MATLAB: An Introduction with Applications

6th Edition

ISBN: 9781119256830

Author: Amos Gilat

Publisher: John Wiley & Sons Inc

expand_more

expand_more

format_list_bulleted

Question

d. Suppose we wish to find the middle 50% of the problem-solving times. What are the end points of these two times? (Do not round your intermediate calculations. Round your answers to 3 decimal places.)

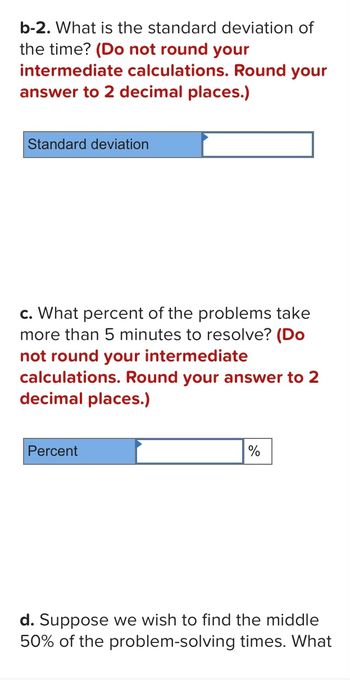

Transcribed Image Text:b-2. What is the standard deviation of

the time? (Do not round your

intermediate calculations. Round your

answer to 2 decimal places.)

Standard deviation

c. What percent of the problems take

more than 5 minutes to resolve? (Do

not round your intermediate

calculations. Round your answer to 2

decimal places.)

Percent

%

d. Suppose we wish to find the middle

50% of the problem-solving times. What

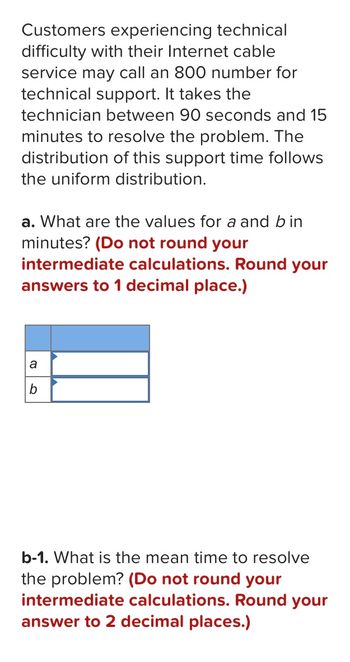

Transcribed Image Text:Customers experiencing technical

difficulty with their Internet cable

service may call an 800 number for

technical support. It takes the

technician between 90 seconds and 15

minutes to resolve the problem. The

distribution of this support time follows

the uniform distribution.

a. What are the values for a and bin

minutes? (Do not round your

intermediate calculations. Round your

answers to 1 decimal place.)

a

b

b-1. What is the mean time to resolve

the problem? (Do not round your

intermediate calculations. Round your

answer to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- You have an opportunity to purchase a bond that will pay out $734 in 14 months. If you would like to earn at least a 2.4% annual rate of simple interest on your investment, what is the largest amount the you should pay for the bond? Round your answer to the nearest cent.arrow_forwardThanks!arrow_forwardThe last table to 5arrow_forward

- I need help!arrow_forward3. The value of a car depreciates by 30% each year. If the car was purchased for $25 000, what will the value of the car be in 4 years? You must include an equation with your solution.arrow_forwardCristian purchased a car by making a down payment of $5,000 and weekly payments of $375 at the end of every week for 5 years. If interest was 3.25% compounded weekly, what was the purchase price of the car? What was the cost of financing? Round all answers to two decimal places if necessary. Enter only positive values for the "Purchase Price of the Car", and "Cost of Financing". N= PV = $ I/Y = PMT = $ Purchase Price of the Car = $ Cost of Financing = $ > Next Question % P/Y = FV = $ C/Y = (enter a positive value) (enter a positive value)arrow_forward

- Need only handwritten solution only (not typed one).arrow_forwardQ6 Your client has been given a trust fund valued at $1.64 million. She cannot access the money until she turns 65 years old, which is in 15 years. At that time, she can withdraw $18,000 per month.If the trust fund is invested at a 4.5 percent rate, how many months will it last your client once she starts to withdraw the money? (Do not round intermediate calculations and round your final answer to 2 decimal places.) NUMBER OF MONTHS?arrow_forwardIf you invest $900 at 4% per year, simple interest, how much will your investment be worth after 9 years? Round your answer to two decimal places if rounding is necessary.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc

MATLAB: An Introduction with ApplicationsStatisticsISBN:9781119256830Author:Amos GilatPublisher:John Wiley & Sons Inc Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning

Probability and Statistics for Engineering and th...StatisticsISBN:9781305251809Author:Jay L. DevorePublisher:Cengage Learning Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...StatisticsISBN:9781305504912Author:Frederick J Gravetter, Larry B. WallnauPublisher:Cengage Learning Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON

Elementary Statistics: Picturing the World (7th E...StatisticsISBN:9780134683416Author:Ron Larson, Betsy FarberPublisher:PEARSON The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman

The Basic Practice of StatisticsStatisticsISBN:9781319042578Author:David S. Moore, William I. Notz, Michael A. FlignerPublisher:W. H. Freeman Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

Introduction to the Practice of StatisticsStatisticsISBN:9781319013387Author:David S. Moore, George P. McCabe, Bruce A. CraigPublisher:W. H. Freeman

MATLAB: An Introduction with Applications

Statistics

ISBN:9781119256830

Author:Amos Gilat

Publisher:John Wiley & Sons Inc

Probability and Statistics for Engineering and th...

Statistics

ISBN:9781305251809

Author:Jay L. Devore

Publisher:Cengage Learning

Statistics for The Behavioral Sciences (MindTap C...

Statistics

ISBN:9781305504912

Author:Frederick J Gravetter, Larry B. Wallnau

Publisher:Cengage Learning

Elementary Statistics: Picturing the World (7th E...

Statistics

ISBN:9780134683416

Author:Ron Larson, Betsy Farber

Publisher:PEARSON

The Basic Practice of Statistics

Statistics

ISBN:9781319042578

Author:David S. Moore, William I. Notz, Michael A. Fligner

Publisher:W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:9781319013387

Author:David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:W. H. Freeman