FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

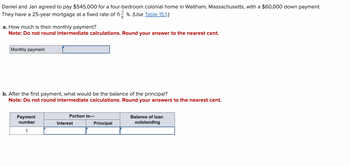

Transcribed Image Text:Daniel and Jan agreed to pay $545,000 for a four-bedroom colonial home in Waltham, Massachusetts, with a $60,000 down payment.

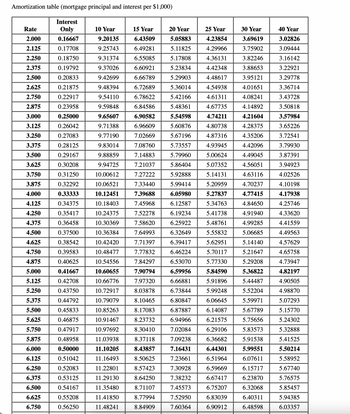

They have a 25-year mortgage at a fixed rate of 63 %. (Use Table 15.1.)

8

a. How much is their monthly payment?

Note: Do not round intermediate calculations. Round your answer to the nearest cent.

Monthly payment

b. After the first payment, what would be the balance of the principal?

Note: Do not round intermediate calculations. Round your answers to the nearest cent.

Payment

number

1

Portion to-

Interest

Principal

Balance of loan

outstanding

Transcribed Image Text:Amortization table (mortgage principal and interest per $1,000)

