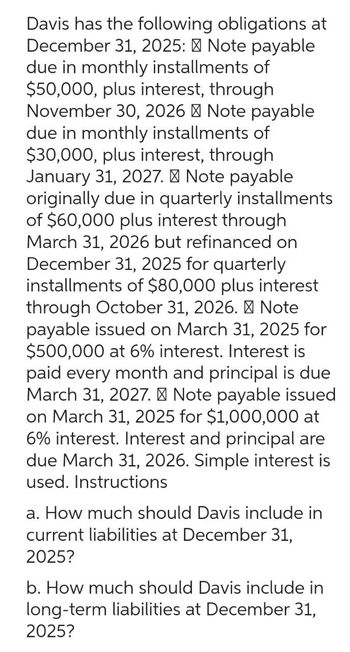

Transcribed Image Text:Davis has the following obligations at

December 31, 2025: Note payable

due in monthly installments of

$50,000, plus interest, through

November 30, 2026 Note payable

due in monthly installments of

$30,000, plus interest, through

January 31, 2027. Note payable

originally due in quarterly installments

of $60,000 plus interest through

March 31, 2026 but refinanced on

December 31, 2025 for quarterly

installments of $80,000 plus interest

through October 31, 2026. Note

payable issued on March 31, 2025 for

$500,000 at 6% interest. Interest is

paid every month and principal is due

March 31, 2027. Note payable issued

on March 31, 2025 for $1,000,000 at

6% interest. Interest and principal are

due March 31, 2026. Simple interest is

used. Instructions

a. How much should Davis include in

current liabilities at December 31,

2025?

b. How much should Davis include in

long-term liabilities at December 31,

2025?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Wrong Answerarrow_forwardAssume a world that meets all assumptions of the portfolio theory. In this world we solely trade in securities A and B like depicted in the graph below. Short selling is allowed. xA and XB indicate the proportions of security A and B within a portfolio respectively. P1, P2, P3 and P4 represent portfolios that can be created by trading (either long and/or short) in securhies A and B. P3 is the portfolio with the lowest risk; the risk of P3 is 0%. The risk of security A and B is measured by the standard deviation of the returns in the particular security and equals 20% for both. The correlation coefficient of the returns between A and B is -1. 40% P1 E(R) A 30% P2 20% P3 10% P4 ++ 30% 0% 10% 20% 40% O(R) Question: Indicate which statements are correct. Take into account that everything is possible, from all correct to all wrong.arrow_forwardPlease answer G part with explanation. Answer was incoorect in previous solutionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education