FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

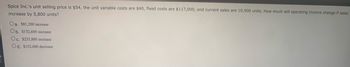

Transcribed Image Text:Spice Inc.'s unit selling price is $54, the unit variable costs are $40, fixed costs are $117,000, and current sales are 10,900 units. How much will operating income change if sales

increase by 5,800 units?

Oa. $81,200 increase

Ob. $152,600 increase

Oc. $233,800 increase

Od. $152,600 decrease

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Assume the following information: Sales Variable expenses Contribution margin Fixed expenses $87,600. $152,600. $94,500. Net operating income Multiple Choice $84,000. Amount $ 300,000 120,000 180,000 105,000 $ 75,000 Per Unit $ 40 If the selling price per unit increases by 10% and unit sales drop by 5%, then the best of estimate of the new net operating income is: 16 $24arrow_forwardDetermine the missing amounts UNIT SELLING PRICE UNIT VARIABLE COSTS UNIT CONTRIBUTION MARGIN CONTRIBUTION MARGIN RATIO $550 $330 (a)$___ (b) ___% $250 (c) $___ $110 (d) ___% (e) $___ (f) $___ $960 40%arrow_forwardK In the equation y = $7.20x + $250,250, O A. $250,250 are the total costs. OB. $250,250 are the total fixed costs. OC. $250,250 are the total overhead costs. OD. $250,250 are the total variable costs. 4arrow_forward

- Please answer in excel with formulaarrow_forward< Contribution Margin Harry Company sells 24,000 units at $26 per unit. Variable costs are $17.16 per unit, and fixed costs are $72,100. Determine (a) the contribution margin ratio, (b) the unit contribution margin, and (c) operating income. a. Contribution margin ratio (Enter as a whole number.) b. Unit contribution margin (Round to the nearest cent.) c. Operating income A LA % per unit Darrow_forward39. If fixed costs are $288,000, the unit selling price is $35, and the unit variable costs are $15, what are the break-even sales (units) if fixed costs are reduced by $39,600? a.18,630 units b.9,936 units c.14,904 units d.12,420 unitsarrow_forward

- Determine the missing amounts Unit Selling Price$250 $500 (e)Unit Variable Costs$180 (c) (f)Unit Contribution Margin(a) $200 $330Contribution Margin Ratio(b) (d) 30%arrow_forwardIf fixed costs are $283,000, the unit selling price is $72, and the unit variable costs are $51, what are the old and new break-even sales in units (rounded to a whole number) if the unit selling price increases by $5? a.3,931 units and 13,476 units b.13,476 units and 3,931 units c.5,549 units and 10,385 units d.13,476 units and 10,885 unitsarrow_forwardWhat is the Break-Even sales (in units) given the following data: Total Fixed Costs = $250,000.00 Unit Selling Price = $105.00 Unit Variable Cost = $65 Group of answer choices a. 6,250 b. 10,000 c. 2,381 d. 3,846arrow_forward

- Calculate the breakeven point and contribution margin. Breakeven point 38,550 units Fixed cost $ 77,100 Contribution margin Selling price per unit $ 5 Variable cost per unit 3arrow_forwardIf fixed costs are $729,000 and variable costs are 60% of sales, what is the break-even point in sales dollars? Oa. $1,822,500 Ob. $2,551,500 Oc. $437,400 Od. $1,166,400arrow_forward8. Assume that Current Sales are $100,000; and Break even in sales dollars is $75,000. What is the Margin of Safety ratio? a. 25% b. 50% c. 75% d. 100% 9. Assume Fixed costs are $10,000; Selling price is $30 and variable costs are $10. What is the break even in units? Give answer to the nearest unit. Group of answer choices a. 500 units b. 1,000 units c. 250 units d 334 units 10. If Direct Labor is 1 hour per unit at a rate of $25 per hour, what would be the budgeted amount for Direct Labor costs for the year if we expect to use 500 hours in the first six months and 600 hours in the second six months? a. $55,000 b. $27,500 c. $2,200 f $25,000 11. If Variable MOH is $2 per direct labor hour and the fixed MOH (all cash) is $2,500 per month, what is the amount of MOH budgeted for the month if 1,000 Direct Labor hours are budgeted? a. $2,500 b. $2,000 c. $4,500 d. $5,000 12. Assume Fixed costs are $10,000; Selling price is $30 and…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education