Interest

Only

0.16667

0.17708

0.18750

0.19792

0.20833

0.21875

0.22917

0.23958

0.25000

0.26042

0.27083

0.28125

0.29167

0.30208

0.31250

0.32292

0.33333

0.34375

0.35417

0.36458

0.37500

0.38542

0.39583

0.40625

0.41667

0.42708

0.43750

0.44792

0.45833

0.46875

0.47917

0.48958

0.50000

0.51042

0.52083

0.53125

0.54167

0.55208

0.56250

Rate

2.000

2.125

2.250

2.375

2.500

2.625

2.750

2.875

3.000

3.125

3.250

3.375

3.500

3.625

3.750

3.875

4.000

4.125

4.250

4.375

4.500

4.625

4.750

4.875

5.000

5.125

5.250

5.375

5.500

5.625

5.750

5.875

6.000

6.125

6.250

6.375

6.500

6.625

6.750

10 Year

9.20135

9.25743

9.31374

9.37026

9.42699

9.48394

9.54110

9.59848

9.65607

9.71388

9.77190

9.83014

9.88859

9.94725

10.00612

10.06521

10.12451

10.18403

10.24375

10.30369

10.36384

10.42420

10.48477

10.54556

10.60655

10.66776

10.72917

10.79079

10.85263

10.91467

10.97692

11.03938

11.10205

11.16493

11.22801

11.29130

11.35480

11.41850

11.48241

15 Year

6.43509

6.49281

6.55085

6.60921

6.66789

6.72689

6.78622

6.84586

6.90582

6.96609

7.02669

7.08760

7.14883

7.21037

7.27222

7.33440

7.39688

7.45968

7.52278

7.58620

7.64993

7.71397

7.77832

7.84297

7.90794

7.97320

8.03878

8.10465

8.17083

8.23732

8.30410

8.37118

8.43857

8.50625

8.57423

8.64250

8.71107

8.77994

8.84909

20 Year

5.05883

5.11825

5.17808

5.23834

5.29903

5.36014

5.42166

5.48361

5.54598

5.60876

5.67196

5.73557

5.79960

5.86404

5.92888

5.99414

6.05980

6.12587

6.19234

6.25922

6.32649

6.39417

6.46224

6.53070

6.59956

6.66881

6.73844

6.80847

6.87887

6.94966

7.02084

7.09238

7.16431

7.23661

7.30928

7.38232

7.45573

7.52950

7.60364

25 Year

4.23854

4.29966

4.36131

4.42348

4.48617

4.54938

4.61311

4.67735

4.74211

4.80738

4.87316

4.93945

5.00624

5.07352

5.14131

5.20959

5.27837

5.34763

5.41738

5.48761

5.55832

5.62951

5.70117

5.77330

5.84590

5.91896

5.99248

6.06645

6.14087

6.21575

6.29106

6.36682

6.44301

6.51964

6.59669

6.67417

6.75207

6.83039

6.90912

30 Year

3.69619

3.75902

3.82246

3.88653

3.95121

4.01651

4.08241

4.14892

4.21604

4.28375

4.35206

4.42096

4.49045

4.56051

4.63116

4.70237

4.77415

4.84650

4.91940

4.99285

5.06685

5.14140

5.21647

5.29208

5.36822

5.44487

5.52204

5.59971

5.67789

5.75656

5.83573

5.91538

5.99551

6.07611

6.15717

6.23870

6.32068

6.40311

6.48598

40 Year

3.02826

3.09444

3.16142

3.22921

3.29778

3.36714

3.43728

3.50818

3.57984

3.65226

3.72541

3.79930

3.87391

3.94923

4.02526

4.10198

4.17938

4.25746

4.33620

4.41559

4.49563

4.57629

4.65758

4.73947

4.82197

4.90505

4.98870

5.07293

5.15770

5.24302

5.32888

5.41525

5.50214

5.58952

5.67740

5.76575

5.85457

5.94385

6.03357

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Ann is looking for a fully amortizing 30 year Fixed Rate Mortgage with a mortgage amount of $4,500 and monthly payments. She takes the mortgage with 7.38% interest rate that requires Ann to pay 3 points upfront. Assuming Ann makes payments for 30 years, what is Ann's annualized IRR? Write your answer as a percent rounded to two decimal points without (e.g. if you get 5.6499%, write 5.65). the % signarrow_forward9. Implied interest rate and period Consider the case of the following annuities, and the need to compute either their expected rate of return or duration. Jacob needed money for some unexpected expenses, so he borrowed $2,138.41 from a friend and agreed to repay the loan in three equal installments of $800 at the end of each year. The agreement is offering an implied interest rate of . Jacob’s friend, Devan, wants to go to business school. While his father will share some of the expenses, Devan still needs to put in the rest on his own. But Devan has no money saved for it yet. According to his calculations, it will cost him $31,897 to complete the business program, including tuition, cost of living, and other expenses. He has decided to deposit $3,800 at the end of every year in a mutual fund, from which he expects to earn a fixed 6% rate of return. It will take approximately for Devan to save enough money to go to business school.arrow_forwardCeline has established that she can afford a weekly payment of $1,450.00. She would like to have a mortgage with an amortization of 25 years and a 7-year term. Current interest rates for a 7-year term are 6.55% compounded semi-annually not in advance. What the maximum conventional mortgage amount Celine would be able to acquire? a) $215, 498.80 b) $467,590.16 c) $935, 413.12 d) $935, 760.22please give me the answer with explaination and with right calculationsarrow_forward

- Anthony planned to buy a house but could afford to pay only $9,000 at the end of every 6 months for a mortgage with an interest rate of 5.70% compounded semi-annually for 25 years. She paid $30,000 as a down payment. a. What was the maximum amount she could afford to pay for a house? b. What was her total amount spent for the house through the mortgage period including the down payment (not taking the time-value of money into account)? c. What was the total amount of interest paid through the mortgage period?arrow_forwardShirley Trembley bought a house for $185,300. She put 20% down and obtains a simple interest amortized loan for the rest at 6 3 8 % for thirty years. (Round your answers to the nearest cent.) (a) Find her monthly payment.$ (b) Find the total interest.$ (c) Prepare an amortization schedule for the first two months of the loan. PaymentNumber PrincipalPortion InterestPortion TotalPayment Balance 0 $ 1 $ $ $ $ 2 $ $ $ $ (d) Most lenders will approve a home loan only if the total of all the borrower's monthly payments, including the home loan payment, is no more than 38% of the borrower's monthly income. How much must Shirley make to qualify for the loan?$ per montharrow_forwardMichael Sanchez purchased a condominium for $83,000. He made a 20% down payment and financed the balance with a 30 year, 5% fixed-rate mortgage. (Round your answers to the nearest cent. Use this table, if necessary.) (a) What is the amount (in $) of the monthly principal and interest portion, PI, of Michael's loan? $ (b) Construct an amortization schedule for the first four months of Michael's mortgage. PaymentNumber MonthlyPayment(in $) MonthlyInterest(in $) Portion Usedto ReducePrincipal(in $) LoanBalance(in $) 0 $ 1 $ $ $ $ 2 $ $ $ $ 3 $ $ $ $ 4 $ $ $ $ (c) If the annual property taxes are $1,610 and the hazard insurance premium is $760 per year, what is the total monthly PITI of Michael's loan (in $)? $ Table 14-1: Monthly Payments to Amortize Principal and Interest per $1,000 Financed Monthly Payments(Necessary to amortize a loan of $1,000) InterestRate (%) 5Years 10Years 15Years 20Years 25Years 30Years 35Years 40Years…arrow_forward

