Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

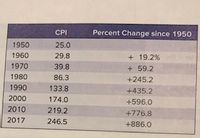

An engineer in 1950 was earning $6,200 a year. In 2017 she earned $82,000 a year. However, on average prices in 2017 were higher than in 1950. What was her real income 2017 in terms of constant 1950 dollars?

See table attached

Transcribed Image Text:CPI

Percent Change since 1950

1950

25.0

1960

29.8

+ 19.2%

1970

39.8

+ 59.2

1980

86.3

+245.2

1990

133.8

+435.2

2000

174.0

+596.0

2010

219.2

+776.8

2017

246.5

+886.0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Peter and Blair recently reviewed their future retirement income and expense projections. They hope to retire in 29 years and anticipate they will need funding for an additional 20 years. They determined that they would have a retirement income of $62,000.00 in today's dollars but that they would actually need $86,142.00 in retirement income (in today's dollars) to meet all of their objectives. a. What is their annual shortfall at retirement assuming inflation of 3 percent per year? Click on the table icon to view the FVIF table: b. At the time that they retire, how much additional amount must they have accumulated to fund their retirement needs, assuming 3 percent inflation and a rate of return of 9 percent? Click on the table icon to view the PVIFA table: c. Calculate the additional amount that Peter and Blair must save each year for the next 29 years if they wish to completely fund their income shortfall. Click on the table icon to view the FVIFA table:arrow_forwardTammy had the following aggregate results from her 2019 investing activity: STCG $300,000 LTCG $450,000 STCL $260,000*** LTCL $390,000*** *** These are negative numbers, obviously. After the “netting procedure” described in the textbook, what is / are Tammy’s net 2019 result(s)?arrow_forwardYour mom just checked on findmassmoney.gov and found out that she has unclaimed property that is worth $3015.54 today. She figured out that she had invested $866 years ago and she calculated that she earned a return of 28.08% on her money. How many years ago did your mom invest that money? Include up to 2 decimal places.arrow_forward

- Jake has total fixed monthly expenses of $1,320 and his gross monthly income is $3,950. What is his debt-to-income ratio? How does his ratio compare to the desired ratio? Debt-to-income ratio = % (Round to the nearest integer as needed.) Jake's ratio is V the maximum percentage.arrow_forwardCody Sebastian, of Lubbock, Texas, earns $56,000 a year. He pays 12 percent of his gross income in federal, state, and local taxes. He has fixed expenses in addition to taxes of $1,600 per month and variable expenses that average $1,400 per month. What is his net cash flow (surplus or deficit) for the year? Enter negative values with minus sign. Round your answer to the nearest dollar.arrow_forwardVijayarrow_forward

- Willie invests some money at 7.5%. He also invests $4,000 less than this amount at 6.59. His total annual incomefrom the interest of these two investments is $1,000. How much money is invested at each rate?arrow_forwardAura currently pays $800 each month to rent her apartment. Due to inflation, however, her rent is increasing by $50 each year. Meanwhile, her monthly take-home pay is $1500 and she predicts that her monthly pay will only increase by $15 each year. Assuming that her rent and take-home pay will continue to grow linearly, will her rent ever equal her take-home pay? If so, when? And how much will rent be that year?arrow_forwardThe Touche family took out $243,000, 20-year mortgage at an APR of 4.24%. The assessed value of their home is $9,700 and the annual tax rate is 90% of assessed value. What is the annual property tax?arrow_forward

- In 1974, your father purchased a rare art item for $10,000. In 2010, you sold it for $5 million. What annual rate of return did you earn on your father’s purchase? A. 17.77% B. 16.81% C. 20.06% D. 21.43% E. 23.02% F. 18.84%arrow_forwardA homeowner purchased a house 30 years ago by $85,000, today the house value is $140,000. What compounded annual interest rate was recover by the owner of the house?arrow_forwardJennifer Pontesso, from Lincoln, Nebraska, wants to better understand her financial situation. Use the following balance sheet and cash flow statement information to determine her net worth and her net surplus for a recent month. Liquid assets: $9,000; home value: $230,000; monthly mortgage payment: $1,350 on $170,000 mortgage; investment assets: $70,000; personal property: $22,000; total assets: $331,000; short-term debt: $3,240 ($270 a month); total debt: $173,240; monthly gross income: $10,000; monthly disposable income: $6,500; monthly expenses: $5,500. Round your answers to the nearest dollar.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education