ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:2. Consider an individual who not only consumes goods x and y, but also needs a mini-

mum amount of x = xo to survive. Her (Stone-Geary) utility function is given by

U(x, y) = (x − x₁)¹/2y¹/2

Let prices be pa, Py and income is I > Prxo.

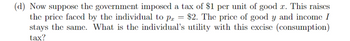

Transcribed Image Text:(d) Now suppose the government imposed a tax of $1 per unit of good x. This raises

the price faced by the individual to p = $2. The price of good y and income I

stays the same. What is the individual's utility with this excise (consumption)

tax?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- For two goods that I consume and I like both of them, say hamburger and Ice Latte, if hamburger is drawn on the horizontal axis and Ice Latte drawn on the vertical axis, if a uniform ad valorem sales tax of 8% is levied on both of them, this will only shrink the budget set but has no effect on slope of the budget line. True Falsearrow_forwardLea's utility function is U =0.7 ln( x ) + y where x denotes her consumption of good X and y denotes her consumption of good Y. Suppose the government imposes a per-unit tax on good X equal to 5 dollars. The price of good X charged by the sellers of good X is Px = 9 (and does not change due to the tax), the price of good Y is Py = 13 and Lea's income is M = 389. What is Lea's own-price substitution effect of the price increase due to the tax ?arrow_forwardSuppose a consumer’s preferences over two goods x_1 and x_2 are given by u = Square root (X_1,X_2). Her income is M and the two goods cost p1 and p2 per unit respectively. a) Derive her utility at the optimal consumption point as a function of prices and income. b) Now suppose the government imposes a proportional tax t on the value of the good x_1 (such as VAT). If the consumer approaches the government for income compensation to remain as well off as before the tax (i.e. compensating variation in income), how much money would she ask for? c) If instead, the government decides to maintain consumer’s utility level not through lump-sum transfer but by introducing a proportional subsidy S on the price of good 2, then what should be the size of the subsidy? d) Based on your answer in part c) discuss how much would it cost for the government to introduce both a tax and a subsidy at the same time? Can you think of any situation when this policy would make sense?arrow_forward

- Scenario 3 Suppose the government implements an income support program with the intention of making sure residents are able to purchase sufficient food. The government pays a cash benefit to all individuals with incomes less than $1000 according the following formula: cash benefit (CB) = $200 – 0.2*(earned income(I)) Households spend all of their income on food (F) and other goods (X). The price of food and other goods are normalized to 1. A households budget constraint is F + X = CB + I Households have the following preferences: U = 0.25*ln(F) + 0.75*ln(X) Refer to Scenario 3 Suppose a household has earned income of $300. How much does this household receive in benefits? and how much does the household spend on food?arrow_forwardQuestion 6: Suppose Connie has preferences over bread (good 1) and butter (good 2) U(q1, 92) = qi"´92 1/2 1/2 The price of bread is p1 2 and the price of butter is p2 2 and her income is Y = 20. Due to a wheat shortage, the government has stipulated a quota Q which denotes the maximum number of units of bread that any one consumer may purchase. (1) Draw Connie's budget set for the case that Q = 8 and for the case that Q = 4. (2) Suppose first that Q = 8. Find Connie's optimal choice. (3) Now suppose that Q = 4. Find Connie's optimal choice. Use graphs to illustrate your answer.arrow_forwardq 13. An agent consumes goods x and y, with prices Px=$5 per unit and Py=$8 per unit. the consumers income is I=$48. The government imposes a tax of $1 per unit on good x. what is the new equation for the budget constraint? a) y=6-(5/8)x b)y=6-.75x c) y=48-8xarrow_forward

- 1arrow_forward05- Income and Substitution Effects Question 2arrow_forwardLet the consumer have the utility function a. Show that the utility maximizing demands are and b. Letting p1 = p2 = 1, use the inverse elasticity rule to show that the optimal tax rates are related by c. Setting w = 100, r1 = 0:75, and r2 = 0:5, find the tax rates required to achieve revenue of R = 0:5 and R = 10. d. Calculate the proportional reduction in demand for the two goods comparing the no-tax position with the position after imposition of the optimal taxes for both revenue levels. Comment on the results.arrow_forward

- Yam has the following utility function for Apples (X1) and Ice Cream (X2). U(X1,X2) = Min{3X1,X2). If the prices of Apples and Ice Cream are p1 =$1, p2 -S1. Suppose a quantity tax of $1 is imposed on Apples. Which of the following is true after the imposition of the tax? O a. Yam's demand for Ice Cream will not decrease O b. Only Yam's demand for Apple will decreased C. Yam's demand for both Ice Cream and Apple will decrease O d. The tax will not change Yam's utilityarrow_forwardWendy drinks 10 sugary drinks and 4 smoothies a week. Smoothies are $5 each and sugary drinks were $2 each. This week, things are different: the government has slapped a tax on sugary drinks and their price has doubled to $4. But it's not all bad news for Wendy. The government has also revised the income tax, so Wendy's drinks budget has increased. She can now just afford to buy her usual 10 sugary drinks and 4 smoothies a week.arrow_forwardPlease no written by hand and no image Consumer B has income Y=100, and prices for goods a and b are Pa=2 and Pb=3. If B spends all of their income and buys a=23 units of a, how much good b do they buy? (Just enter the number, no units)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education