FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Current Attemptin rrugress

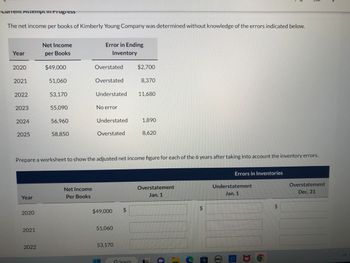

The net income per books of Kimberly Young Company was determined without knowledge of the errors indicated below.

Year

2020

2021

2022

2023

2024

2025

Year

2020

2021

Net Income

per Books

2022

$49,000

51,060

53,170

55,090

56,960

58,850

Error in Ending

Inventory

Net Income

Per Books

Overstated

Overstated

Understated

No error

Understated

Overstated

Prepare a worksheet to show the adjusted net income figure for each of the 6 years after taking into account the inventory errors.

$49,000

51,060

53,170

$

$2,700

O Search

8,370

11,680

1,890

8,620

Overstatement

Jan. 1

$

Errors in Inventories

Understatement

Jan. 1

DELL)

|

$

Overstatement

Dec. 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please do not give solution in image format thankuarrow_forwarddog subject-Accountingarrow_forwardComplete the missing piece of information involving the changes in inventory, and their relationship to goods available for sale, for the two years shown: 2021 2022 Beginning inventory $11,000 $7,200 Purchases 22,000 2,500 Goods available for sale $33,000 $fill in the blank 1 Ending inventory 7,200 fill in the blank 2 Cost of goods sold $fill in the blank 3 $8,100arrow_forward

- Please do not give solution in image format thankuarrow_forwardCurrent Attempt in Progress Cullumber Company began operations on January 1, 2024, adopting the conventional retail inventory system. None of the company's merchandise was marked down in 2024 and, because there was no beginning inventory, its ending inventory for 2024 of $31,248 would have been the same under either the conventional retail system or the LIFO retail system. On December 31, 2025, the store management considers adopting the LIFO retail system and desires to know how the December 31, 2025, inventory would appear under both systems. All pertinent data regarding purchases, sales, markups, and markdowns are shown below. There has been no change in the price level. Cost Retail Inventory, Jan. 1, 2025 $31,248 $50,400 Markdowns (net) 10,920 Markups (net) 18,480 Purchases (net) 109,960 149,520 Sales (net) 140,280 Determine the cost of the 2025 ending inventory under both (a) the conventional retail method and (b) the LIFO retail method. (Round ratios for computational purposes to…arrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward

- Please do not give solution in image format thankuarrow_forwardNonearrow_forwardCurrent Attempt in Progress Nash Company began operations on January 1, 2024, adopting the conventional retail inventory system. None of the company's merchandise was marked down in 2024 and, because there was no beginning inventory, its ending inventory for 2024 of $46,080 would have been the same under either the conventional retail system or the LIFO retail system. On December 31, 2025, the store management considers adopting the LIFO retail system and desires to know how the December 31, 2025, inventory would appear under both systems. All pertinent data regarding purchases, sales, markups, and markdowns are shown below. There has been no change in the price level. Inventory, Jan. 1, 2025 Markdowns (net) Markups (net) Purchases (net) Sales (net) Cost $46,080 167,600 Retail $76,800 16,640 28,160 227,840 213,760 Determine the cost of the 2025 ending inventory under both (a) the conventional retail method and (b) the LIFO retail method. (Round ratios for computational purposes to 2…arrow_forward

- Do not Give solution in images format The records of Earthly Goods provided the following information for the year ended December 31, 2023. At Cost At Retail January 1 beginning inventory $ 451,350 $ 907,150 Purchases 2,967,585 6,378,700 Purchase returns 48,800 115,350 Sales 5,455,700 Sales returns 42,600 Required: 1. Prepare an estimate of the company’s year-end inventory by the retail method. (Round all calculations to two decimal places.) 2. Under the assumption the company took a year-end physical inventory at marked selling prices that totalled $1,671,800, prepare a schedule showing the store’s loss from theft or other causes at cost and at retail.arrow_forwardPlease do not give solution in image format thankuarrow_forwardPlease do not give solution in image format thankuarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education