FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

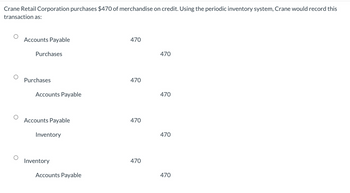

Transcribed Image Text:Crane Retail Corporation purchases $470 of merchandise on credit. Using the periodic inventory system, Crane would record this

transaction as:

Accounts Payable

Purchases

Purchases

Accounts Payable

Accounts Payable

Inventory

Inventory

Accounts Payable

470

470

470

470

470

470

470

470

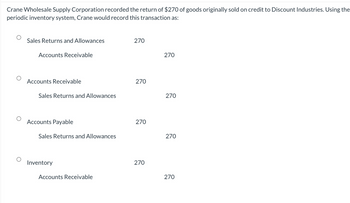

Transcribed Image Text:Crane Wholesale Supply Corporation recorded the return of $270 of goods originally sold on credit to Discount Industries. Using the

periodic inventory system, Crane would record this transaction as:

Sales Returns and Allowances

Accounts Receivable

Accounts Receivable

Sales Returns and Allowances

Accounts Payable

Sales Returns and Allowances

Inventory

Accounts Receivable

270

270

270

270

270

270

270

270

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Levine Company uses the perpetual inventory system. April 8 Sold merchandise for $3,400 (that had cost $2,513) and accepted the customer's Suntrust Bank Card. Suntrust charges a 4% fee. April 12 Sold merchandise for $8,400 (that had cost $5,443) and accepted the customer's Continental Card. Continental charges a 2.5% fee. Prepare journal entries to record the above credit card transactions of Levine Company. Note: Round your answers to the nearest whole dollar amount. View transaction list Journal entry worksheet > 1 2 3 4 Record the cost of goods sold, $5,443. Note: Enter debits before credits. Date General Journal Debit Credit April 12 Cost of goods sold Merchandise inventoryarrow_forwardCumberland Co. sells $919 of inventory to Hancock Co. for cash. Cumberland paid $673 for the merchandise. Under a perpetual inventory system, which of the following journal entry(ies) would be recorded?arrow_forwardplease enter the journal entriesarrow_forward

- Levine Company uses the perpetual inventory system. April 8 Sold merchandise for $8,700 (that had cost $6,429) and accepted the customer's Suntrust Bank Card. Suntrust charges a 4% fee. April 12 Sold merchandise for $8,000 (that had cost $5,184) and accepted the customer's Continental Card. Continental charges a 2.5% fee. Prepare journal entries to record the above credit card transactions of Levine Company. (Round your answers to the nearest whole dollar amount.)arrow_forwardBrown Inc. records purchases in a purchases journal and purchase returns in the general journal. Oct. 1 Purchased inventory on account from Price Inc. for $2,000. Oct. 3 Purchased inventory on account from Cabrera Inc. for $3,000. Oct. 8 Returned half of the inventory to Price Inc. Oct. 9 Purchased inventory on account from Price Inc. for $4,200. Record the above transactions using a purchases journal, a general journal, and an accounts payable subsidiary ledger. The company uses the periodic method of accounting for inventory. If an amount box does not require an entry, leave it blank. Page: 121 DATE ACCOUNT TITLE DOC.NO. POST.REF. DEBIT CREDIT 1 Oct. 8 Accounts Receivable-Cabrera Inc. Accounts Receivable-Cabrera Inc. 1 2 Accounts Payable-Price Inc. Accounts Payable-Price Inc. 2 PURCHASES JOURNAL Page: 113 Date Account PurchaseOrder No. Ref. MerchandiseInventory DR AccountsPayable CR 2019 Oct. 1 fill…arrow_forwardSuppose that Ivanhoe uses a periodic inventory system and has these account balances: Purchases $571,000; Purchase Returns and Allowances $11,800; Purchases Discounts $9,100; and Freight-In $14,300. Determine net purchases and cost of goods purchased. Net purchases tA Cost of goods purchased $arrow_forward

- Recording Inventory Purchases and Sales on Account Record the entries for the following transactions for Shoppers Inc. Shoppers uses a perpetual inventory system and records sales taxes payable at the point of sale. a. On January 1, 2020, Shoppers Inc. purchased merchandise for resale for $56,000 on credit terms 1/15, n/30. Shoppers Inc. incurred a shipping charge of $288 on the purchase, which was immediately paid. Shoppers Inc. uses the gross method to record purchases. b. Shoppers Inc. sells $22,400 of inventory during the first week of January 2020, to customers for $40,000, with a sales tax rate of 5%. Of the total sales for the week, 30% are cash sales, and 70% are credit sales (n/30). c. On January 14, 2020, Shoppers Inc. pays the balance for purchases on account. d. Assume instead that Shoppers Inc. sells $24,000 of inventory during the first week of January 2020 to customers for $44,800, which includes a 5% sales tax. Of the total sales for the week, 30% are cash sales, and…arrow_forwardThe following are the transactions of CARI, INC during 2022: The company follows a periodic inventory system 04.01.2022 Purchases merchandise, in cash SR 100,000.00 01.03.2022 Sales merchandise, on credit SR 180,000.00 06.03.2022 Customer takes discount and pays SR 162,000.00 15.10.2022 Pays downtow's shop rent SR 4,000.00 30.12.2022 Purchases a machinery, in cash SR 35,000.00 31.12.2022 Closes beginning inventory SR 30,000.00 31.12.2022 Records the ending inventory SR 12,000.00 31.12.2022 Revenues & expenses balanced off TBD Record the transactions, prepare the trial balance and show the following financial statements: → Balance sheet (Statement of Financial Position) as of 31.12.2022 → Profit & Loss account (Income Statement) for 2022arrow_forward27 )arrow_forward

- A company that uses a perpetual inventory system purchased inventory on account and later returned goods worth $900.00 to the vendor. Which of the following would be the correct journal entry to record these returns? OA. Accounts Payable 900 Merchandise Inventory 900 OB. Accounts Payable 900 Purchase Returns 900 OC. Merchandise Inventory 900 Accounts Payable 900 OD. Purchase Returns 900 Accounts Payable 900arrow_forwardOn December 22, Travis Company purchased merchandise on account from a supplier for $7,500, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period on December 31. Required: Under a perpetual inventory system, record the journal entries required for the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Chart of Accounts CHART OF ACCOUNTS Travis Company General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Merchandise Inventory 131 Estimated Returns Inventory 140 Supplies 142 Prepaid Insurance 180 Land 190 Equipment 191 Accumulated Depreciation LIABILITIES 210 Accounts Payable 216 Salaries Payable 221 Sales Tax Payable 222 Customers Refunds Payable 231 Unearned Rent 241 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 313 Income Summary REVENUE…arrow_forwardHeer Don't upload any image pleasearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education