FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

prepare statement of changes

Net income is 118,400

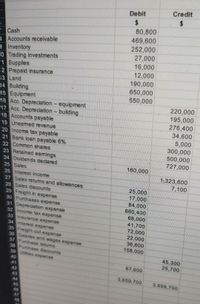

Transcribed Image Text:Credit

Debit

2.

2$

80,800

469,600

252,000

27,000

16,000

12,000

190,000

650,000

550,000

7Cash

B Accounts receivable

e Inventory

0 Trading investments

11 Supplies

12 Prepaid insurance

13 Land

14 Building

15 Equipment

16 Acc. Depreciation - equipment

17 Acc. Depreciation - building

18 Accounts payable

19 Uneamed revenue

20 Income tax payable

21 Bank loan payable 6%

22 Common shares

23 Retained eamings

24 Dividends declared

25 Sales

26 Interest Income

27 Sales retums and allowances

28 Sales discounts

29 Freight in expense

30 Purchases expense

31 Depreciation expense

32 Income tax expense

33 Insurance expense

34 Interest expense

35 Freight out expense

36 Salaries and wages expense

37 Purchase retums

38 Purchase discounts

39 Utilities expense

220,000

195,000

276,400

34,600

5,000

300,000

500,000

727,000

160,000

1,323,600

7,100

25,000

17,000

84,000

660,400

68,000

41,700

72,000

22,000

36,600

158,000

45,300

25,700

40

67,600

41

42

3,659,700

43

3,659,700

44

45

46

47

4B

Transcribed Image Text:Additional Information:

a) The Inventory count at the year end was costed at $221,000

b) On April 2, 2020, Manyellous Carpets Ltd. issued additional Common Shares for $75,000

and recorded this correctly in their ledger.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Times interest earnedarrow_forwardCalculate acid test ratio? Current assets = 212,300 Inventory = 14,300 Current liabilities = 103,000arrow_forwardPartial Income Statement Excel Exercise Compute the Following ՀԱՐ Sales COGS SG&A Depreciation Debt Int. Rate Tax Rate* 2019 100 40 EBITDA EBIT 25 Interest 10 EBT 0.08 Tax 0.25 Net Income ? ? ? ? ? ? Partial Balance Sheet Debt and Loans 150 Total Equity 150 Total Assets 300 Inv. Change 10 A/R Change A/P Change 35 20 Net Profit Margin Equity Multiplier Verify Dupont ROE ? סיי ? ? ? ? ? * Assume all taxes paid in current period (no accrued taxes) for rest of course CF from Operations ROE Asset Turnover CED Tt O 24arrow_forward

- Subject: acountingarrow_forwardNeed help with this Questionarrow_forwardCurrent fiscal year Accounts receivable: 4,532 Inventory: 5,372 Property, plant, and equipment, net: 9,178 Accounts payable: 3,183 Long-term debt: 14,001 Depreciation and amortization expense: 1,831 Net income: 5,791 The next year's forecasted balances for above accounts Accounts Receivable: 4,351 Inventory: 5,050 Property, plant, and equipment, net: 9,637 Accounts payable: 4,584 Long-term debt: 18,341 Depreciation and amortization expense: 1,977 Net income: 4,922 1. Using only the information given abouve what is the forecasted amount for Cash Flows from Operating Activities?arrow_forward

- Calculate Swifty's gross profit percentage and percentage markup on cost for each fiscal year. (Round answers to 2 decimal places, eg. 52.75.) Percentage gross profit Percentage markup on cost Fiscal 2023 35.74 % 3.43 % Fiscal 2022 36.13 % 5.67 %arrow_forwardWELL8 TECHNICAL INBTITUTE Income statement For Year Ended December 31arrow_forwardQuestion 51: In the vertical analysis of an income statement, what is the base (100%) figure? Answer: A. Total expenses B. Total revenues C. Total assets D. Net incomearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education