FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

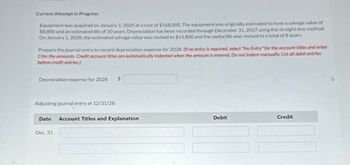

Transcribed Image Text:Current Attempt in Progress

Equipment was acquired on January 1, 2025 at a cost of $168,000. The equipment was originally estimated to have a salvage value of

$8,800 and an estimated life of 10 years. Depreciation has been recorded through December 31, 2027 using the straight-line method.

On January 1, 2028, the estimated salvage value was revised to $14,800 and the useful life was revised to a total of 8 years.

Prepare the journal entry to record depreciation expense for 2028. (If no entry is required, select "No Entry" for the account titles and enter

O for the amounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries

before credit entries.)

Depreciation expense for 2028 $

Adjusting journal entry at 12/31/28:

Date

Dec. 31

Account Titles and Explanation

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Partial-year depreciation Equipment acquired at a cost of $110,000 has an estimated residual value of $7,000 and an estimated useful life of 10 years. It was placed into service on May 1 of t current fiscal year, which ends on December 31. This information has been collected in the Microsoft Excel Online file. Open the spreadsheet, perform the required analysis, and input your answers in the questions below. X Open spreadsheet a. Determine the depreciation for the current fiscal year and for the following fiscal year by the straight-line method. Round your answers to the nearest dollar. Year 1 Year 2 Year 1 Depreciation Year 2 $ b. Determine the depreciation for the current fiscal year and for the following fiscal year by the double-declining-balance method. Do not round the double-declin balance rate. Round your answers to the nearest dollar. Depreciation $ Incorrect $arrow_forwardnku.4arrow_forwardThe following information is available on a depreciable asset: Purchase date January 1, Year 1 Purchase price $96,000 Salvage value $10,000 Useful life 10 years Depreciation method straight-line The asset's book value is $78,800 on January 1, Year 3. On that date, management determines that the asset's salvage value should be $5,000 rather than the original estimate of $10,000. Based on this information, the amount of depreciation expense the company should recognize during Year 3 would be: Multiple Choice $7,880.00 $9,225.00 $8,600.00 $7,380.00 $9,850.00arrow_forward

- Current Attempt in Progress Whispering Company purchased a machine on July 1, 2026, for $31,080. Whispering paid $222 in title fees and delinquent county property taxes of $139 on the machine. In addition, Whispering paid $555 shipping charges for delivery, and $527 was paid to a local contractor to build and wire a platform for the machine on the plant floor. The machine has an estimated useful life of 6 years with a salvage value of $3,330. Determine the depreciation base of Whispering's new machine. Whispering uses straight-line depreciation. Depreciation base $arrow_forwardPlease complete using the same formart. Thank you :)arrow_forwardUse the following information for the Quick Studies below. (Algo) Skip to question [The following information applies to the questions displayed below.]Equipment costing $60,000 with a 4-year useful life and an estimated $10,000 salvage value is acquired and started operating on January 1. The equipment is estimated to produce 5,000 units of product during its life. It produced 750 units in the first year. QS 8-8 (Algo) Recording depreciation journal entries LO P1 Record the journal entries for equipment depreciation for the first year under straight-line, units-of-production, and double-declining-balance.arrow_forward

- eBook Show Me How Revision of Depreciation A building with a cost of $1,200,000 has an estimated residual value of $250,000, has an estimated useful life of 40 years, and is depreciated by the straight-line method.arrow_forwardA piece of equipment is available for purchase for $ 16000 has an estimated useful life of 5 years, and has an estimated salvage value of $ 4000. Determine the depreciation and the book value for each of the 5 years using the straight-line method and the double declining-balance method? (Compare)arrow_forwardCullumber Company had the following assets on January 1, 2022. Useful Life (in years) Salvage Value $ 0 Item Cost Purchase Date Machinery $72,000 Jan. 1, 2012 10 Forklift 31,000 Jan. 1, 2019 Truck 37,400 Jan. 1, 2017 8. 3,000 During 2022, each of the assets was removed from service. The machinery was retired on January 1. The forklift was sold on June 30 for $12,100. The truck was discarded on December 31. Journalize all entries required on the above dates, indluding entries to update depreciation, where applicable, on disposed assets. The company uses straight-line depreciation. All depreciation was up to date as of December 31, 2021. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit (To record depreciation expense on forklift) (To record sale of forklift) (To record depreciation expense on…arrow_forward

- Freeport-McMoRan Copper and Gold has purchased a new ore grading unit for $80,000. The unit has an anticipated life of 10 years and a salvage value of $ 10,000. Use the DB and DDB methods to compare the schedule of depreciation and book values for each year. Solve by hand and by spreadsheet.arrow_forwardRequired information Skip to question [The following information applies to the questions displayed below.] Ramirez Company installs a computerized manufacturing machine in its factory at the beginning of the year at a cost of $49,100. The machine's useful life is estimated at 10 years, or 401,000 units of product, with a $9,000 salvage value. During its second year, the machine produces 34,100 units of product. Determine the machine’s second-year depreciation and year end book value under the straight-line method.arrow_forwardA plant asset acquired on January 4, 200B, at a cost of $300,000 has an estimated useful life of 10 years. The salvage value is estimated fthe asset's useful life. to be $25,000 at the end of- Instructions Determine the depreciation expense for each of the first two years using: (a) the straight-line method. (b) the double-declining-balance method. Please show your work either in the answer space provided OR upload a file. A - U X2 x2 a. Straight-Line F4 PrtScn Home 21 F5 F6 F7 F8 F9 illarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education