FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

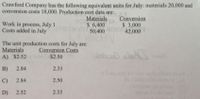

Transcribed Image Text:Crawford Company has the following equivalent units for July: materials 20,000 and

conversion costs 18,000. Production cost data are:

Work in process, July 1

Costs added in July

Materials

S 6,400

50,400

Conversion

$ 3,000

42,000

The unit production costs for July are:

Materials

A) $2.52

Conversion Costs

$2.50

B)

2.84

2.33

C)

2.84

2.50

D)

2.52

2.33

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Maniarrow_forwardCosts per Equivalent Unit and Production Costs The following information concerns production in the Forging Department for November. All direct materials are placed into the process at the beginning of production, and conversion costs are incurred evenly throughout the process. The beginning inventory consists of $33,320 of direct materials. LOOK AT IMAGE TO help solve D. and E Cost per equivalent units of $9.50 for Direct Materials and $2.10 for Conversion Costs. Based on the above data, determine each of the following amounts. If required, round your interim calculations to two decimal places. Round final answers (a-c) to the nearest dollar. a. Cost of beginning work in process inventory completed in November.$ 40222 b. Cost of units transferred to the next department during November.$ 368502 c. Cost of ending work in process inventory on November 30.$30753 d. Costs per equivalent unit of direct materials and conversion included in the November 1 beginning work in…arrow_forwardMarigold Company has the following equivalent units of production for July: materials 23240 and conversion costs 18500. Production cost data are: Work in process, July 1 Costs added in July Materials $2.50 $2.50 $2.28 Materials Conversion The unit production costs for July are: $2.28 $5100 53000 Conversion Costs $2.22 $2.40 $2.40 $3400 $2.22 41000arrow_forward

- The cost data and production data for Beth Company for the month of August were as follows:Cost Data:Work in process, August 1: Materials 52,000 Cost added this month: Materials 600,000Conversion costs 69,000 Conversion costs 1,602,000Production Data:Work in process, August 1 (60% complete) 9,375 units Work in process, August 31 (30% to be done) 16,250 unitsStarted in production this August 100,000 units Normal lost units 1,375 unitsTransferred out 90,625 units Abnormal lost units ?All materials are added at the start of the process and lost units are detected at the inspection point of 75% completion.Requirement:1. Using the FIFO method, what are the cost assigned to units transferred out and units in ending work in process?2. Using the average method, what are the cost assigned to units transferred out and units in ending work in process?3. Using FIFO and weighted average, what is the amount that shall be expensed as incurred?arrow_forwardProduction costs chargeable to the Finishing Department in June in Hollins Company are materials $15,428, labor $39,952, overhead $18,800. Equivalent units of production are materials 20,300 and conversion costs 19,200. Production records indicate that 18,100 units were transferred out, and 2,200 units in ending work in process were 50% complete as to conversion costs and 100% complete as to materials. Prepare a cost reconciliation schedule. (Round unit costs to 2 decimal places, eg. 2.25 and final answers to O decimal places, e.g. 125.) Cost Reconciliation Cost accounted for Transferred out Work in process Materials Conversion costs Total cost accounted for e Textbook and Media Save for Later M debe alhilling 64 $ 1530 25 25 Attempts: 0 of 2 used Submit Apcworarrow_forwardProduction Information shows the following costs and units for the smoothing department in August. Units Work in process Beginning balance: materials $1,550 Beginning units 640 Beginning balance: conversion 2,500 Transferred in 1,790 Materials Labor Overhead 7,135 All materials are added at the beginning of the period. The ending work in process is 20% complete as to conversion. What is the value of the inventory transferred to finished goods and the value of the WIP Inventory at the end of the month? Transferred out Cost Ending Inventory 6,955 Transferred out 1,810 14,540arrow_forward

- Department M had 2,300 units 56% completed in process at the beginning of June, 11,300 units completed during June, and 1,800 units 33% completed at the end of June. The number of equivalent units of production for conversion costs for June if the first-in, first-out method is used to cost inventories is Oa. 9,000 units Ob. 13,694 units Oc. 10,606 units Od. 11,894 unitsarrow_forwardCurrent Attempt in Progress Production costs chargeable to the Sanding Department in July in Monty Company are $41,160 for materials, $14,700 for labor, and $12,740 for manufacturing overhead. Equivalent units of production are 29,400 for materials and 19,600 for conversion costs. Compute the unit costs for materials and conversion costs. (Round answers to 2 decimal places, e.g. 15.25.) Unit costs $ Materials $ Conversion Costsarrow_forwardEquivalent Units of Materials Cost The Rolling Department of Jabari Steel Company had 4,500 tons in beginning work in process inventory (30% complete) on October 1. During October, 74,300 tons were completed. The ending work in process inventory on October 31 was 3,700 tons (50% complete). What are the total equivalent units for direct materials for October if materials are added at the beginning of the process? X unitsarrow_forward

- Muscat Painting Company has the following production data for March. Beginning work process 400,000 units (60% complete), started into production 370,000 units, completed and transferred out 706,000 units, and ending work in process 40,000 units (40% complete). the equivalent units of production for conversion costs will be: Select one: O a. 810,000. O b. 650,000. O c 770,000. O d. None of the answers are correct O e. 722,000.arrow_forwardDepartment M had 2, 800 units 53% completed in process at the beginning of June, 11, 200 units completed during June, and 800 units 33% completed at the end of June. The number of equivalent units of production for conversion costs for June if the first - in, first-out method is used to cost inventories is a. 11,464 units b. 9, 980 units c. 8, 400 units d. 12, 264 unitsarrow_forwardDepartment M had 2,600 units 58% completed in process at the beginning of June, 12,100 units completed during June, and 1,500 units 25% completed at the end of June. What was the number of equivalent units of production for conversion costs for June if the first-in, first-out method is used to cost inventories? Oa. 13,975 units Ob. 9,500 units Oc. 10,967 units Od. 12,475 unitsarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education