FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

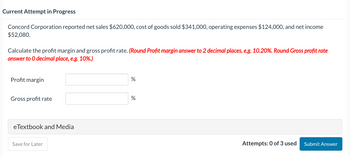

Current Attempt in Progress Concord Corporation reported net sales $620,000, cost of goods sold $341,000, operating expenses $124,000, and net income $52,080. Calculate the profit margin and gross profit rate. (Round Profit margin answer to 2 decimal places, e.g. 10.20%. Round Gross profit rate answer to 0 decimal place, e.g. 10%.) Profit margin % Gross profit rate % eTextbook and Media

Transcribed Image Text:Current Attempt in Progress

Concord Corporation reported net sales $620,000, cost of goods sold $341,000, operating expenses $124,000, and net income

$52,080.

Calculate the profit margin and gross profit rate. (Round Profit margin answer to 2 decimal places, e.g. 10.20%. Round Gross profit rate

answer to O decimal place, e.g. 10%.)

Profit margin

Gross profit rate

eTextbook and Media

Save for Later

%

%

Attempts: 0 of 3 used Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Calculate the gross and net profits (in $) and the two profit margins (as %s) for the given company. (Round profit margins to the nearest tenth of a percent.) Gross Profit Margin (%) 38.43 % Company Net Sales an optometry store $340,735 Cost of Goods Sold $209,655 $ Gross Profit Operating Expenses $83,921 Net Profit $ 47,159 ✓ Net Profit Margin (%) %arrow_forwardPerform a vertical analysis of the P&L (FS Company). "Formula: Vertical Analysis % Each income statement items / Revenues (or Net sales) Fill in each Blank. Round your answers to the nearest tenth percent, i.e. 4.5%. PLEASE SUBMIT YOUR ANSWERS IN % and include the % symbol. Do not leave any blank. If the answer is 0, be sure to put 0. Cost of goods sold Gross profit Net sales $858,000 Select] Other expenses Interest revenue Income from operations Interest expense 2018 Income before income taxes Income tax expense Net income 513,000 345,000 244,000 101,000 4,000 24,000 81,000 33,000 FS Company Comparative P&L statement Years Ended December 31, 2018 and 2017 48,000 % of sales Select J [Select] | Select | [Select] [Select] [Select] [ Select] Select] Select > >arrow_forwardAssume Martinez Company has the following reported amounts: Sales revenue $ 610,000, Sales returns and allowances $ 30,000, Cost of goods sold $ 396,500, and Operating expenses $ 84,000. (a) Compute net sales. Net sales (b) Compute gross profit. Gross profit (c) Compute income from operations. Income from operations (d) Compute the gross profit rate. (Round answer to 1 decimal place, e.g. 25.2%.) Gross profit rate %24arrow_forward

- Assume Carla Vista Company has the following reported amounts: Sales revenue $1,489,000, Sales returns and allowances $44,000. Cost of goods sold $955,145, and Operating expenses $321,200. (a) Compute net sales. Net sales $ (b) Compute gross profit. Gross profit $ (c) Compute income from operations. Income from operations $ (d) Compute the gross profit rate. (Round answer to 1 decimal place, e.g. 25.2%.) Gross profit rate %arrow_forwardCalculate income from operations for Jonas Company based on the following data: Sales $764,000 Selling expenses 52,500 Cost of goods sold 538,000 Oa, $711.500 Ob. $173,500 Oc. $485,500 Od. $226,000 ( Previous Nextarrow_forwardThe following is Cullumber Company’s income statement for the past year. Sales revenue $336,000 Cost of goods sold 134,400 Gross margin 201,600 Operating expenses 145,600 Operating income $56,000 What is the gross margin percentage? (Round answer to 0 decimal places, e.g. 45%.) Gross margin percentage enter gross margin percentage rounded to 0 decimal places %arrow_forward

- Nonearrow_forwardComplete the balance sheet and sales information using the following financial data: Total assets turnover: 1.1x Days sales outstanding: 73.0 daysa Inventory turnover ratio: 4x Fixed assets turnover: 3.0x Current ratio: 2.5x Gross profit margin on sales: (Sales - Cost of goods sold)/Sales = 20% aCalculation is based on a 365-day year. Do not round intermediate calculations. Round your answers to the nearest dollar. Cash Accounts receivable Inventories Fixed assets Total assets Sales $ $ Balance Sheet $270,000 Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Cost of goods sold $ $ $ 54,000 67,500arrow_forwardRevenue and expense data for Innovation Quarter Inc. for two recent years are as follows: Current Year Previous Year Sales $490,000 $446,000 Cost of merchandise sold 289,100 231,920 Selling expenses 78,400 84,740 Administrative expenses 88,200 75,820 Income tax expense 14,700 22,300 a. Prepare an income statement in comparative form, stating each item for both years as a percent of sales. If required, round percentages to one decimal place. Enter all amounts as positive numbers. Innovation Quarter Inc. Comparative Income Statement For the Years Ended December 31 Current year Amount Current year Percent Previous year Amount Previous year Percent Sales $490,000 % $446,000 % Cost of merchandise sold 289,100 % 231,920 % % % Selling expenses 78,400 84,740 % Administrative expenses 88,200 % 75,820 % % % Income tax expense 14,700 % 22,300 % % % b. The vertical analysis indicates that the cost of merchandise sold as a percent of sales - by 7 percentage points, while selling expenses by 3…arrow_forward

- Nonearrow_forwardCochran corporation, Inc. has the following income statement: Cochran corporation, Inc. Income statement For the year ended December 31, 2021 net sales $240 Cost of goods sold $150 gross profit $90 Operating expenses $65 Net income $25 Using vertical analysis, what percentage is assigned to operating expenses? a. 27,1% b. 43.3% c. 72.2% d. 260.0%arrow_forwardTotal assets turnover: 1.1x Days sales outstanding: 36.5 daysa Inventory turnover ratio: 3.75x Fixed assets turnover: 2.5x Current ratio: 2.0x Gross profit margin on sales: (Sales - Cost of goods sold)/Sales = 15% aCalculation is based on a 365-day year. 1 Do not round intermediate calculations. Round your answers to the nearest dollar. Balance Sheet Cash Accounts receivable Inventories Fixed assets Total assets Sales $ $ $330,000 Current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity Cost of goods sold $ $ $ 49,500 115,500 Check My Work (2 remainiarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education