Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

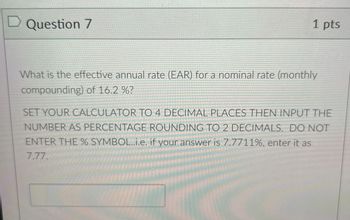

Transcribed Image Text:D Question 7

1 pts

What is the effective annual rate (EAR) for a nominal rate (monthly

compounding) of 16.2 %?

SET YOUR CALCULATOR TO 4 DECIMAL PLACES THEN INPUT THE

NUMBER AS PERCENTAGE ROUNDING TO 2 DECIMALS. DO NOT

ENTER THE % SYMBOL..i.e. if your answer is 7.7711%, enter it as

7.77.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- Problem 6-12 Calculating EAR [LO4] Find the EAR in each of the following cases: (Use 365 days a year. Do not round intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) Stated Rate (APR) Number of Times Effective Rate Compounded (EAR) 8.5 % 17.5 Quarterly Monthly % 13.5 Daily 10.5 Infinitearrow_forward6arrow_forwardProblem 5-63 Effective Interest Rate (LO4) Assume you take out a car loan of $7,700 that calls for 60 monthly payments of $210 each. a. What is the APR of the loan? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Use a financial calculator or Excel. Annual percentage rate % b. What is the effective annual interest rate on the loan? Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places. Effective annual rate %arrow_forward

- Chapter 5 Question 8arrow_forwardQuestion 5: Find the missing EAR and APR in each of the following cases: APR Number of Times Couponed EAR ??? Semi annually 12.4% 7% Quarterly ??? ??? Monthly 11.7% 10% Infinite ????arrow_forwardQuestion 1 1.5 pts You win the lottery and are told you won $42000000. You actually won $1000000 every year for the next 42 years. If the first payment were to be made today and your required rate of return is 6% (effective annual rate) what would you accept today (in dollars) in exchange for all those 42 payments? (Round your answer to three decimal places. For example, 1.23450 or 1.23463 will be rounded to 1.235 while 1.23448 will be rounded to 1.234)arrow_forward

- %24 What is the present value of a $1,000 payment made in five years when the discount rate is 10 percent? (Do not round Intermedlate calculatlons. Round your enswer to 2 declmal places.) Present value र् ( Prev 37 of 40 Next > ype here to search DELL F2 F4 F5 F7 F8 F11 F12 KA #3 V %arrow_forwardProblem 5-15 Calculating the Interest Rate (LO2) Find the interest rate implied by the following combinations of present and future values. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. Leave no cells blank - be certain to enter "0" wherever required. Present Value $360 163 260 Years 10 3 6 Future Value 708 217 260 Interest Rate % % 0 %arrow_forwardProblem 5-6 Present Value of an Annuity Due (LG5-6)If the present value of an ordinary, 6-year annuity is $5, 600 and interest rates are 7.5 percent, whats the present value of the same annuity due?Note: Round your percentage answer to 2 decimal places (i. e.. 0.1234 should be entered as 12.34).arrow_forward

- I f Topic 2: Linear Equations AT 9. A passbook savings account has a rate of 6%, Find the effective annual yie if the interest is compounded daily. Assume 360 days in a year. (Round to the nearest tenth of a percent, if necessary. For example, 20.5%) n 0.06 360 =C1+9 - C 1 36C -(t0.0a1 666) 360-1 . oo01 6666 360-1 3-1 360 1 1, o0ul 10arrow_forwardProblem 6-13 Calculating EAR (LO3) Find the EAR in each of the following cases: (Use 365 days a year. Do not round intermediate calculations. Round the final answers to 2 decimal places.) Stated Rate (APR) 10.8% 19.8 15.8 12.8 Number of Times Compounded Quarterly Monthly Daily Infinite Effective Rate (EAR) 용arrow_forwardHi, I am working on a regular payments savings plan spreadsheet assignment. I'm having trouble understanding what a compound is and how to find the interest.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education