Concept explainers

I am currently working on some practice problems for my finance class and am unsure how to set up and calculate the following problems:

1) use the following information for the next two problems

you have concluded that next year the following relationships are possible:

| economic status | probability | |

| weak economy | .15 | -5% |

| static economy | .60 | 5% |

| strong economy | .25 | 15% |

a) what is your expected rate of return [E(Ri)] for next year? - I calculated this portion and got 6.00% which is the answer but part B is where I got stuck

b) compute the standard deviation of the rate of return for the one year period?

2) use the following information for the next two problems

| asset a | asset b |

| E(Ra) = 10% | E (Rb) = 15% |

| st.dev a = 8% | st.dev 9.5% |

| Wa = 0.25 | Wb = 0.75 |

Cov AB = 0.006

a) what is the expected return of a portfolio of two risky assets if the expected return, standard deviation, covariance, and asset weight are shown as above?

b) what is the standard deviation of this portfolio?

3) what is the expected return of the three stock portfolios described below?

| common stock | market value | expected return |

| ando inc | 95000 | 12.% |

| bee co. | 32,000 | 8.75% |

| cool inc. | 65000 | 17.7% |

4) the expected return for a stock, calculated using the

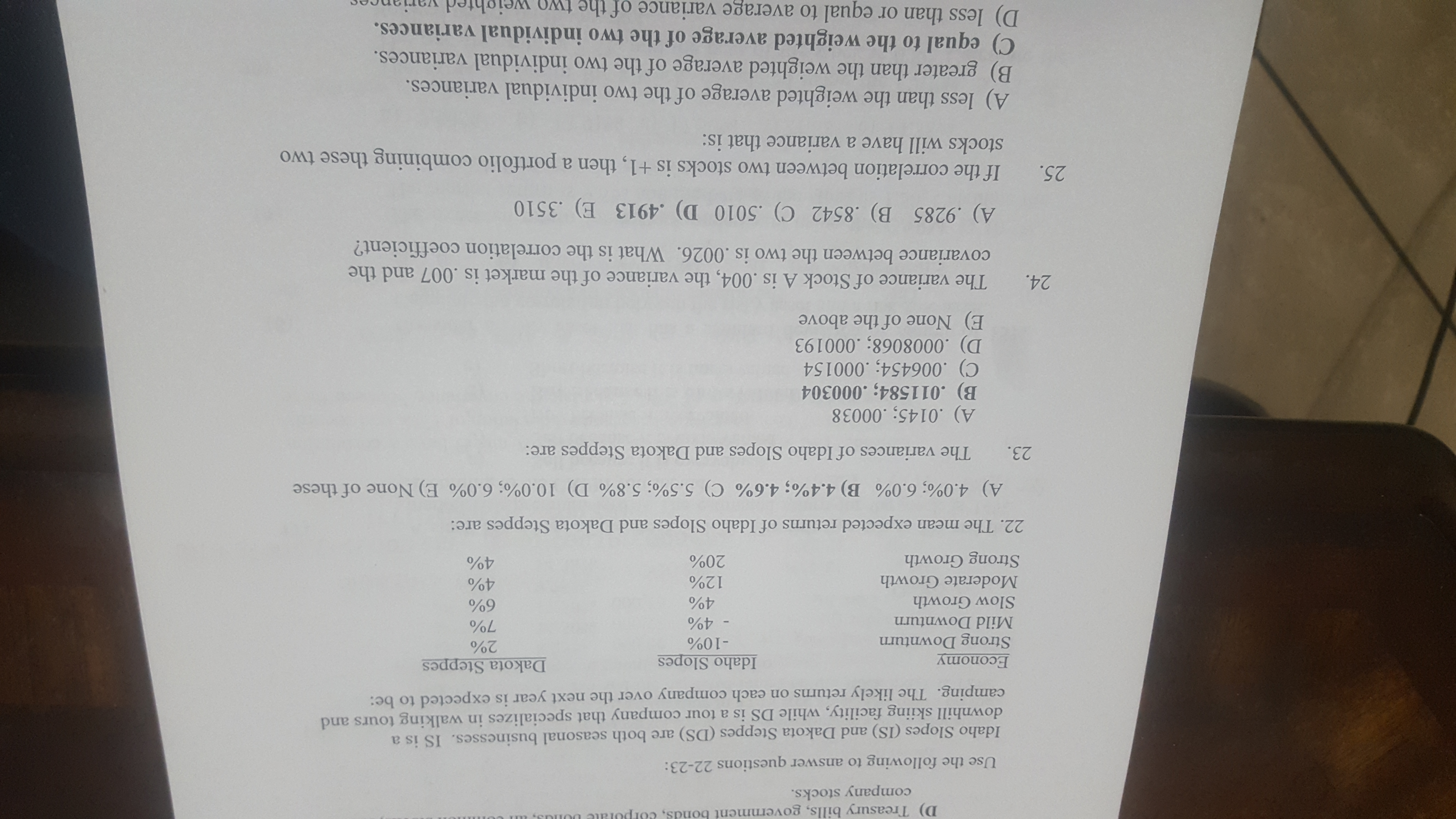

Last three problems are attached as images (22-24)

Trending nowThis is a popular solution!

