FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

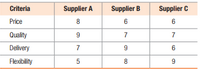

Beagle Clothiers uses a weighted score for the evaluation and

selection of its suppliers of trendy fashion garments. Each sup-

plier is rated on a 10-point scale (10 = highest) for four different

criteria: price, quality, delivery, and flexibility (to accommodate

changes in quantity and timing). Because of the volatility of

the business in which Beagle operates, flexibility is given twice

the weight of each of the other three criteria, which are equally

weighted. The table below shows the scores for three potential

suppliers for the four performance criteria. Based on the highest

weighted score, which supplier should be selected?

Transcribed Image Text:Criteria

Supplier A

Supplier B

Supplier C

Price

6

6

Quality

9

7

7

Delivery

9

6

Flexibility

5

8

9

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- accoutingarrow_forwardCrane Decor sells home decor items through three distribution channels-retail stores, the Internet, and catalog sales. Each distribution channel is evaluated as an investment center. Selected results from the latest year are as follows: Retail Stores Internet Catalog Sales Sales revenue $10,130,000 $4,080,000 $3,400,000 Variable expenses 4,080,000 1,630,000 1,930,000 Direct fixed expenses 4,580,000 1.130.000 1,330,000 Average assets 8,080,000 4,080,000 1,600,000 Required rate of return 10% 10% 10% (a) Your answer is incorrect. Calculate the current residual income for each distribution channel. (If the residual income is a loss then enter with a negative sign preceding the number, e.g. -5,125 or parenthesis, e.g. (5,125).) Residual Income $ Retail $ Online $ Catalogarrow_forwardMaking sales mix decisions Moore Company sells both designer and moderately priced fashion accessories. Top management is deciding which product line to emphasize. Accountants have provided the following data: The Moore Company store in Grand Junction, Colorado, has 14,000 square feet of Floorspace. If Moore Company emphasizes moderately priced goods, it can display 840 items in the store. If Moore Company emphasizes designer wear, it can display only 560 designer items. These numbers are also the average monthly sales in units. Prepare an analysis to show which product the company should emphasize.arrow_forward

- The manager of the West store has concerns relating to the store’s financial performance and has asked for help analyzing transfer costs. After calculating the operating income in dollars and the operating income percent, analyze the following financial information to determine costs that may need further investigation. It may be helpful to perform a vertical analysis (i.e., perform a vertical analysis). warehouse west store sales $18,920 $43,860 cost of goods sold 9,082 21,053 gross profit $9,838 $22,807 selling expenses 860 2,752 wages expense 4,730 15,351 costs allocated from corporate 2,838 4,386 Total expenses $8,428 $22,489 operating income/(loss) $ ? ? Operating Income/(loss) % ? ?arrow_forwardMillard Corporation is a wholesale distributor of office products. It purchases office products from manufacturers and distributes them in the West, Central, and East regions. Each of these regions is about the same size and each has its own manager and sales staff. The company has been experiencing losses for many months. In an effort to improve performance, management has requested that the monthly income statement be segmented by sales region. The company's first effort at preparing a segmented income statement for May is given below. Sales Regional expenses (traceable): Cost of goods sold Advertising Salaries Utilities Depreciation Shipping expense Total regional expenses Regional income (loss) before corporate expenses Corporate expenses: Advertising (general) General administrative expense Total corporate expenses Net operating income (loss) Variable expenses: Total variable expenses Traceable fixed expenses: Total traceable fixed expenses Common fixed expenses: Total common…arrow_forwardGiven the following data from a recent Comparative Competitive Efforts page in the CIR: Industry Average $250 Your Company vs. Ind. Avg. Your AC CAMERA SEGMENT Price (Average Wholesale Price $ per unit) P/Q Rating (1 to 10 stars) Brand Reputation Company $235 5.0 -6.0% 5.1 -2.0% 71 75 -5.3% Number of Models 3 3.1 -3.2% Retail Outlets Multi-Store Chains 26 35 -25.7% Online Retailers 51 68 -25.0% 2,150 5.86 2,897 6.92 Local Retailers -25.8% Retailer Support ($ per unit) Advertising Budget ($000s) Website Displays ($000s) Weeks -15.3% 1,000 800 1,929 1,764 -48.2% -54.6% Sales Promotions 2 4.7 -57.4% Discount 12.0% 15.9% -24.5% Warranty Period (days) Demand for ACC Units (000s) Gained /Lost (due to stockouts) AC Camera Units Sold (000s) Market Share 60 69 -13.0% 255.8 279.0 -8.4% +1.3 257.1 -0.1 278.9 -7.8% 13.2% 14.3% -1.1 pts Special AC Camera Contracts Discount Offer Value Index Avg. Discount =12.4% Avg. Value Index = 71 Total Units = 58.5k 0.0% Special Contract Units Sold (000) Based…arrow_forward

