Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Please help me for this question to find cash flow and net present value

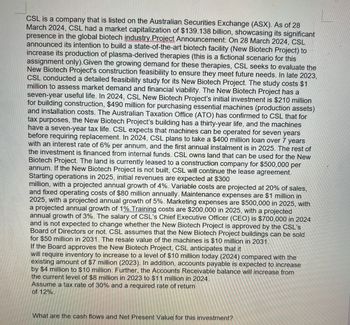

Transcribed Image Text:CSL is a company that is listed on the Australian Securities Exchange (ASX). As of 28

March 2024, CSL had a market capitalization of $139.138 billion, showcasing its significant

presence in the global biotech industry Project Announcement: On 28 March 2024, CSL

announced its intention to build a state-of-the-art biotech facility (New Biotech Project) to

increase its production of plasma-derived therapies (this is a fictional scenario for this

assignment only). Given the growing demand for these therapies, CSL seeks to evaluate the

New Biotech Project's construction feasibility to ensure they meet future needs. In late 2023,

CSL conducted a detailed feasibility study for its New Biotech Project. The study costs $1

million to assess market demand and financial viability. The New Biotech Project has a

seven-year useful life. In 2024, CSL New Biotech Project's initial investment is $210 million

for building construction, $490 million for purchasing essential machines (production assets)

and installation costs. The Australian Taxation Office (ATO) has confirmed to CSL that for

tax purposes, the New Biotech Project's building has a thirty-year life, and the machines

have a seven-year tax life. CSL expects that machines can be operated for seven years

before requiring replacement. In 2024, CSL plans to take a $400 million loan over 7 years

with an interest rate of 6% per annum, and the first annual instalment is in 2025. The rest of

the investment is financed from internal funds. CSL owns land that can be used for the New

Biotech Project. The land is currently leased to a construction company for $500,000 per

annum. If the New Biotech Project is not built, CSL will continue the lease agreement.

Starting operations in 2025, initial revenues are expected at $300

million, with a projected annual growth of 4%. Variable costs are projected at 20% of sales,

and fixed operating costs of $80 million annually. Maintenance expenses are $1 million in

2025, with a projected annual growth of 5%. Marketing expenses are $500,000 in 2025, with

a projected annual growth of 1%. Training costs are $200,000 in 2025, with a projected

annual growth of 3%. The salary of CSL's Chief Executive Officer (CEO) is $700,000 in 2024

and is not expected to change whether the New Biotech Project is approved by the CSL's

Board of Directors or not. CSL assumes that the New Biotech Project buildings can be sold

for $50 million in 2031. The resale value of the machines is $10 million in 2031.

If the Board approves the New Biotech Project, CSL anticipates that it

will require inventory to increase to a level of $10 million today (2024) compared with the

existing amount of $7 million (2023). In addition, accounts payable is expected to increase

by $4 million to $10 million. Further, the Accounts Receivable balance will increase from

the current level of $8 million in 2023 to $11 million in 2024.

Assume a tax rate of 30% and a required rate of return

of 12%.

What are the cash flows and Net Present Value for this investment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Discuss the following terms as they relate to the presentation of cash flow information: Liquidity Solvency Financial flexibilityarrow_forwardWhat is an example of a situation where TVM calculations are used? HOw would cash flow be impacted?arrow_forwardCould you please give me a brief overview of what "cash flow for ROR analysis" is? Thanks.arrow_forward

- How can we obtain the Cash flow from financing activities?arrow_forwardHow do we measure and compare various cash flows? Give an example?arrow_forwardPlease explain how to prepare a statement of cash flows (indirect method) including analyzing tables? Please provide an example. Thank you,arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education