Step by stepSolved in 7 steps with 5 images

- Arnold Vimka is a venture capitalist facing two alternative investment opportunities. He intends to invest $1,000,000 in a start-up firm. He is nervous, however, about future economic volatility. He asks you to analyze the following financial data for the past year’s operations of the two firms he is considering and give him some business advice. Company Name Larson Benson Variable cost per unit (a) $ 18.00 $ 9.00 Sales revenue (8,900 units × $29.00) $ 258,100 $ 258,100 Variable cost (8,900 units × a) (160,200 ) (80,100 ) Contribution margin $ 97,900 $ 178,000 Fixed cost (24,700 ) (104,800 ) Net income $ 73,200 $ 73,200 Required Use the contribution margin approach to compute the operating leverage for each firm. If the economy expands in coming years, Larson and Benson will both enjoy a 11 percent per year increase in sales, assuming that the selling price remains unchanged. Compute the change in net income for…arrow_forwardArnold Vimka is a venture capitalist facing two alternative investment opportunities. He intends to invest $1 million in a start-up firm. He is nervous, however, about future economic volatility. He asks you to analyze the following financial data for the past year’s operations of the two firms he is considering and give him some business advice. Company Name Larson Benson Variable cost per unit (a) $ 19.00 $ 9.50 Sales revenue (8,100 units × $28.00) $ 226,800 $ 226,800 Variable cost (8,100 units × a) (153,900 ) (76,950 ) Contribution margin $ 72,900 $ 149,850 Fixed cost (24,300 ) (101,250 ) Net income $ 48,600 $ 48,600 Required Use the contribution margin approach to compute the operating leverage for each firm. If the economy expands in coming years, Larson and Benson will both enjoy a 11 percent per year increase in sales, assuming that the selling price remains unchanged. Compute the change in net income for…arrow_forwardFinancial Accountingarrow_forward

- Chachagogo, Inc. is planning its operations for next year, and the CEO wants you to forecast the firm's additional funds needed (AFN). Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? Last year's sales P200,000 Sales growth rate 40% Last year's current assets 65,000 Last year's noncurrent assets 70,000 Last year's profit margin 20.0% L last year's accounts payable P50,000 Last year's notes payable P25,000 Last year's accruals P20,000 Target plowback ratio 75.0% choices: -44,000 -50,000 -54,000 -16,000 -40,000 Jonson, Inc. is planning its operations for the coming year, and the CEO wants you to forecast the firm's additional funds needed (AFN). Data for use in the forecast are shown below. However, the CEO is concerned about the impact of a change in the retention ratio from 90% that was used in the past to 50%, which the firm's investment bankers have recommended. Seventy-five percent of the total assets are considered…arrow_forwardThe following table presents sales forecasts for Golden Gelt Giftware. The unit price is $30. The unit cost of the giftware is $25. Year Unit Sales 20, 000 2. 31, 200 14, 900 5, 700 Thereafter It is expected that net working capital will amount to 25% of sales in the following year. For example, the store will need an initial (year 0) investment in working capital of 0.25 x 20,000 x $30 = $150,000. Plant and equipment necessary to establish the giftware business will require an additional investment of $197,000. This investment will be depreciated in an asset class with a CCA rate of 25%. We will assume that the firm has other assets in this asset class. After 4 years, the equipment will have an economic and book value of zero. The firm's tax rate is 35%. The discount rate is 10%. What is the net present value of the project? (Round your answer to the nearest whole dollar amount.) NPV $arrow_forwardAccounting solve the problemarrow_forward

- In your internship with Lewis, Lee, & Taylor Inc. you have been asked to forecast the firm's additional funds needed (AFN) for next year. The firm is operating at full capacity. Data for use in your forecast are shown below. Based on the AFN equation, what is the AFN for the coming year? Last year's sales = So Sales growth rate = g Last year's total assets = Ao* Last year's profit margin= PM -$14,440 B -$15,200 Ⓒ-$16,000 D-$16,800 $200,000 40% $135,000 20.0% Last year's accounts payable Last year's notes payable Last year's accruals Target payout ratio $50,000 $15,000 $20,000 25.0%arrow_forwardDuring the past year Heart Company had a net income of $175,000. What is the ROI if the investment is $25,000? Select one: a. 2.500 b. 7.000 c. 0.142 d. 5.450 e. 5.140arrow_forwardNikularrow_forward

- Which is not an example of a well stated financial objective? Increase sales by 10% this year Reduce costs of good sold for next product launch in January 2022 Double our gross margin % by end of the year. Deliver 15% earnings growth in the 4th quarter of 2021arrow_forwardA company is thinking of investing in one of two potential new products for sale. The projections are as follows: Year Revenue/cost £ (Product A) Revenue/cost £ (Product B)0 (150,000) outlay (150,000) outlay 1 24,000 12,0002 24,000 25,3333 44,000 52,0004 84,000 63,333 Calculate the IRR for Product B only using 3% and 15% to 2 d.p.arrow_forwardAccounting Problem: Database systems is considering expansion into a new product line. Assets to support expansion will cost $500,000. It is estimated that Database can generate $1,200,000 in annual sales, with a 6 percent profit margin. What would net income and return on assets(investment) be for the year?arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT