FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

How do I construct a pro forma balance sheet for the next year and how do I calculate external funds needed?

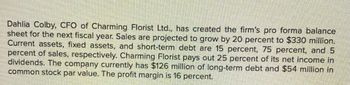

Transcribed Image Text:Dahlia Colby, CFO of Charming Florist Ltd., has created the firm's pro forma balance

sheet for the next fiscal year. Sales are projected to grow by 20 percent to $330 million.

Current assets, fixed assets, and short-term debt are 15 percent, 75 percent, and 5

percent of sales, respectively. Charming Florist pays out 25 percent of its net income in

dividends. The company currently has $126 million of long-term debt and $54 million in

common stock par value. The profit margin is 16 percent.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- How is a cash budget used to help manage current assets?arrow_forwardWhich of the following best describes the process of capital budgeting? a Forecasting revenues and expenses hmiting funds for capital improvements without considering the profitability of proposed prot determining a companys short term goals d. determinung the amount to spend on fixed assets and which fixed assets to purchasearrow_forwardthe major purpose of which of the following is to prepare an accurate estimate of future cash flows? A. Operating budget B. Cash budget C. Capital budget D. Executive budgetarrow_forward

- Question 16 what give rises to the changes in the balance of planned assets? A- cash contributions B- cash paid out to retirees C- actual returns of planned assets D- all of the above O A ODarrow_forwardA capital budget shows a proposed list of investments.arrow_forwardWhat are the advantages of evaluating fund performance based on Internal Rate of Return (IRR)? Why would an investor prefer to evaluate a fund based on a cash-on-cash return?arrow_forward

- 10.-From the following options, choose the four that correspond to the application of financial management in the long term. A) Preparing financial reports B) Long-term investments C) Manage working capital D) Capital structure E) Support in identifying SWOT F) Budgeting G) Financial strategy (Class excercise)arrow_forwardWhat is the capital expenditures budget?arrow_forwardWhat other sources provide resources for capital projects funds?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education