FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

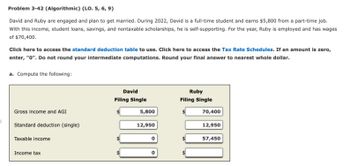

Transcribed Image Text:Problem 3-42 (Algorithmic) (LO. 5, 6, 9)

David and Ruby are engaged and plan to get married. During 2022, David is a full-time student and earns $5,800 from a part-time job.

With this income, student loans, savings, and nontaxable scholarships, he is self-supporting. For the year, Ruby is employed and has wages

of $70,400.

Click here to access the standard deduction table to use. Click here to access the Tax Rate Schedules. If an amount is zero,

enter, "0". Do not round your intermediate computations. Round your final answer to nearest whole dollar.

a. Compute the following:

Gross income and AGI

Standard deduction (single)

Taxable income

Income tax

David

Filing Single

5,800

12,950

0

Ruby

Filing Single

70,400

12,950

57,450

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Tamar owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses in connection with her condo: Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance Utilities Depreciation $ 1,080 670 4,650 1,320 1,180 1,130 10,500 During the year, Tamar rented out the condo for 96 days, receiving $26,500 of gross income. She personally used the condo for 44 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Assume Tamar uses the Tax Court method of allocating expenses to rental use of the property. Assume 365 days in the current year. Note: Do not round apportionment ratio. Round all other dollar values to the nearest whole dollar amount. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo (assuming she itemizes deductions before considering…arrow_forwardTyler earns $80,000 per year and has a 22 percent marginal tax rate. His employer is willing to provide health insurance coverage for Tyler if he will agree to a salary reduction. The insurance will cost the employer $4,680. How much salary should Tyler be willing to forgo to receive the $4,680 in health insurance coverage?arrow_forwardSam and Margaret are 62 and 59 respectively. They are married, lived together all year, but prefer to file taxes separately. Both work and each have a traditional IRA. Sam is mostly retired but Margaret works full-time. In 2022, Sam earned $4,500 in wages from working at Walmart as a Greeter. He also received $29,000 in annuity income. Margaret earned $65,000 in wages. What is the maximum Sam can contribute to his IRA?arrow_forward

- Sam is currently 30 years of age. He owns his own business and wantsto retire at the age of 60. He has little confidence in the current SocialSecurity system. He wants to retire with an annual income of $72,000a year.a. If Sam believes he will live to age 90, how much does he have to accumulateby the time he reaches age 60 to receive $72,000 at the end of each yearfor the rest of his life? Sam believes he can earn 8 percent on his money in astock mutual fund.b. How much does he have to accumulate if he wants the payment of $72,000at the beginning of each year?c. What dollar amount of interest will Sam have earned during retirement if hereceives his $72,000 at the beginning of each year?arrow_forwardDonald Jefferson and his wife, Maryanne, live in a modest house located in a Los Angeles suburb. Donald has a job at Pittsford Cast Iron that pays him $50,000 annually. In addition, he and Maryanne receive $2,500 interest from bonds that they purchased 10 years ago. To supplement his annual income, Donald bought rental property a few years ago. Every month he collects $3,500 in rent from all of the property he owns. Maryanne manages the rental property, and she is paid $15,000 annually for her work. During 2015, Donald had to have the plumbing fixed in the houses that he rents as well as the house in which he and Maryanne live. The plumbing bill was $1,250 for the rented houses and $550 for the Jeffersons’ personal residence. In 2015, Donald paid $18,000 for mortgage interest and property taxes—$12,650 was for the rental houses, and the remaining $5,350 was for the house occupied by him and his wife. The couple has three children who have graduated from medical school and now are…arrow_forwardIn 2020, Emily and Mark are married. Emily earns $150,000 from her job as a finance executive. Mark earns $25,000 per year as a part-time florist. They have two children, Peter and Sam, ages 2 and 5. Emily’s great aunt Joan gave her a check for $17,000 during the year because she is her favorite niece. Also, Emily’s job reimbursed him $5,000 for childcare for his two sons.Mark owns a 20% interest in Flowers to Go (a partnership). The partnership earned $75,000 in operating income during the year, it also paid a cash distribution of $15,000 to Mark during the year.Emily and Mark have a joint checking account that earned interest of $165 for the year. Emily also own City of Scranton bonds which paid interest of $1,000.They also have the following expenses during the year:· Medical Expenses: $22,000· State & Local Taxes: $11,500· Federal Income Tax Payments: $10,000· Cash Charitable Contributions: $3,000The standard deduction amounts for 2021 are listed below:· Single: $12,550· Head…arrow_forward

- Bruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses.Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm:● Utilities: $2,000● Office Rent: $14,000● Self-Employment Tax: $5,000● Salary for her secretary: $20,000● Fines/Penalties: $8,000● Payroll Taxes (Employer Portion): $1,000● Business Meals: $2,000● Bribe to police officer to forgive parking violation $1,500Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income. Also, during the year a tornado damaged the roof of their personal…arrow_forwardShen and Sondra Xiang are 37 years old and have one daughter, age 5. Shen is the primary earner, making $87,000 per year. Sondra does not currently work. The Xiangs have decided to use the needs analysis method to calculate the value of a life insurance policy that would provide for Sondra and their daughter in the event of Shen’s death. Shen and Sondra estimate that while their daughter is still living at home, monthly living expenses for Sondra and their child will be about $3,700 (in current dollars). After their daughter leaves for college in 13 years, Sondra will need a monthly income of $3,100 until she retires at age 65. The Xiangs estimate Sondra’s living expenses after 65 will only be $2,700 a month. The life expectancy of a woman Sondra’s age is 87 years, so the Xiang family calculates that Sondra will spend about 22 years in retirement. Using this information, complete the first portion of the needs analysis worksheet to estimate their total living expenses. Life Insurance…arrow_forwardKaan, a 55-year-old software engineer, earned a pre-tax income of $200,000 in 2024. He plans to quit his current job in 10 years to start his own business. Kaan already holds several accounts with RBC but intends to open new TFSA, RRSP, and non-registered investment accounts with TD Bank. He will allocate funds in TD Bank for his business venture while reserving funds in RBC for emergencies and retirement. Kaan has the capacity to save $100,000 annually in real, before tax dollars and will only deposit to TD bank accounts from now on until retirement. His savings strategy includes contributions to a TFSA, RRSP, and non-registered investment account at TD Bank. In 2024, he will contribute to the TFSA up to the 2024 annual limit, with contributions increasing annually to match the inflation rate. The RRSP contribution remains fixed at $20,000 in real dollars due to employer contributions. Any remaining savings are directed to the non-registered investment account. Contributions occur at…arrow_forward

- Fred is a 22-year-old full-time college student. During 2022, he earned $2,550 from a part-time job and $1,150 in interest income. Required: If Fred is a dependent of his parents, what is his standard deduction amount? If Fred supports himself and is not a dependent of someone else, what is his standard deduction amount?arrow_forwardMartin and Rachel are married and have a 3-year-old child. Martin is going to medical school full-time for 12 months of the year and Rachel earns $45,000. Their child is in day care so Martin can go to school while Rachel is at work. The cost of their day care is $10,000. What is their child and dependent care credit? Please show your calculations.arrow_forwardRita is a self-employed taxpayer who turns 39 years old at the end of the year (2023). In 2023, her net Schedule C income was $280,000. This was her only source of income. This year, Rita is considering setting up a retirement plan. What is the maximum amount Rita may contribute to the self-employed plan in each of the following situations? Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Problem 13-85 Part b (Algo) b. She sets up an individual 401(k). Maximum contributionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education