ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

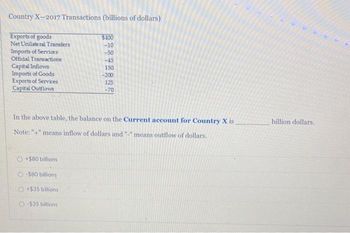

Transcribed Image Text:Country X-2017 Transactions (billions of dollars)

Exports of goods

Net Unilateral Transfers

Imports of Services

Official Transactions

Capital Inflows

Imports of Goods

Exports of Services

Capital Outflows

Note:

In the above table, the balance on the Current account for Country X is.

means inflow of dollars and "-" means outflow of dollars.

#.#

$100

-10

-50

+$80 billions

-$80 billions

O+$35 billions

O-$35 billions

-45

150

-200

125

-70

billion dollars.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- A 216.arrow_forwardIf one Canadian dollar buys US$0.85, and one Euro buys US$1.20, then one Euro should buy O a. C$1.02 O b. C$1.41 O c. C$2 O d. C$1.64arrow_forwardIf Canadian exports of goods and services were $37 billion, imports of goods and services were $42 billion, transfers by Canadians to foreigners were $3 billion and transfers from foreigners to Canadian citizens were $2 billion, then the current account balance would be O A. $4 billion. O B. - $6 billion. O C. $8 billion O D. $6 billion. O E. - $4 billion.arrow_forward

- Do not use chatgpt.arrow_forward1a. Draw foreign currency markets for the US dollar and the European zone euro. Show on eachmodel the impact of US exports of grain to the European zone. Determine the impact on theinternational value of the US dollar and of the euro. b. What will happen to these currencies? (Circle one for each)?US Dollar EuroAppreciate DepreciateDepreciate Appreciatearrow_forwardThe current account is the record of receipts from other countries. other countries, minus official lending to; record of foreign investment in; interest and rents other countries, plus the net amount of O A. record of foreign investment in; transfer payments to; capital O B. O C. O D. the sale of goods and services to; payments for goods and services bought from; interest and transfers payments for goods and services bought from; the sale of goods and services to; wages and transfers received from and paid toarrow_forward

- Use the following graph, which shows the supply and demand curves for dollars in the pound/dollar market, to answer the next question. Pound Price of Dollars 1/4 1/5 O Q₁ M D₁ D₂ Q₂ Q3 Quantity of Dollars D₂ Assume that D1 and S1 are the initial demand for and supply of dollars. Now suppose that Great Britain increases its imports of American products. Assuming freely-floating exchange rates, A) the dollar price of pounds will increase to $5 = 1 pound B) the pound price of dollars will rise to 1/4 pound = $1arrow_forwardThe table gives some information about Nordland's international transactions in 2016. Calculate the current account balance, the capital and financial account balance, and the official settlements account balance. >>> If your answer is negative, include a minus sign. If your answer is positive, do not include a plus sign. GEXES The current account balance is -111 billion dollars. The capital and financial account balance is The official settlements account balance is bilion dollars. 460 billion dollars. Item Imports of goods and services Foreign investment in Nordland Exports of goods and services Nordland's investment abroad Net interest income Net transfers Statistical discrepancy Billions of dollars 1,400 1,100 1,350 600 9 -70 -40arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education