Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Question

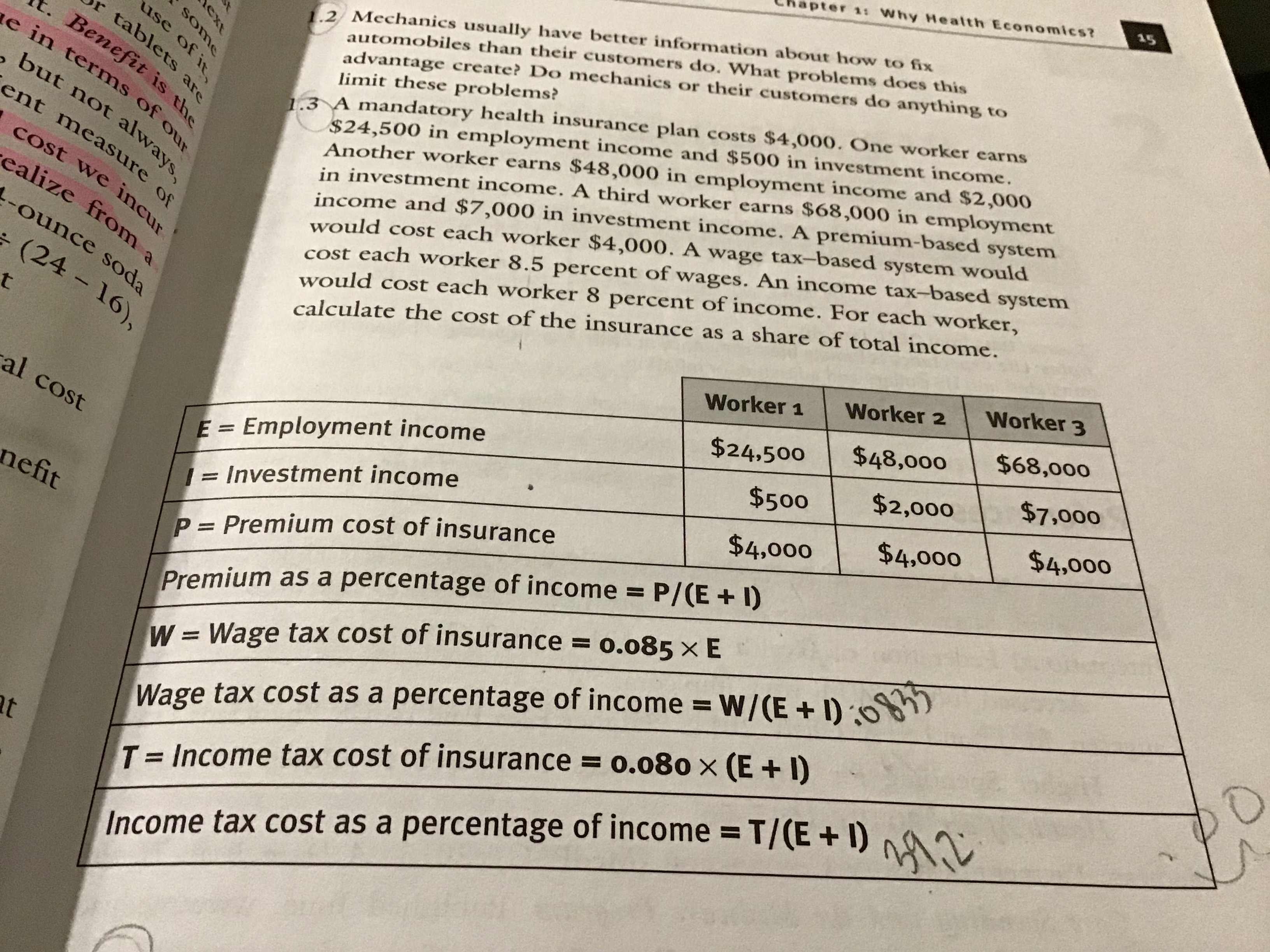

A mandatory health insurance plan costs $4,000. One worker earns $24,000 in employment income and $500 in investment income. Another worker earns $48,000 in employment income and $2,000 in investment income. A third worker earns $68,000 in employment income and $7,000 in investment income. A premium-based system would cost each worker $4,000. A wage tax-based system would cost each worker 8.5 percent of wages. An income tax-based system would cost each worker 8 percent of income. For each worker, calculate the cost of the insurance as a share of total income.

Transcribed Image Text:CRapter 1s Why Health Economics?

2 Mechanics usually have better information about how to fix

automobiles than their customers do. What problems does this

advantage create? Do mechanics or their customers do anything to

limit these problems?

3 A mandatory health insurance plan costs $4,000. One worker earns

$24,500 in employment income and $500 in investment income

Another worker earns $48,000 in employment income and $2,00o

in investment income. A third worker earns $68,000 in employment

income and $7,000 in investment income. A premium-based system

would cost each worker $4,000. A wage tax-based system would

cost each worker 8.5 percent of wages. An income tax-based system

would cost each worker 8 percent of income. For each worker,

calculate the cost of the insurance as a share of total income

6)

Worker 1Worker 2 Worker 3

$24,500 $48,000$68,000

$500 $2,00o $7,000

$4,000 $4,000 $4,000

= Employment income

ef

Investment income

- Premium cost of insurance

Premium as a percentage of income P/(E +ID

W = Wage tax cost of insurance-0.085 × E

Wage tax cost as a percentage of income W/CE+D

7-income tax cost of insurance-0.080 × (E + 1)

Income tax cost as a percentage of incomeTE

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- How can deductibles, copayments, and coinsurance reduce moral hazard?arrow_forwardWhat is an actuarially fair insurance policy?arrow_forwardIn an insurance system, would you expect each person to receive in benefits pretty much what they pay in premiums or is it just that the average benefits paid will equal the average premiums paid?arrow_forward

- Exercise B7 What is an income effect?arrow_forwardUsing two demand and supply diagrams, one for the low-wage labor market and one for the high-wage labor market, explain how information technology can increase income inequality if it is a complement to high-income workers like salespeople and managers, but a substitute for low-come workers like file clerks and telephone receptionists.arrow_forwardEdna is living in a retirement home where home where most of her needs are taken care of, but she has some discretionary spending. Based on the basket of goods in Table 22.5, by what percentage does Ednas cost of living increase between time 1 and time 2arrow_forward

- A website offers a place for people to buy and sell emeralds, but information about emeralds can be quite imperfect. The website then enacts a rule that all sellers in the market must pay for two independent examinations of their emerald, which are available to the customer for inspection. How would you expect this improved information to affect demand for emeralds on this website? How would you expect this improved information to affect the quantity of high-quality emeralds sold on the website?arrow_forwardTo what sorts of customers would an insurance company offer a policy with a high copay? What about a high premium with a lower copay?arrow_forwardHow can moral hazard lead to more costly insurance premiums than one was expected?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax

Principles of Economics 2eEconomicsISBN:9781947172364Author:Steven A. Greenlaw; David ShapiroPublisher:OpenStax Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of MicroeconomicsEconomicsISBN:9781305156050Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics 2e

Economics

ISBN:9781947172364

Author:Steven A. Greenlaw; David Shapiro

Publisher:OpenStax

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Principles of Microeconomics

Economics

ISBN:9781305156050

Author:N. Gregory Mankiw

Publisher:Cengage Learning