ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

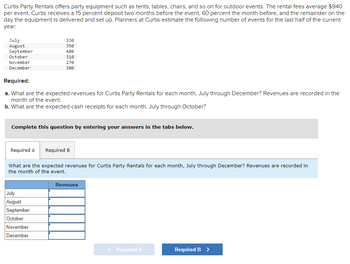

Transcribed Image Text:Curtis Party Rentals offers party equipment such as tents, tables, chairs, and so on for outdoor events. The rental fees average $940

per event. Curtis receives a 15 percent deposit two months before the event, 60 percent the month before, and the remainder on the

day the equipment is delivered and set up. Planners at Curtis estimate the following number of events for the last half of the current

year:

July

August

September

October

November

December

Required:

a. What are the expected revenues for Curtis Party Rentals for each month, July through December? Revenues are recorded in the

month of the event.

b. What are the expected cash receipts for each month, July through October?

330

350

400

310

270

300

Complete this question by entering your answers in the tabs below.

Required A Required B

What are the expected revenues for Curtis Party Rentals for each month, July through December? Revenues are recorded in

the month of the event.

July

August

September

October

November

December

Revenues

< Required A

Required B

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- (c) If A and B are mutually exclusive projects, which project would you select based on the rate of return on incremental investment at MARR = 10%? The rate of return on the incremental investment is %. (Round to one decimal place.) Which project would you select based on the rate of return on incremental investment at MARR = 10%? Choose the correct answer below. Project A O Project B 1: More Info FOT23 n 0 1 Net Cash Flow Project A - $145,000 35,000 35,000 140,000 Project B - $130,000 25,000 25,000 150,000arrow_forwardJenny Tanaka wants to buy a new car, and the annual gasoline expense is a major consideration. Her present car gets 25 miles per gallon (mpg), and she is considering purchasing a new car that gets 40 mpg. Jenny now drives about 12,000 miles per year and pays $3.25 per gallon of gasoline. She therefore calculates an annual gasoline consumption of 480 gallons for her 25 mpg car (12,000 miles/25 mpg) compared to 300 gallons consumed per year for the 40 mpg car (12,000 miles/40 mpg). Since driving the higher- mileage car would use 180 gallons less per year, Jenny estimates the new car will save her $585 in gasoline expense per year (180 gallons 3 $3.25 per gallon). Suppose Jenny buys the 40 mpg car. According to economic theory, Jenny's actual annual savings on gasoline will be 7 1 C 1 U C VI 10 V K W S TACAZEC 10 GUNS TOMBER 2 than her initial estimate of $585.arrow_forwardElectricity is produced with water according to the function: E = 5 + 5W-1W² where E = kilowatt-hour and W = gallons of water. Water costs $0.02 per gallon. Electricity can be sold on the grid for $0.10 per kWh (kilowatt-hour). How much water should be purchased?arrow_forward

- Q4= SAUDI Chemical Company is considering two types of equipment for burning waste material. Both equipment has burning capacity of 20 tons per day. The following data have been compiled for comparison of both equipment's. ITEM Installation cost Annual Operation & Maintenance cost Salvage value Income Tax Service Life EQUIPMENT A $1,220,000 $55,000 $65,000 $45,000 20 years EQUIPMENT B $ 770,000 $85,000 $35,000 $35,000 10 years Determine the yearly processing cost per ton of solid waste for each equipment, if the company's MARR is 12%. Also illustrate which option is best for selection?arrow_forwarda. A project costs $10 up front and has net benefits of $15 with probability 0.8 at the end of the second year and otherwise returns nothing. The discount rate is 0.035. What is the NPV? b. At what probability of returning $15 after year 2 would the ENPV be 0?arrow_forwardAuria will produce a venicle component and knows that each start generates a cost of 5,000 pesos. Its production capacity is 150,000 units and the cost per unit is $ 200, tne annual demand is 100,000 units, and the inventory rate is 15% per month. Consider that the product allows shortages and the cost of goodwill loss is $ 0.3 for each unit of said items, while the penalty cost if they do not deliver is S 30 / unit / year. a) Calculate the total annual cost and the quantity Q required.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education