ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

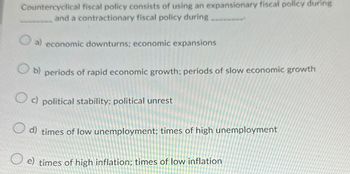

Transcribed Image Text:Countercyclical fiscal policy consists of using an expansionary fiscal policy during

and a contractionary fiscal policy during

a) economic downturns; economic expansions

Ob) periods of rapid economic growth; periods of slow economic growth

Oc) political stability: political unrest

d) times of low unemployment; times of high unemployment

e) times of high inflation; times of low inflation

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Explain your decision making regarding government expenditure and how it changed based on the macroeconomic conditions. What was the intent of your fiscal policy decisions in response to the given economic climate? Evaluate your fiscal policy decisions, including how they impacted key macroeconomics factors such as real GDP growth and unemployment. To what extent did your policies yield positive or negative outcomes? Refer to the AD/AS model to support your analysis in this section of your report.arrow_forwardWhich is considered expansionary fiscal policy? a)a tax increase for wealthy individuals b)an increase in national defense spending c)regulations raising emission standards on trucks d)an increase in the money supplyarrow_forwardWhich of the following is not a predicted outcome of implementing automatic fiscal policy? О а. Reduces the size of the multiplier O b. Helps prevent inflation due to inflationary gaps O C. Moderates the business cycle O d. Decreases the deficit O e. Reduces the effects of economic shocksarrow_forward

- In regards to time lags as they relate to Fiscal Policy, which lag is possibly the longest and most troublesome? Decision Lag Information Lag Recognition Lag Implementation Lagarrow_forwardWhich of the following statements regarding government fiscal policy are correct? Assume ceteris paribus. a) The government's debt to GDP ratio will be increasing if there is a primary budget deficit. + b) Higher spending on interest payments increases government debt but does not increase the primary deficit. c) In a recession, a government using fiscal policy to stabilize aggregate demand will design its policy to override the automatic stabilizers. ◆ +arrow_forwardPlease match each description with the appropriate approach to federal finance. Policymakers should reduce spending and increase taxes when the economy is growingin order to prevent "overheating". This approach was considered conventional wisdom until the advent of theGreat Depression. Policymakers should focus on keeping unemployment low and providing the peoplewith the public goods and services they want. If insisted upon, this approach would only worsen the economy during a recession. This approach ignores the impact of the budget on the business cycle.arrow_forward

- If a recession persists due to nominal wage and price stickiness (i.e., slow adjustment of nominal wages downward), what kind of fiscal policy can bring us out of this recession? decreased government expenditures and increased taxes increased government expenditures and decreased taxes decreased government expenditures contractionary fiscal policyarrow_forwardplease answer the following question: 1.The fact that it takes time for government officials to recognize an economic problem in is one reason for time lags in fiscal policy making. a)true b)falsearrow_forwardIf expansionary fiscal policy is used following a supply shock such as the one experienced during the Covid-19 pandemic, the expansionary fiscal policy will result in real GDP ________ and the price level ________. decreasing; increasing increasing; decreasing increasing; increasing decreasing; decreasinarrow_forward

- When GDP and incomes are high, the government collects more dollars in tax revenue. When they're low, the government collects fewer tax dollars. These higher and lower amounts help even out the economy without having to wait for changes in tax rates or other legal matters. For these reasons, tax revenues (not rates) are best described as automatic stabilizers. contractionary fiscal policy monetary policy O the marginal propensity to consumearrow_forwardFor each of the following scenarios, determine which time lag is most likely to result when designing and implementing fiscal policy. a. The separation of power demonstrated between the legislative and executive branches of government combined with strong partisanship attitude among our elected politicians. . . . . b. The fact that it takes economists working for the National Bureau of Economic Research months to declare the dates of peaks and troughs. . . . Recognition lag Legislative lag Implementation lag All of these lags c. The time it takes to design and build new infrastructure after these projects have been passed by the legislature. Recognition lag • Legislative lag . Implementation lag All of these lags . Recognition lag Legislative lag Implementation lag . All of these lagsarrow_forwarda) What are the three fiscal policy tools and how would each be used to counter a contractionary gap? b) True or False and explain: Fiscal Policy is effective at reducing the duration of an economic contraction. c) True or False and explain: Households always react to tax changes in a predictable manner.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education