FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:esc

!

1

Q

A

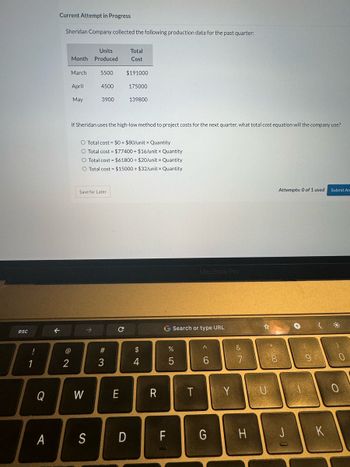

Current Attempt in Progress

Sheridan Company collected the following production data for the past quarter:

2

Units

Month Produced

March

April

May

5500

4500

3900

W

Save for Later

If Sheridan uses the high-low method to project costs for the next quarter, what total cost equation will the company use?

O Total cost = $0 + $80/unit x Quantity

O Total cost = $77400+ $16/unit x Quantity

O Total cost = $61800 + $20/unit x Quantity

O Total cost = $15000+ $32/unit x Quantity

#3

Total

Cost

$191000

с

175000

E

139800

S D

$

4

R

G Search or type URL

FL

67 5⁰°

%

5

MacBook Pro

T

A

6

G

Y

&

7

H

U

Attempts: 0 of 1 used Submit An

J

Co

K

о

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- For the coming year, Cabinet Inc. anticipates fixed costs of $199,100, a unit variable cost of $70, and a unit selling price of $125. The maximum sales within the relevant range are $912,250. a. Determine the maximum possible operating loss. $ Xarrow_forwardSpartans Inc gathered data on sales (in units) and costs ($) over the past 12 months (displayed below) and estimated its cost function as: Y = $2,395 + $34.81(X) Month January February March April May June July August September October November Sales (units) December 228 129 218 156 177 68 129 83 90 107 139 Costs ($) $10,332 $8,651 $11,294 $9,734 $10,006 $4,762 $6,837 $5,138 $8,004 $7,774 $10,869 $6,935 98 (data used to generate cost function) Over the next three months Spartans Inc. has forecasted units sales (in units) as shown below. Estimate the total costs to be incurred and indicate whether the cost function generates a reliable forecast valuearrow_forwardDevelop an equation for total monthly production costs. Total Monthly Production costs = Fixed Costs + Variable Costs = _____________ + ($ per unit X Number of units) Predict total costs for a monthly production volume of 9,000 units.arrow_forward

- Please provide correct solutionarrow_forwardUse the breakeven model to determine which of the statements below is TRUE according to the information provided in the table relating to two different locations considered for a new manufacturing facility. LOCATION ANNUAL FIXED COSTS UNIT VARIABLE COSTS Site A $120,000 Site B $110,000 a. The breakeven point for these two locations is 909 units per year b Se B is the desired location if the production rate is 1000 units per year The breakeven point for these two locations is 625 units per year d Ste A is the desired location if the production rate is 500 mits per year $18 $29arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education