Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

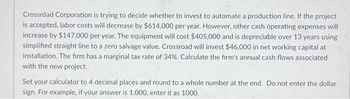

Transcribed Image Text:Crossroad Corporation is trying to decide whether to invest to automate a production line. If the project

is accepted, labor costs will decrease by $614,000 per year. However, other cash operating expenses will

increase by $147,000 per year. The equipment will cost $405,000 and is depreciable over 13 years using

simplified straight line to a zero salvage value. Crossroad will invest $46,000 in net working capital at

installation. The firm has a marginal tax rate of 34%. Calculate the firm's annual cash flows associated

with the new project.

Set your calculator to 4 decimal places and round to a whole number at the end. Do not enter the dollar

sign. For example, if your answer is 1,000, enter it as 1000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Tempura, Inc., is considering two projects. Project A requires an investment of $48,000. Estimated annual receipts for 20 years are $19.000; estimated annual costs are $12,500. An alternative project, B, requires an investment of $77,000, has annual receipts for 20 years of $23,000, and has annual costs of $18,000. Assume both projects have a zero salvage value and that MARR is 11.0 %/year. Click here to access the TVM Factor Table Calculator Part a What is the present worth of each project? Project A. $ Project B: $arrow_forwardTropetech Inc. is looking at investing in a production facility that will require an initial investment of $500,000. The facility will have a three-year useful life, and it will not have any salvage value at the end of the project's life. If demand is strong, the facility will be able to generate annual cash flows of $265,000, but if demand turns out to be weak, the facility will generate annual cash flows of only $120,000. Tropetech Inc. thinks that there is a 50% chance that demand will be strong and a 50% chance that demand will be weak. If the company uses a project cost of capital of 13%, what will be the expected net present value (NPV) of this project? O -$38,656 O -$25,013 -$45,478 O -$47,752 Tropetech Inc. could spend $510,000 to build the facility. Spending the additional $10,000 on the facility will allow the company to switch the products they produce in the facility after the first year of operations if demand turns out to be weak in year 1. If the company switches product…arrow_forwardMountain Sounds Corp. is evaluating a cost savings project. The project's expected operational life is seven years. The project will save the firm $248,730 in net working capital, a one time savings for the life of the project. The project will require an investment in capital equipment of $5,631,945 and has an expected after-tax salvage value of $888,328. After considering the cash savings and depreciation impact the firm expects the project to generate operating cash flows of $1,034,805 each year for the life of the project. What is the NPV of the project if the firm's WACC is 8.9%?arrow_forward

- Lakeside Winery is considering expanding its winemaking operations. The expansion will require new equipment costing $697,000 that would be depreciated on a straight-line basis to zero over the 5-year life of the project. The equipment will have a market value of $192,000 at the end of the project. The project requires $62,000 initially for net working capital, which will be recovered at the end of the project. The operating cash flow will be $187,600 a year. What is the net present value of this project if the relevant discount rate is 14 percent and the tax rate is 21 percent? Multiple Choice -$19,132 -$3,975 -$16,142 -$22,893 -$21,257arrow_forwardWendy and Wayne are evaluating a project that requires an initial investment of $792,000 in fixed assets. The project will last for fourteen years, and the assets have no salvage value. Assume that depreciation is straight-line to zero over the life of the project. Sales are projected at 143,000 units per year. Price per unit is $43, variable cost per unit is $24, and fixed costs are $800,712 per year. The tax rate is 36 percent, and the required annual return on this project is 12 percent. The projections given for price, quantity, variable costs, and fixed costs are all accurate to within +/- 15 percent. Required: (a)Calculate the best-case NPV. (Do not round your intermediate calculations.) (Click to select) (b)Calculate the worst-case NPV. (Do not round your intermediate calculations.) (Click to select) Warrow_forwardDog Up! Franks is looking at a new sausage system with an installed cost of $500,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $74,000. The sausage system will save the firm $180,000 per year in pretax operating costs and the system requires an initial investment in net working capital of $33,000. If the tax rate is 24 percent and the discount rate is 9 percent, what is the NPV of this project? Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16. Answer is complete but not entirely correct. S 119,822.41 NPVarrow_forward

- ACE Ltd is evaluating whether it should invest in a machine that costs $100,000. The machine would be fully depreciated over ten years to zero value using the straight-line depreciation method. With the new machine, the firm projects that it will be able to generate an additional $20,000 annually in sales revenue and additional $10,000 cost annually. The firm would also need an additional net working capital of $40,000. Given the firm’s cost of capital is 10% and tax rate of 20%, calculate annual operating cash flow (OCF) of the investment.arrow_forwardPivot, Inc. is currently valuing a new project that has the average risk of its investment projects. The project requires upfront R&D and marketing expenses of $10 million and a $30 million investment in equipment. The equipment will be obsolete in 3 years and will be depreciated using the straight-line method over that period. For each year over the next 3 years, the project offers annual sales of $100 million, has annual manufacturing costs of $30 million, and annual operating expenses of $10 million. Further, the project requires no net working capital in year 0, and $2.0 million in net working capital in each year from year 1 to year 2 and no net working capital in year 3. Beyond year 3, the project's free cash flows are expected to growth at an annual rate of 1%. Pivot currently has 20 million outstanding shares with its stock price of $30 per share, $320 million in debt, $20 million in excess cash, the cost of debt of 5%, and the cost of equity of 10%, and the corporate tax rate…arrow_forwardDog Up! Franks is looking at a new sausage system with an installed cost of $863,006. This cost will be depreciated straight-line to 68,640 over the project's 7-year life, at the end of which the sausage system can be scrapped for $130,815. The sausage system will save the firm $249,240 per year in pretax operating costs, and the system requires an initial investment in net working capital of $61,737. If the tax rate is 0.29 and the discount rate is 0.1, what is the total cash flow in year 7? (Make sure you enter the number with the appropriate +/- sign)arrow_forward

- Dog Up! Franks is looking at a new sausage system with an installed cost of $440,000. This cost will be depreciated straight-line to zero over the project's five-year life, at the end of which the sausage system can be scrapped for $62,000. The sausage system will save the firm $250,000 per year in pretax operating costs, and the system requires an initial investment in net working capital of $21,000. If the tax rate is 34 percent and the discount rate is 10 percent, what is the NPV of this project? (Do not round intermediate calculations and round your final answer to 2 decimal places, e.g., 32.16.) NPV eBook & Resources eBook: 10.6. Some Special Cases of Discounted Cash Flow Analysis Check my workarrow_forwardA division of Virginia City Highlands Manufacturing is considering purchasing for $1,500,000 a machine that automates the process of inserting electronic components onto computer motherboards. The annual cost of operating the machine will be $50,000, but it will save the company $370,000 in labor costs each year. The machine will have a useful life of 10 years, and its salvage value in 10 years is estimated to be $300,000. Straight-line depreciation will be used in calculating taxes for this project, and the marginal corporate tax rate is 32 percent. If the appropriate discount rate is 12 percent, what is the NPV of this project?arrow_forwardXYZ Corporation is studying a project that would have a ten-year life and would require a $450,000 investment in equipment which has no salvage value. The project would provide net operating income each year as follows for the life of the project (Ignore income taxes.): Sales $ 500,000 Less cash variable expenses 200,000 Less cash fixed expenses 150,000 Less depreciation expenses 45,000 Net operating income $ 105,000 The company's required rate of return is 12%. Compute the payback period for this project Enter your answerarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education