Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

please step by step solution.

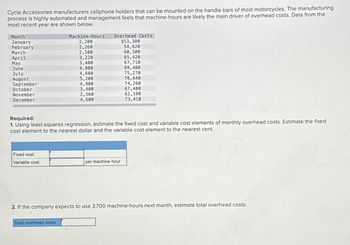

Transcribed Image Text:Cycle Accessories manufacturers cellphone holders that can be mounted on the handle bars of most motorcycles. The manufacturing

process is highly automated and management feels that machine-hours are likely the main driver of overhead costs. Data from the

most recent year are shown below.

Month

January

February

March

Overhead Costs

$53,300

54,620

Machine-Hours

2,200

2,260

2,500

60,500

April

3,220

65,420

May

3,400

67,710

June

4,000

69,480

July

4,600

75,270

August

5,200

76,640

September

4,900

74,260

October

3,400

67,400

November

2,560

62,190

December

4,600

73,410

Required:

1. Using least-squares regression, estimate the fixed cost and variable cost elements of monthly overhead costs. Estimate the fixed.

cost element to the nearest dollar and the variable cost element to the nearest cent.

Fixed cost

Variable cost

per machine hour

2. If the company expects to use 3,700 machine-hours next month, estimate total overhead costs.

Total overhead costs

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 10 images

Knowledge Booster

Similar questions

- Flash E Card Manufacturing manufactures software parts for the computer software systems that produce e -cards. The Flash II part is currently manufactured in the Computer Department. The Data Department also produces the part and the plant has excess capacity to produce the Flash ll part. The current market price of the Flash Il part is $500. The managerial accountant reported the following manufacturing costs and variable expense data: Flash E-Card Manufacturing Manufacturing Costs and Variable Expense Report Flash Component Direct materials $800 $170 Direct labor $110 Variable manufacturing overhead Fixed manufacturing overhead (current production level) Variable selling expenses (only incurred on sales to outside consumers) $125 $140 If the highest acceptable transfer price is $500 in the market, what is the lowest acceptable in house price the Data Department should receive to produce the part in house at the Computer Department? O A. $1,080 О В. $800 О С. $170 O D. $110arrow_forwardFlash E−Card Manufacturing manufactures software parts for the computer software systems that produce e−cards. The Flash II part is currently manufactured in the Computer Department. The Data Department also produces the part, and the plant has excess capacity to produce the Flash II part. The current market price of the Flash II part is $900. The managerial accountant reported the following manufacturing costs and variable expense data: Flash E−Card Manufacturing Manufacturing Costs and Variable Expense Report Flash Component Direct materials $860 Direct labor $110 Variable manufacturing overhead $150 Fixed manufacturing overhead (current production level) $145 Variable selling expenses (only incurred on sales to outside consumers) $118 If the highest acceptable transfer price is $900 in the market, what is the lowest acceptable in−house price the Data Department should receive to produce the part in−house at the ComputerDepartment?arrow_forwardAdriana Corporation manufactures football equipment. In planning for next year, the managers want to understand the relation between activity and overhead costs. Discussions with the plant supervisor suggest that overhead seems to vary with labor-hours, machine-hours, or both. The following data were collected from last year's operations. Month Labor-Hours Machine-Hours Overhead Costs 1 725 1,349 $ 102,630 2 720 1,404 103,742 3 685 1,517 109,818 4 750 1,459 108,368 5 770 1,589 116,290 6 745 1,583 114,521 7 735 1,396 107,079 8 720 1,307 102,082 9 715 1,463 106,471 10 790 1,538 113,065 11 675 1,298 103,776 12 720 1,608 116,796 Required: a. Use the high-low method to estimate the fixed and variable portions of overhead costs based on machine-hours. b. Managers expect the plant to operate at a monthly average…arrow_forward

- Adriana Corporation manufactures football equipment. In planning for next year, the managers want to understand the relation between activity and overhead costs. Discussions with the plant supervisor suggest that overhead seems to vary with labor hours, machine hours, or both. The following data were collected from last year’s operations. Month Labor-Hours Machine-Hours Overhead costs 1 720 1,355 $ 102,644 2 720 1,411 103,842 3 675 1,527 109,938 4 750 1,462 108,297 5 785 1,582…arrow_forwardMemanarrow_forwardHow much overhead cost would be assigned to product?arrow_forward

- Answer in step by step with explanation. Don't use Ai and chatgpt.arrow_forwardPlease do not provide answers in an image format thank you.arrow_forwardFountain Water Products (FWP) manufacturers water bottles. They have historically used a traditional system that allocated the manufacturing overhead costs based on machine hours. FWP is looking at switching to an ABC system in order to ensure more accurate product costing. They first want to compare the traditional and ABC costing systems to determine if it is worth the effort and costs to implement and maintain. They estimate a total overhead cost of $459,000. Under the traditional system they identified machine hours as the cost driver, and estimated a total of 51,000 machine hours. They actually incurred 48,700 machine hours in production. The total applied MOH calculated under the more precise ABC system was $320,000. The ABC costing system will cost $50,000 to implement. FWP has determined that a benefit of more accurate costing by $80,000 is worth the $50,000 implementation cost. What is the difference between the ABC costing and traditional system? Enter your number as a…arrow_forward

- Adirana corporation manufacturers football equipment please give me answer accountingarrow_forwardSmokeCity, Inc., manufactures barbeque smokers. Based on past experience, SmokeCity has found that its total annual overhead costs can be represented by the following formula: Overhead cost = $520,475 + $1.49X, where X equals number of smokers. Last year, SmokeCity produced 19,100 smokers. Actual overhead costs for the year were as expected. Required: 1. What is the driver for the overhead activity? For questions 2-4, Enter the final answers rounded to the nearest dollar. 2. What is the total overhead cost incurred by SmokeCity last year? $fill in the blank 2 3. What is the total fixed overhead cost incurred by SmokeCity last year? $fill in the blank 3 4. What is the total variable overhead cost incurred by SmokeCity last year? $fill in the blank 4 For questions 5-7, round your answers to the nearest cent. Use those rounded figures in subsequent computations, if necessary. 5. What is the overhead cost per unit produced? $fill in the blank 5 per unit 6. What is the fixed overhead cost…arrow_forwardSunland Co. gathered the following information on power costs and factory machine usage for the last six months: Month January February March April May June (a) Power Cost $28,390 (b) 36,069 32,895 26,235 (c) 23,890 20,700 Your answer is correct. Variable power costs $ Using the high-low method of analyzing costs, answer the following questions and show computations to support your answers. eTextbook and Media Your answer is correct. Factory Machine Hours What is the estimated variable portion of power costs per factory machine hour? (Round answer to 2 decimal places, e.g. 15.25.) Fixed power costs $ eTextbook and Media 15,800 21,400 Total power cost $ 18,700 High 15,100 13,500 What is the estimated fixed power cost each month? 10,500 1.41 5,895 per factory machine hour Low 5,895 If it is estimated that 13,800 factory machine hours will be run in July, what is the expected total power cost for July?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College