ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

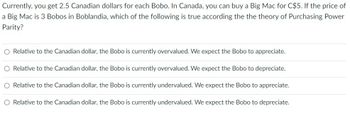

Transcribed Image Text:Currently, you get 2.5 Canadian dollars for each Bobo. In Canada, you can buy a Big Mac for C$5. If the price of

a Big Mac is 3 Bobos in Boblandia, which of the following is true according the the theory of Purchasing Power

Parity?

O Relative to the Canadian dollar, the Bobo is currently overvalued. We expect the Bobo to appreciate.

O Relative to the Canadian dollar, the Bobo is currently overvalued. We expect the Bobo to depreciate.

O Relative to the Canadian dollar, the Bobo is currently undervalued. We expect the Bobo to appreciate.

O Relative to the Canadian dollar, the Bobo is currently undervalued. We expect the Bobo to depreciate.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- in fall 2011 the euro dollar exchange rate was $1.35 and by spring 2015 it strenghthed to $1.10 . Asssume that the euorpean luxury marketeres cut the price of an $8000 linen suit by 10 percent when launching its spring 2015 collection . how would revenues have been affected when dollar prices were converted to euros?arrow_forwardAssume the Bobo (the currency in Boblandia) is the domestic currency. The exchange rate between the Bobo and the Wakandan dollar is currently 2.17. The current price of a Big Mac in Boblandia is 106 Bobos. The current price of a Big Mac in Wakanda is W$217. What is the exchange rate predicted by the theory of Purchasing Power Parity? Round to two decimal places, and do not enter the currency symbols.arrow_forwardIf Boblandia had a flexible exchange rate, it would cost 10 Bobos to purchase a Canadian dollar. The Central Bank of Boblandia (aka, the Bank of Boblandia, or BoB) has fixed the exchange rate, saying it will buy or sell Bobos at C$0.12 for each Bobo. Which of the following represents a choice it is currently facing? O In order to not have to buy Canadian dollars, it could buy bonds from domestic banks. O In order to not have to buy Canadian dollars, it could sell bonds to domestic banks. O In order to not have to sell Canadian dollars, it could buy bonds from domestic banks. O In order to not have to sell Canadian dollars, it could sell bonds to domestic banks.arrow_forward

- Question 2 of 25 In which situation is a country most likely to choose a flexible exchange rate for its currency? O A. A country believes that its currency will be in low demand in global markets. B. A country worries that the value of its currency could rise and fall unpredictably. C. A country has a reputation for having a strong and stable economy over time. O D. A country wants to make sure that its currency is stable in all economic situations.arrow_forward1. If Thalland wants to maintain a fixed exchange rate of 1 baht per euro, it should ___________ euros in the foreign exchange market. To be successful, this policy would have to ___________ euros by______ billion euros at any given exchange rate. 2. If investors believe the baht is going to be _________ as a result of the change in demand, a speculative attack may occur. 3. True or False: in the event of a successful speculative attack. Thai businesses tend to suffer because their foreign debt will now cost more to repay. True Falsearrow_forwardWhich of the following will most likely cause a nation's currency to appreciate on the foreign exchange market? a. A decrease in domestic interest rates O b. An increase in foreign interest rates c. Stable domestic prices while the nation's trading partners are experiencing 10 percent inflation O d. Domestic inflation of 10 percent while the nation's trading partners are experiencing stable pricesarrow_forward

- If Boblandia had a flexible exchange rate, it would cost 5 Bobos to purchase a Canadian dollar. The Central Bank of Boblandia (aka, the Bank of Boblandia, or BoB) has fixed the exchange rate, saying it will buy or sell Bobos at C$0.25 for each Bobo. Which of the following is true? O At the fixed exchage rate, supply of Bobos exceeds demand. The BoB's holdings of Canadian dollars will increase. O At the fixed exchage rate, supply of Bobos exceeds demand. The BoB's holdings of Canadian dollars will decrease. O At the fixed exchage rate, supply of Bobos is less than demand. The BoB's holdings of Canadian dollars will increase. O At the fixed exchage rate, supply of Bobos is less than demand. The BoB's holdings of Canadian dollars will decrease.arrow_forwardWhich of the following statement(s) is/are TRUE? I. The US dollar, the XCD dollar and the British pound are the most popular reserve currencies II. The EMS was replaced by the Bretton Woods system III. India and Spain are full members of the G20 IV. The market forces influence the floating exchange rate O a. I, III and IV only O b. II only С. I and II only O d. IV onlyarrow_forwardConsider avocado trading between you and nber. Your tree grows 100 this year and 10 next year.Nber's tree grows 20 this year and 50 next year.Let the equilibrium exchange rate be v. Consider a different scanerio: Your tree grows 100 this year and 10 next year.Nber's tree grows 20 this year and 60 next year.Let the equilibrium exchange rate be v'. Then v>v'. Hint: you can use your intuition to figure this out without any calculation. A. TrueB. Falsearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education