CONCEPTS IN FED.TAX.,2020-W/ACCESS

20th Edition

ISBN: 9780357110362

Author: Murphy

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Question

What is the amount of gain on these general accounting question?

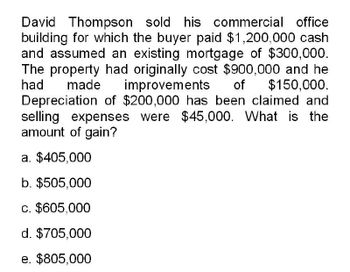

Transcribed Image Text:David Thompson sold his commercial office

building for which the buyer paid $1,200,000 cash

and assumed an existing mortgage of $300,000.

The property had originally cost $900,000 and he

had made improvements of $150,000.

Depreciation of $200,000 has been claimed and

selling expenses were $45,000. What is the

amount of gain?

a. $405,000

b. $505,000

c. $605,000

d. $705,000

e. $805,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 4, 1986, Rita Racksaw purchased a warehouse for $150,000. In 2020, she sold the warehouse for $107,000. She took $150,000 depreciation under ACRS and straight-line depreciation would have been $150,000. How much and what type of income or gain would Rita have on the sale? $43,000 Section 1231 loss $107,000 Section 1231 gain $107,000 long-term capital gain $107,000 ordinary incomearrow_forwardWhat is jorge's gain or loss realized on the machine?arrow_forwardRock Properties recently purchased a building that generates Gross Rental Income of $190,000 per year and Net Operating Income of $125,000 per year. Rock paid $250 per square foot for the 3,000 square foot building. What was the capitalization rate based on the purchase price? a. 25.3% b. 65.8% c. 16.7% d. 12.5% e. None of the above.arrow_forward

- Kk.49.arrow_forwardEleven years ago, Lynn, Incorporated purchased a warehouse for $315,000. This year,the corporation sold the warehouse to Firm D for $80,000 cash and D’s assumption ofa $225,000 mortgage. Through date of sale, Lynn deducted $92,300 straight-linedepreciation on the warehouse.Required:.b. What is the character of this gain capital gain and ordiary gain?arrow_forwardN1.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT