FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Current Attempt in Progress

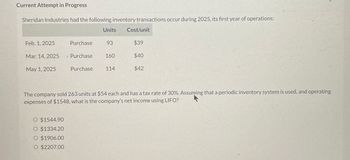

Sheridan Industries had the following inventory transactions occur during 2025, its first year of operations:

Units

Cost/unit

Feb. 1, 2025

Purchase

93

$39

Mar. 14, 2025

Purchase

160

$40

May 1, 2025

Purchase

114

$42

The company sold 263 units at $54 each and has a tax rate of 30%. Assuming that a periodic inventory system is used, and operating

expenses of $1548, what is the company's net income using LIFO?

O $1544.90

O $1334.20

O $1906.00

O $2207.00

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- 1arrow_forwardSunland Company's inventory on January 1, 2025, at cost and retail are $97,500 and $141,000, respectively. Sunland established its base year amounts on January 1, 2025. The current year price index was 1.20. Sunland also had the following information: Purchases Sales Mark-ups Mark-downs Cost $195,000 Retail $282,000 243,000 19,740 (11,280) Determine ending inventory using: (Round ratio to 2 decimal places, e.g. 75.35% and final answer to O decimal places, e.g. 5,275.) (a) LIFO retail. (b) Dollar Value LIFO. (a) Ending inventory under LIFO retail $ tA (b) Ending inventory under Dollar Value LIFO $arrow_forward! Required information [The following information applies to the questions displayed below.] A company began 2024 with 17,000 units of inventory on hand. The cost of each unit was $5.00. During 2024, an additional 35,000 units were purchased at a single unit cost, and 27,000 units remained on hand at the end of 2024 (25,000 units therefore were sold during 2024). The company uses a periodic inventory system. Cost of goods sold for 2024, applying the average cost method, is $142,500. The company is interested in determining what cost of goods sold would have been if the FIFO or LIFO methods were used. Required: 2. Determine the cost of goods sold for 2024 using the LIFO method. Note: Do not round intermediate calculations. LIFO cost of goods soldarrow_forward

- Bettencourt Clothing Corporation uses a periodic inventory system and the LIFO cost method. The company began 2024 with the following inventory layers (listed in chronological order of acquisition): 5,200 units @ $12 per unit 8,200 units @ $14 per unit Beginning inventory $ 62,400 114,800 $ 177,200 During 2024, 20,200 units were purchased for $16 per unit. Sales for the year totaled 30,400 units at various prices, leaving 3,200 units in ending inventory. Required: 1. Calculate cost of goods sold for 2024. 2. Determine the amount of LIFO liquidation profit that the company must report in a disclosure note to its 2024 financial statements, assuming the amount is material. Assume an income tax rate of 25%. Cost of goods sold LIFO liquidation profitarrow_forwardcomplete this question by entering your answers in the tabs below. only typed solutionarrow_forwardMetlock Corporation adopted the dollar-value LIFO retail inventory method on January 1, 2024. At that time the inventory had a cost of $128,075 and a retail price of $235,000. The following information is available: 2024 2025 2026 2027 Year-End Inventory at Retail Ending inventory $256,100 $ 278,100 265,100 297,500 Current Year Cost-Retail% 2024 54% 56% 57% 55% Year-End Price Index $ 104 The price index at January 1, 2024, is 100. Compute the ending inventory at December 31 of the years 2024-2027. (Round ratios for computational purposes to 1 decimal place, e.g 78.7% and final answers to O decimal places, e.g. 28,987.) 108 110 119 2025 42 2026 $ 2027arrow_forward

- A company uses the dollar-value LIFO method of computing inventory. An external price index is used to convert ending inventory to base year. The company began operations on January 1, 2024, with an inventory of $120,000 Year-end inventories at year-end costs and cost indexes for its one inventory pool were as follows: Year Ended December 31 2024 2025 2026 2027 Date Required: Calculate inventory amounts at the end of each year Note: Round intermediate calculations and final answers to the nearest whole dollars. 01/01/2024 12/31/2024 12/31/2025 12/31/2026 Ending Inventory at Cost Index (Relative to Year-End Costs Base Year) $ 198,000 261,800 243,600 240,800 12/31/2027 Inventory Layers Converted to Base Year Cost Inventory at Year End Cost Inventory Layers at Base Year Cost Inventory Layers Converted to Cost Inventory Layers Converted to Cost Base Base 2024 Base 2024 2025 Base 1.10 1.19 1.16 1.12 2024 2025 2026 Base 2024 2025 2026 2027 Inventory Layers at Base Year Cost Inventory DVL…arrow_forwardCullumber Games reported the following information for a three-year period: 2024 2023 2022 Ending inventory $21,200 $31,800 $36,040 Sales 132,500 135,680 121,900 Cost of goods sold 53,000 54,272 48,760 Profit 31,800 44,520 42,400 Calculate the inventory turnover, days sales in inventory, and gross profit margin for 2024 and 2023. (Round number of days answers to O decimal places, e.g. 52 and other answers to 2 decimal places, e.g. 52.75. Use 365 days for calculation.) Inventory turnover Days sales in inventory Gross profit margin 2024 times days 2023 times days % %arrow_forwardSagararrow_forward

- help mearrow_forwardCurrent Attempt in Progress The trial balance of Crane Company at the end of its fiscal year, August 31, 2022, includes these accounts: Inventory $35,000; Purchases $154,900; Sales Revenue $191,000; Freight-In $9,200; Sales Returns and Allowances $4,400; Freight-Out $1,900; and Purchases Returns and Allowances $6,900. The ending inventory is $28,000. Prepare a cost of goods sold section for the year ending August 31.arrow_forwardplease answer within 30 minutes..arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education