Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

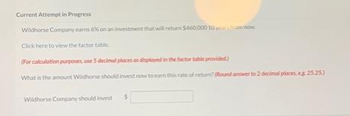

Transcribed Image Text:Current Attempt in Progress

Wildhorse Company earns 6% on an investment that will return $450,000 10 years from now.

Click here to view the factor tabi

(For calculation purposes, use 5 decimal places as displayed in the factor provided)

What is the amount Wildhorse should invest now to earn this rat of return? (Round answer to 2 decimal places, eg 25.253

Wildhorse Company should invest

5

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Julie wants to borrow $10,250 from you. She has offered to pay you back $12,250 in a year. If the cost of capital of this investment opportunity is 12%, what is its NPV? Question content area bottom Part 1 The NPV of the investment is $enter your response here. (Round to the nearest cent.)arrow_forwardplease solve this practice problemarrow_forwardPlease do not give solution in image format thankuarrow_forward

- How much must be invested now at 6% interest in order to have $75,000 in ten years? TVM Tables link (will open in a new window) Select one: O a. $70,755 O b. $134,854 c. $43,268 O d. $39,509 e. $41,879arrow_forwardWhat amount of money invested today at 3.54% compounded monthly will have an accumulated value of $452,000 in 6 years from now. Round all answers to two decimal places if necessary. A P/Y = C/Y = N = I/Y = PMT = $ FV = $ PV = $arrow_forwardSubject-Acountingarrow_forward

- Bark and Bliss Limited is a pet supply company headquartered in Edmonton, Alberta. They have four different lines of business. Here is an excerpt of their financial statements for the December 31, 2020 fiscal year: Dog Walking Brick & Division Online Shop Pet Training & Pet Care Mortar Stores Sales $1 22,500,000 13,980,000 27,630,500 5,407,000 Net operating income $4 1,250,000 1,840,000 2,845,200 1,134,750 Average operating assets $1 7,580,000 8,275,000 14,500,000 5,250,000 Bark and Bliss Limited has a policy that all investments must have a rate of return of at least 15%. Required: a. What is the return on investment for each of Bark and Bliss' four lines of business? Round your calculations to one decimal place, b. If the Online Store division was able to reduce its operating expenses by $57,000, what would be its new return on investment? Acti c. What is the residual income for each of Bark and Bliss' four lines of businessa Go toarrow_forwardDon't give answer in imagearrow_forwardComplete the table by finding the balance A when $18,000 is invested at rate r for t years, compounded continuously. (Round your answers to two decimal places.) r = 8% t 10 20 30 40 50 A $ $ $ $ $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education