FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Data table

Ticket No.

Ttem

Account Debited

Amount

Ticket No. 1

Delivery of programs to customers Delivery Expense

%24

25

Ticket No. 2

Mail package

Postage Expense

20

Ticket No. 3

Newsletter

Printiig Expense

30

Ticket No. 4

Key to closet

Miscellaneous Expense

35

Ticket No. 5

Сopier paper

Office Supplies

70

Print

Done

Cou

DELL

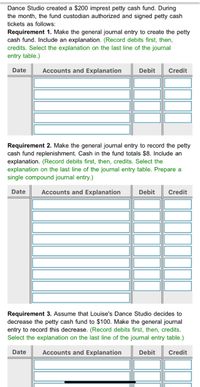

Transcribed Image Text:Dance Studio created a $200 imprest petty cash fund. During

the month, the fund custodian authorized and signed petty cash

tickets as follows:

Requirement 1. Make the general journal entry to create the petty

cash fund. Include an explanation. (Record debits first, then,

credits. Select the explanation on the last line of the journal

entry table.)

Date

Accounts and Explanation

Debit

Credit

Requirement 2. Make the general journal entry to record the petty

cash fund replenishment. Cash in the fund totals $8. Include an

explanation. (Record debits first, then, credits. Select the

explanation on the last line of the journal entry table. Prepare a

single compound journal entry.)

Date

Accounts and Explanation

Debit

Credit

Requirement 3. Assume that Louise's Dance Studio decides to

decrease the petty cash fund to $100. Make the general journal

entry to record this decrease. (Record debits first, then, credits.

Select the explanation on the last line of the journal entry table.)

Date

Accounts and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On March 20, Novak's petty cash fund of $118 is replenished when the fund contains $20 in cash and receipts for postage $47, supplies $19, and travel expense $32. Prepare the journal entry to record the replenishment of the petty cash fund. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.) Date Account Titles and Explanation Mar. 20 Debit Creditarrow_forwardSwifty Company established a petty cash fund on May 1, cashing a check for $125.00. The company reimbursed the fund on June 1 and July 1 with the following results. June 1: Cash in fund $5.55. Receipts: delivery expense $30.80, postage expense $37.75, and miscellaneous expense $50.90. July 1: Cash in fund $3.00. Receipts: delivery expense $19.95, entertainment expense $47.05, and miscellaneous expense $55.00. On July 10, Swifty increased the fund from $125.00 to $155.Prepare journal entries for Swifty Company for May 1, June 1, July 1, and July 10. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 2 decimal places, e.g. 52.75. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit choose a transaction date May 1June 1July 1July 10 enter an account title enter a debit amount…arrow_forwardInstructions Journalize the necessary entries for each of the following: Required: a. On March 1, issued a check to establish a petty cash fund of $1,410.* b. On April 1, the amount of cash in the petty cash fund is $440. Issued a check to replenish the fund, based on the following summary of petty cash receipts: repair expense, $850, and miscellaneous selling expense, $80. Record any missing funds in the cash short and over account.* *Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used for debit or credit entries. CNOW journals will automatically indent a credit entry when a credit amount is entered. Journal a. On March 1, issued a check to establish a petty cash fund of $1,410. Refer to the chart of accounts for the exact wording of the account titles. CNOW journals do not use lines for journal explanations. Every line on a journal page is used…arrow_forward

- Halle’s Berry Farm establishes a $200 petty cash fund on September 4 to pay for minor cash expenditures. The fund is replenished at the end of each month. At the end of September, the fund contains $30 in cash. The company has also issued a credit card and authorized its office manager to make purchases. Expenditures for the month include the following items:Entertainment for office party (petty cash) $170Lawn maintenance (credit card) 420Postage (credit card) 575Fuel for deliveries (credit card) 285Required:1. Record the establishment of the petty cash fund on September 4.2. Record credit card expenditures during the month. The credit card balance is not yet paid.3. Record petty cash expenditures during the month.arrow_forwardJournalize the entries to record the following (refer to the Chart of Accounts for exact wording of account titles): Instructions A. On March 1, Check is issued to establish a petty cash fund of $1,175. B. On April 1, the amount of cash in the petty cash fund is now $110. Check is issued to replenish the fund, based on the following summary of petty cash receipts: office supplies, $665; miscellaneous selling expense, $211; miscellaneous administrative expense, $178. (Because the amount of the check to replenish the fund plus the balance in the fund do not equal $1,175, record the discrepancy in the cash short and over account.)arrow_forwardis the answer to this question correct If you received a check from Mr. Jones for $500 for work you performed last week, which journal would you use to record receipt of the amount they owed you? What would be recorded? This transaction will be recorded in the Cash Receipts Journal. The receipt of cash from the sale of goods, as payment on accounts receivable or from other transactions, is recorded in a cash receipts journal with a debit to cash and a credit to the source of the cash, whether that is from sales revenue, payment on an account receivable, or some other account. Chapter 7 Accounting Information Systems out of Principles of Accounting, Volume 1. CASH RECEIPTS JOURNAL Date Account Cash DR Accounts Receivable CR 2022 Mar.13 Mr. Jones $ 500 $ 500arrow_forward

- Vishuarrow_forwardCarson's Bakery requires $500 cash to be on hand in the petty cash fund. During the month of October the following receipts were provided to the accountant in charge of petty cash; Gas $50, Supplies $100, Stamps $75. The petty cash fund now has a current balance of $270. How much cash needs to be withdrawn from the bank in order to replenish he petty cash fund? Record your answer as a numeric value without a $ sign. Type your answer..arrow_forwardPetty Cash Fund Minsky Ltd. maintains a balance of $2,500 in its petty cash fund. On December 31, Minsky's petty cash account has a balance of $216. Minsky replenishes the petty cash account to bring it back up to $2,500. Minsky classifies all petty cash transactions as miscellaneous expense. Required: What journal entry is made to record the replenishment of the petty cash fund?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education