ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

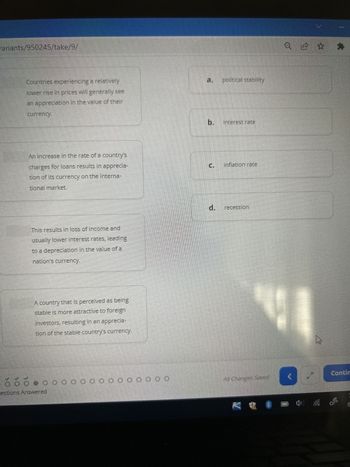

Transcribed Image Text:### Economic Principles and Currency Value

Understanding the determinants of a nation's currency value is crucial for grasping basic economic principles. The text below provides explanatory insights into how various factors contribute to either the appreciation or depreciation of a country's currency.

1. **Inflation Rate**

- **Statement:** Countries experiencing a relatively lower rise in prices will generally see an appreciation in the value of their currency.

- **Explanation:** When the inflation rate in a country is low, the purchasing power of the currency is maintained, making the currency stronger and more desirable for foreign investors. This results in an appreciation of the currency in international markets.

2. **Interest Rate**

- **Statement:** An increase in the rate of a country’s charges for loans results in appreciation of its currency on the international market.

- **Explanation:** Higher interest rates offer lenders in an economy a higher return relative to other countries. This attracts foreign capital and causes an appreciation in the value of the currency.

3. **Recession**

- **Statement:** This results in loss of income and usually lower interest rates, leading to a depreciation in the value of a nation's currency.

- **Explanation:** During a recession, economic activity slows down, leading to loss of income and lower interest rates. This makes the country less attractive to foreign investors, thereby leading to a decrease in the value of its currency.

4. **Political Stability**

- **Statement:** A country that is perceived as being stable is more attractive to foreign investors, resulting in an appreciation of the stable country’s currency.

- **Explanation:** Political stability in a country boosts investor confidence. Stable environments reduce the risk associated with investments, making the country's currency more attractive and leading to its appreciation.

### Graphs/Diagrams Explanation

There are no graphs or diagrams included in the given text. The content is a multiple-choice format where each economic principle is matched with its corresponding factor that influences currency value.

These principles are key to understanding how macroeconomic indicators influence global financial markets and currency exchange rates.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- National Saving - Investment = X - IM A country whose National Saving is greater than its Investment will experience a Trade deficit (IM > X) Balanced trade (IM – X) = 0 O Trade surplus (X > IM)arrow_forwardUrgentarrow_forwardA country has been experiencing a persistent deficit in its current account balance due to high levels of imports compared to exports, along with significant outflows of income payments and transfers. To address this issue, the government is considering implementing a range of policies, including devaluation of the currency, imposition of tariffs, and promotion of export industries. The goal is to correct the balance of payments imbalance and improve the country's international financial position. The question is: In this scenario, the primary objective of the government's policies is to: A) Increase the country's reliance on imports B) Decrease foreign investment in the country C) Correct the balance of payments deficit D) Eliminate all forms of international tradearrow_forward

- If the U.S. dollar depreciates 20 percent, how does this affect the export and domestic sales of a U.S. manufacturer? Explain.arrow_forwardWhat will happen to an economy when inflation remains constant, with high interest rates?a) Imports to decrease.b) Foreign investment in that country increase.c) The foreign trade deficit remains constant.d) The value of the dollar would depreciate relative to foreign currencies.arrow_forwardWhich of the following creates a supply of Japanese yen in foreign exchange markets? Multiple Choice A Canadian student purchases a new Japanese car. A Canadian goes on a business trip to Japan. A Japanese company sells an insurance policy to a Canadian citizen. A Japanese tourist takes a trip to the Canadian Rockies. A Japanese investor receives dividends on some Canadian stock,arrow_forward

- If the U.S. Dollar appreciates, foreigners will find American goods more expensive because they have to spend less for those goods in USD, meaning with higher prices, the number of U.S. goods being exported will likely drop and leads to a reduction in the Gross Domestic Product (GDP). True or Falsearrow_forwardA consumer living in Ithaca, NY buys $1,000 dollars worth of toys from a company that manufactures toys in Tokyo, Japan. If we consider the US Balance of Payments and assume all foreign exchange transactions are between private citizens, this purchase results in to net exports and to private foreign assets in the US. a) a debit; a credit b) a credit; a debit C) a credit; a credit D) a debit; a debitarrow_forwardFor a small open economy, the domestic real interest rate (r) for a given country must be the same as the world real interest rate (r). only if capital is not perfectly mobile because with no barriers to capital flows, if the world rate > domestic rate the domestic residents would just lend abroad putting upward pressures on the domestic rate until both rates equal each other because with no barriers to capital flows, if the world rate < the domestic rate domestic residents would only lend to foreigners putting downward pressures on the domestic rate until both rates equal each other for none of these reasons for all of these reasonsarrow_forward

- Holding all else equal, will a decrease in demand for domestic goods relative to foreign goods lead to an appreciation or depreciation in the domestic currency relative to the foreign currency? (One word answer please)arrow_forwardNational savings of a Classical small open economy is 120, Investment is 20, and the net export schedule is: NX = 200 - 50*(real exchange rate). If trade restrictions shift the net export function to NX = 300 - 50*(real exchange rate), in the new situation:arrow_forwardWhen the dollar buys less foreign currency, there has been a depreciation of the dollar. True Falsearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education