- Ben and Carla Covington plan to buy a condominium. They will obtain a $224,000, 30-year mortgage at 7.0 percent. Their annual property taxes are expected to be $2,000. Property insurance is $520 a year, and the condo association fee is $240 a month. Based on these items, determine the total monthly housing payment for the Covingtons. Use Exhibit 7-7. (Round your intermediate calculations and final answer to 2 decimal places.) Total monthly housing paymentarrow_forwardBill and Kim Johnson are purchasing a house for $252,000. Their Bank requires them to pay a 20% down payment. The current mortgage rate is 10%, and they are required to pay one point at the time of closing. Determine the total amount Bill and Kim will pay for their house, including principal, interest, down payment, and points (do not include taxes and homeowners' insurance) for the following lengths of their mortgage. a) 10 years b) 20 years c) 30 yearsarrow_forwardAnna is buying a house selling for $265,000. To obtain the mortgage, Anna is required to make a 15% down payment. Anna obtains a 25-year mortgage with an interest rate of 4%. LOADING... Click the icon to view the table of monthly payments. a) Determine the amount of the required down payment. b) Determine the amount of the mortgage. c) Determine the monthly payment for principal and interest. a) Determine the amount of the required down payment. $nothing b) Determine the amount of the mortgage. $nothing c) Determine the monthly payment for principal and interest. $nothing (Round to the nearest cent.)arrow_forward

- Ben buys a house. He obtains a $220,000, 30-year mortgage at 5%. Annual property taxes $1,800, property insurance $480 a year, house association fee $220 a month. Based on these items what is the total monthly mortgage payment?arrow_forwardAnna is buying a house selling for $285,000. To obtain the mortgage, Anna is required to make a 10% down pa Anna obtains a 30-year mortgage with an interest rate of 4%. Click the icon to view the table of monthly payments. a) Determine the amount of the required down payment b) Determine the amount of the mortgage. c) Determine the monthly payment for principal and interest. a) Determine the amount of the required down payment. COarrow_forwardDaniel and Jan agreed to pay $556,000 for a four-bedroom colonial home in Waltham, Massachusetts, with a $70,000 down payment. They have a 25-year mortgage at a fixed rate of 638638 %. (Use Table 15.1.) a. How much is their monthly payment? Note: Round your answer to the nearest cent. Monthly payment: b. After the first payment, what would be the balance of the principal? Note: Round your answers to the nearest cent. Payment number Portion to interest portion to principal Balance of loan outstanding 1 TABLE 15.1 Amortization table (mortgage principal and interest per $1,000) Rate Interest Only 10 Year 15 Year 20 Year 25 Year 30 Year 40 Year 2.000 0.16667 9.20135 6.43509 5.05883 4.23854 3.69619 3.02826 2.125 0.17708 9.25743 6.49281 5.11825 4.29966 3.75902 3.09444 2.250 0.18750 9.31374 6.55085 5.17808 4.36131 3.82246 3.16142 2.375 0.19792 9.37026 6.60921 5.23834 4.42348 3.88653 3.22921 2.500 0.20833 9.42699 6.66789 5.29903 4.48617 3.95121 3.29778 2.625…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education