Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Hi,

I need with part C and D please.

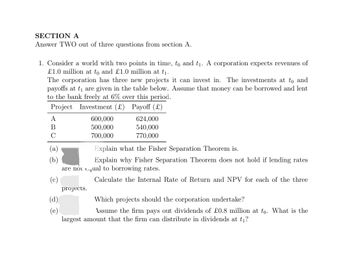

Transcribed Image Text:SECTION A

Answer TWO out of three questions from section A.

1. Consider a world with two points in time, to and t₁. A corporation expects revenues of

£1.0 million at to and £1.0 million at t₁.

The corporation has three new projects it can invest in. The investments at to and

payoffs at t₁ are given in the table below. Assume that money can be borrowed and lent

to the bank freely at 6% over this period.

Project Investment (£) Payoff (£)

A

B

C

600,000

500,000

700,000

projects.

624,000

540,000

770,000

Explain what the Fisher Separation Theorem is.

Explain why Fisher Separation Theorem does not hold if lending rates

are not equal to borrowing rates.

Calculate the Internal Rate of Return and NPV for each of the three

Which projects should the corporation undertake?

Assume the firm pays out dividends of £0.8 million at to. What is the

largest amount that the firm can distribute in dividends at t₁?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 3 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

please help me with part E.

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

please help me with part E.

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- I need answer typing clear urjent no chatgpt used i will give upvotesarrow_forwardI need typing clear urjent no chatgpt use i will give 5 upvotes I need full explanationarrow_forwardRequired information [The following information applies to the questions displayed below.] Consider the following narrative describing the process of filling a customer's order at a Starbucks branch: Identify the start and end events and the activities in the following narrative, and then draw the business process model using BPMN: the Starbucks customer entered the drive-through lane and stopped to review the menu. He then ordered a Venti coffee of the day and a blueberry muffin from the barista. The barista recorded the order in the cash register. While the customer drove to the window, the barista filled a Venti cup with coffee, put a lid on it, and retrieved the muffin from the pastry case and placed it in a bag. The barista handed the bag with the muffin and the hot coffee to the customer. The customer has an option to pay with cash, credit card, or Starbucks gift card. The customer paid with a gift card. The barista recorded the payment and returned the card along with the…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education