FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

PLEASE ANSWER WITHIN 30 MINUTES.

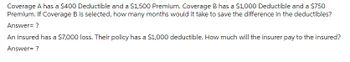

Transcribed Image Text:Coverage A has a $400 Deductible and a $1,500 Premium. Coverage B has a $1,000 Deductible and a $750

Premium. If Coverage B is selected, how many months would it take to save the difference in the deductibles?

Answer= ?

An insured has a $7,000 loss. Their policy has a $1,000 deductible. How much will the insurer pay to the insured?

Answer= ?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- BUS 038 : Business Computations 8. An invoice for $75.20 has terms of 3/10, 1/30, n/60. If you make payment 25 days after the invoicedate, what amount should you pay?arrow_forwardInterval Answer: A. B. C. Monthly D. on day 1st of every 1 O An unscheduled journal entry O Recording uncollectable receivables O Logging the usage of a prepaid service O Setup of a recurring transfer month(s) Start date 01/01/2026 End After 12 occurrencesarrow_forwardCurrent Attempt in Progress To establish a revenue stream for your retirement, you deposit $89000 in an account with a nominal interest rate of 4.2 percent, compounding monthly, which sends you a check of $311.50 each month starting next month. After 10 years, the account value is O $89311.50 $89000 O $37380.00 O $88688.5 eTextbook and Media Save for Later Attempts: 0 of 2 used Submit Answerarrow_forward

- What is the guest ledger? Give an example of something included in it. Describe how you would post a check for prepayment of two nights’ room rate.arrow_forwardA man gets an inyoice for $460 with terms 3/10, 1/15, n/30. How much would he pay 8 days after the invoice dáte? (Round to the nearest cent as needed) The net amount due is $ CoC-oalalala Help Me Solve This Calculator Get More Help - Clear All Check Answer Pearson 2:43 PM P Type here to search 75°F 9/10/2021 DELL prt se home Insert delete backspace 6. 8 9. R Y U D F\ K V pg up alt ctrlarrow_forwardPrepare all necessary journal entries for 2024.arrow_forward

- Today is 1/7/2021, John plans to deposit $500 at the beginning of each month into an investment fund. The first deposit will be deposited today. John predicts that the return rate of this fund will be j2=2.23% from 1/7/2021 to 30/9/2021 and j2=4.3% from 1/10/2021 to 31/12/2021. What will be balance amount of this account on 31/12/2021? Round your answer to three decimal places. a. 3032.601 b. 3033.695 c. 3032.335 d. 3031.814arrow_forwardAt age 20, you begin depositing $50 each month into a savings account with an APR of 5% compounded monthly. At age 40, your employer begins to deposit $300 a month into an account with an APR of 6% compounded monthly. If you continue to make your $50 monthly deposits, what will your total nest egg be by 4. age 65?arrow_forwardCatherine Dohanyos plans to retire in 20 years. She will make 20 years of monthly contributions to her retirement account. One month after her last contribution, she will begin the first of 10 years of withdrawals. She wants to withdraw $2400 per month. How large must her monthly contributions be in order to accomplish her goal if the account earns interest of 7.3% compounded monthly for the duration of her contributions and the 120 months of withdrawals? Question content area bottom Part 1 The amount of her monthly contributions must be Senter your response here. (Round to the nearest cent as needed.)arrow_forward

- Belts are shipped to the buyer on June 4 at a cost of $5500.00. The terms on invoice are 3/10, n/60. When is the last day the buyer can get the cash discount? If the buyer decides to pay for the shipment on June 30. What is the net amount to be paid?arrow_forwardShould we record account payable at 12/31, if the invoice date is after 12/31, lets say 1/3, for example the utility or telephone bill for December.arrow_forwardam.101.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education