ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

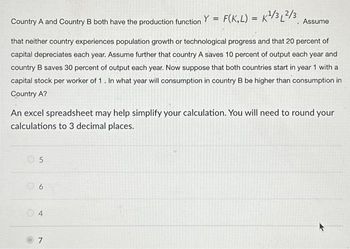

Transcribed Image Text:Country A and Country B both have the production function Y = F(K,L) = K¹/32/3 Assume

that neither country experiences population growth or technological progress and that 20 percent of

capital depreciates each year. Assume further that country A saves 10 percent of output each year and

country B saves 30 percent of output each year. Now suppose that both countries start in year 1 with a

capital stock per worker of 1. In what year will consumption in country B be higher than consumption in

Country A?

An excel spreadsheet may help simplify your calculation. You will need to round your

calculations to 3 decimal places.

O

5

6

t

7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- A country has a Cobb-Douglas production function given by: Y = AK0.5H0.1 If total factor productivity is 46, human capital is 1,828, and the capital stock is 2,736, what will this country's GDP be? Do not round until your final answer, when you may round to two decimal places. Country A produces GDP according to the following equation: GDP 5K and has a capital = stock of 13,399. If the country devotes 13% of its GDP to producing or repairing investment goods, how much is this country currently investing? Rounds your answer to two decimal places.arrow_forwardConsider a Solow-Swan economy with a Cobb-Douglas production function. Imagine that the savings rate "s" is an increasing function of capital and it has the following functional form: for low values of k the savings rate is constant at some low level. For intermediate levels of k, the savings rate increases rapidly. For high values of k the savings rate is constant again. In other words, the savings rate looks like: Does a steady state necessarily exist? b. Will the steady state be necessarily unique? а. Will the steady state(s) be stable? d. Will there be a "poverty trap"? (define poverty trap) С. How can this model be used (and how has this model been used) to justify large increases in foreign development aid? Discuss THREE potential flaws of the "savings poverty trap" model. е. f.arrow_forwardConsider an economy that has access to a production technology Y = AKαL1−α where Y is output, A is the level of technology, K is capital and L is the amount of labor in the economy. Capital evolves according to K˙ = sY (thus, the depreciation rate δ = 0). The x˙ population growth rate is n. (Throughout, gx = x , where x can be any of the variables in the model.) (a) Assume that technology is determined by A = BKφ What sort of endogenous growth model is this? Find K/K in terms of the K, L, and other parameters of the model.arrow_forward

- Suppose that the TFP parameter, As, in the Solow production function is the same across countries. What differs across countries is their savings rate, s. For the 1750 starter its savings rate is .25. Find the savings rate for a country that switches to Solow in 1950. Use the calibrated parameters from class. Also, assume the same population growth function holds in the 1750 starter and the 1950 starter.arrow_forwardGive typing answer with explanation and conclusionarrow_forwardExhibit 2-18 Production possibilities curves CONSUMPTION GOODS PRODUCTION Year X B CAPITAL GOODS PRODUCTION Year Y In Exhibit 2-18, the production possibilities curves for a country are shown for Year X and Year Y. Suppose this country was located at point A in Year X and point B in Year Y. This country: O is producing the same number of capital goods in both years. O is producing the same number of consumption goods in both years. O has shown no growth between Year X and Year Y. Ohas higher unemployment in Year X than in Year Y.arrow_forward

- Q5 Suppose in a Solow model, we have the following parameter values: n = 0, s = 0.5, a = 0.3. There is no growth in the total factor productivity so that A, = A = 1. Moreover, we know that at time 0, the economy is at a steady state so that k = k, =1. Now imagine that a foreign power invaded this %3D country. 1% of the population was killed and another 14% of the population fleeded the country to avoid violence. Moreover, 15% of capital stocks were destroyed. All of this happens in period t=1. After that, the war ended and there was no more destruction of capital or loss of population (but the refugee permanently settled outside of the country and will never return0. What is the growth rate of per-capita output in period t =4?arrow_forwardAssume the economy is initially in its balanced growth state. Suppose policymakers pursue policies that would increase the saving rate to s1=0.3. Draw a carefully-labelled diagram to illustrate the effect of the change in the saving rate on the economy in the long run. Explain the effect of the change in saving rate on steady-state capital per effective worker and steady-state consumption per effective worker?arrow_forward1. Consider Avataria, which can be described by the Solow model with the population growth. Its production function Y(K,L) = 2K¹2 L¹/2 Its investment rate is 40%, its depreciation rate is 10%, and its population growth rate is 10%. Calculate the capital-labor ratio, output per worker, and consumption per worker in the steady state. Assume that now the population growth slows down to 4%. What happens with the output per worker and consumption per worker in the new steady state? Calculate the exact values. (a) (b)arrow_forward

- In a Solow economy with technological progress, the production function is given by: Y = KO.5(LE)0.5. Furthermore, the saving rate of this economy is 0.2. The population growth rate is 0.03. The depreciation rate is 0.01. The technological progress is given by g which is equal to 0.01. Define y = Y/LE and k = K/LE. a) Find out the steady state values of k (i.e.: k*) and y (i.e.: y"). 2. Ay Ak AY ΔΚ b) Find out the values of and in the steady state. K y'k'Yarrow_forwardQ8. Assume a closed economy. Suppose the capital-output ratio is 3, the depreciation rate is 3%, and the gross savings rate is 10%. Use the Harrod-Domar growth equation to determine the rate of growth in total output. What would the gross savings rate have to be to achieve 5% growth? Why is capital the only factor of production in the Harrod-Domar model? Compare the assumptions made about the production function in the Solow model and the Harrdo-Domar model.arrow_forward3) Suppose your per capita production function is given as y = k". Capital evolves according to the expression Ak = sy – (n +d)k, and your consumption function is c = (1– s)y. As usual, s is the savings rate, n is the - population growth rate and d is the capital depreciation rate. Imagine a foreign government decides to grant your country an investment subsidy in the form of b, which represents a constant fraction of domestic investment per capita (ia) such that irotal = ia + bia. In per capita terms the expenditure function with the subsidy is y = c + itotal and it is y = c + ia without the subsidy. a) Derive an expression for the steady state capital stock after the subsidy is granted. (Hint: Use the expenditure function with the subsidy to solve for sy then use the expenditure function without the subsidy to solve for domestic investment ia.) b) Use the Solow diagram to show living standards before and after the subsidy is granted. Explain the dynamic process towards the new steady…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education