- A furniture manufacturer specializes in wood tables. The tables sell for $220 per unit and incur $110 per unit in variable costs. The company has $17,575 in fixed costs per month. Calculate the breakeven point in units under each independent scenario. 14. Variable costs increase by $15 per unit. 15. Fixed costs decrease by $525. 16. Sales price increases by 20%. Begin by selecting the formula labels. Then enter the amounts to compute the number of wood tables the company must sell to break even under each independent scenario, beginning with scenario 14. (Abbreviation used: CM = contribution margin. Complete all input fields. For items with a zero value, enter "0". Round the breakeven point-the required sales in units-up to the nearest whole unit. For example, 10.25 would be rounded to 11.) = Required sales in units 14. ( 15. ( 16. ( + + + ) ÷ ) ÷ ) = ) ÷ = = -C =arrow_forwardToxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate their break-even points and make decisions. She took the prior month's companywide income statement and prepared the absorption format segmented income statement shown below: Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income. Total Company $ 885,000 572,300 312,700 276,000 $36,700 Commercial Residential $ 295,000 $ 590,000 418,900 153,400 141,600 171, 100 122,000 $ 19,600 154,000 $ 17,100 In preparing these statements, the intern determined that Toxaway's only variable selling and administrative expense is a 10% sales commission on all sales. The company's total fixed expenses include $73,500 of common fixed expenses that would continue to be incurred even if the Commercial or Residential…arrow_forwardAnnie B's Homemade Ice Cream is an ice cream shop in Asheville, NC. The table shown below contains five measures under the column heading If and five measures under the column heading Then. If Employee turnover percentage Number of new flavors created Average revenue per order Inventory as a percent of sales Average customer order fulfillment time → → → + Then Customer perception of our customer intimacy Customer perception of our product leadership Net operating income Return on assets Percent of customers that strongly agree with the statement "I would readily recommend your company to someone else" Required: 1. For each row in the table, write an if-then hypothesis statement that connects the two measures in a manner that most likely reflects the goals of the company. If the employee turnover percentage If the number of new flavors created If the average revenue per order If the inventory as a percent of sales If the average customer order fulfillment time then the customer…arrow_forward

- During the current year, Mute Corporation expected to sell 24,300 telephone switches. Fixed costs for the year were expected to be $12,145,500, the unit sales price was budgeted at $3,350, and unit variable costs were budgeted at $1,560. Mute's margin of safety ratio (MOS %) is: (Do not round intermediate calculations.) Multiple Choice 72.07%. 87.82%. 71.07%. 93.32%. 76.97%.arrow_forwardToxaway Company is a merchandiser that segments its business into two divisions-Commercial and Residential. The company's accounting intern was asked to prepare segmented income statements that the company's divisional managers could use to calculate their break-even points and make decisions. She took the prior month's companywide income statement and prepared the absorption format segmented income statement shown below: erences Mc. Graw H&M Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income Total Company $ 825,000 555,500 269,500 260,000 $9,500 Commercial Residential $ 275,000 $ 550,000 154,000 401,500 121,000 148,500 114,000 146,000 $ 7,000 $ 2,500 In preparing these statements, the intern determined that Toxaway's only variable selling and administrative expense is a 10% sales commission on all sales. The company's total fixed expenses include $79,500 of common fixed expenses that would continue to be incurred even if the Commercial or…arrow_forwardThe Carlsbad Corporation produces and markets two types of electronic calculators: Model 4A and Model 5A. The following data were gathered on activities during the third quarter: Sales in units Sales price per unit Variable production costs per unit Traceable fixed production costs Variable selling expenses per unit Traceable fixed selling expenses Allocated portion of corporate expenses Sales Variable expenses Contribution margin Traceable fixed production costs Traceable fixed expenses Segment margin Common fixed expenses Net operating income (loss) Required: Prepare a segmented income statement for last quarter. The statement should provide sufficient detail to allow the company to evaluate the performance of the manager of each product line. X Answer is complete but not entirely correct. Model 4A 876,000 240,000 X 636,000 $ $ Model 4A 6,000 $ 146 $ 40 $ 210,000 $20 $ 15,000 $ 136,000 $ Total Company 1,926,000 485,000 X 1,441,000 520,000 35,000 886,000 276,000 610,000 $ 210,000…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education