Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

answer must be in table format or i will give down vote

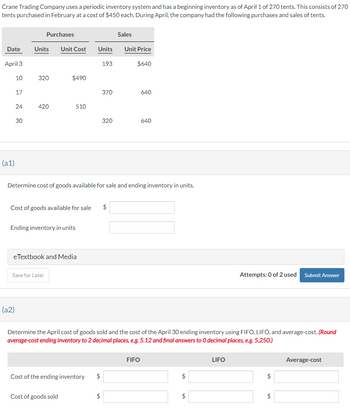

Transcribed Image Text:Crane Trading Company uses a periodic inventory system and has a beginning inventory as of April 1 of 270 tents. This consists of 270

tents purchased in February at a cost of $450 each. During April, the company had the following purchases and sales of tents.

Purchases

Sales

Date

Units

Unit Cost

Units

Unit Price

April 3

193

$640

10

320

$490

17

370

640

24

420

510

30

320

640

640

(a1)

Determine cost of goods available for sale and ending inventory in units.

Cost of goods available for sale

Ending inventory in units

eTextbook and Media

Save for Later

$

Attempts: 0 of 2 used Submit Answer

(a2)

Determine the April cost of goods sold and the cost of the April 30 ending inventory using FIFO, LIFO, and average-cost. (Round

average-cost ending inventory to 2 decimal places, e.g. 5.12 and final answers to O decimal places, e.g. 5,250.)

Cost of the ending inventory

$

Cost of goods sold

$

FIFO

$

LIFO

Average-cost

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 8 images

Knowledge Booster

Similar questions

- Jessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December.arrow_forwardJessie Stores uses the periodic system of calculating inventory. The following information is available for December of the current year when Jessie sold 500 units of inventory. Using the FIFO method, calculate Jessies inventory on December 31 and its cost of goods sold for December. RE7-11 Using the information from RE7-10, calculate Jessie Storess inventory on December 31 and its cost of goods sold for December using the LIFO method.arrow_forwardDymac Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the next 12 months, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forward

- Pappas Appliances uses the periodic inventory system. Details regarding the inventory of appliances at January 1, purchases invoices during the year, and the inventory count at December 31 are summarized as follows: Instructions 1. Determine the cost of the inventory on December 31 by the first-in, first-out method. Present data in columnar form, using the following headings: If the inventory of a particular model comprises one entire purchase plus a portion of another purchase acquired at a different unit cost, use a separate line for each purchase. 2. Determine the cost of the inventory on December 31 by the last-in, first-out method, following the procedures indicated in (1). 3. Determine the cost of the inventory on December 31 by the weighted average cost method, using the columnar headings indicated in (1). 4. Discuss which method (FIFO or LIFO) would be preferred for income tax purposes in periods of (a) rising prices and (b) declining prices.arrow_forwardCalculate the cost of goods sold dollar value for A65 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for first-in, first-out (FIFO).arrow_forwardBeginning inventory, purchases, and sales for Item Zebra 9x are as follows: Assuming a perpetual inventory system and using the last-in, first-out (LIFO) method, determine (a) the cost of merchandise sold on April 27 and (b) the inventory on April 30.arrow_forward

- The beginning inventory for Dunne Co. and data on purchases and sales for a three-month period are shown in Problem 7-1B. Instructions 1. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the first-in, first-out method and the periodic inventory system. 2. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the last-in, first-out method and the periodic inventory system. 3. Determine the inventory on June 30 and the cost of merchandise sold for the three-month period, using the weighted average cost method and the periodic inventory system. Round the weighted average unit cost to the dollar. 4. Compare the gross profit and June 30 inventories using the following column headings:arrow_forwardHurst Companys beginning inventory and purchases during the fiscal year ended December 31, 20-2, were as follows: There are 1,200 units of inventory on hand on December 31, 20-2. REQUIRED 1. Calculate the total amount to be assigned to the cost of goods sold for 20-2 and ending inventory on December 31 under each of the following periodic inventory methods: (a) FIFO (b) LIFO (c) Weighted-average (round calculations to two decimal places) 2. Assume that the market price per unit (cost to replace) of Hursts inventory on December 31 was 18. Calculate the total amount to be assigned to the ending inventory on December 31 under each of the following methods: (a) FIFO lower-of-cost-or-market (b) Weighted-average lower-of-cost-or-market 3. In addition to taking a physical inventory on December 31, Hurst decides to estimate the ending inventory and cost of goods sold. During the fiscal year ended December 31, 20-2, net sales of 100,000 were made at a normal gross profit rate of 35%. Use the gross profit method to estimate the cost of goods sold for the fiscal year ended December 31 and the inventory on December 31.arrow_forwardCalculate the cost of goods sold dollar value for A66 Company for the month, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for last-in, first-out (LIFO).arrow_forward

- Akira Company had the following transactions for the month. Calculate the gross margin for the period for each of the following cost allocation methods, using periodic inventory updating. Assume that all units were sold for $25 each. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forwardData on the physical inventory of Katus Products Co. as of December 31 follow: Quantity and cost data from the last purchases invoice of the year and the next-to-the-last purchases invoice are summarized as follows: Instructions Determine the inventory at cost as well as at the lower of cost or market, using the first-in, first-out method. Record the appropriate unit costs on the inventory sheet and complete the pricing of the inventory. When there are two different unit costs applicable to an item: 1. Draw a line through the quantity and insert the quantity and unit cost of the last purchase. 2. On the following line, insert the quantity and unit cost of the next-to-the-last purchase. 3. Total the cost and market columns and insert the lower of the two totals in the LCM column. The first item on the inventory sheet has been completed as an example.arrow_forwardTrini Company had the following transactions for the month. Calculate the ending inventory dollar value for each of the following cost allocation methods, using periodic inventory updating. Provide your calculations. A. first-in, first-out (FIFO) B. last-in, first-out (LIFO) C. weighted average (AVG)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,