Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

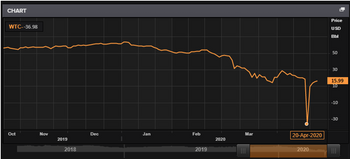

could someone please explain to me why the decrease in stock price ( from 20th April) for the west texas intermediate is unusual? and explain why this has occurred and why the recovery is so sharp.

Thanks

Transcribed Image Text:CHART

WTC--36.98

Oct

Nov

2019

2018

Dec

Jan

Feb

2019

2020

Mar

|||

20-Apr-2020

2020

Price

USD

Bbl

50

30

15.99

10

-10

-30

|||

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Investigate and comment on Microsoft (MSFT)'s stock price changes in recent years. Explain why these changes have occurredarrow_forwardA stock is expected to return 13 percent in an economic boom, 10 percent in a normal economy, and 3 percent in a recessionary economy. Which one of the following will lower the overall expected rate of return on this stock? A. An increase in the rate of return for a normal economy B. A decrease in the probability of a recession occurring C. A decrease in the probability of an economic boom D. No overall change in the rate of return in a recessionary economyarrow_forwardUse the following information on states of the economy and stock returns to calculate the expected return and the standard deviation of returns. Assume that all three states are equally likely. Note: Do not round intermediate calculations. Enter your answers as a percent rounded to 2 decimal places. State of Economy Recession Normal Boom Expected return Standard deviation Security Return if State Occurs -9.00% 15.00 24.00 % %arrow_forward

- Returns earned over a given time period are called realized returns. Historical data on realized returns is often used to estimate future results. Analysts across companies use realized stock returns to estimate the risk of a stock. Consider the case of Falcon Freight Inc. (FF): Five years of realized returns for FF are given in the following table. Remember: 1. While FF was started 40 years ago, its common stock has been publicly traded for the past 25 years. 2. The returns on its equity are calculated as arithmetic returns. 3. The historical returns for FF for 2014 to 2018 are: 2014 2015 2016 2017 2018 Stock return 25.00% 17.00% 30.00% 42.00% 13.00% Given the preceding data, the average realized return on FF’s stock is (63.50%, 25.40%, 50.80%, 78.74%) . The preceding data series represents (the population, a sample, the universe) of FF’s historical returns. Based on this conclusion, the standard deviation of FF’s historical…arrow_forwardUse the data below to construct the advance/decline line for the stock market. Volume figures are in thousands of shares. (Input all amounts as positive values. Do not round intermediate calculations. Round your answers to the nearest whole number.) StocksAdvancing AdvancingVolume StocksDeclining DecliningVolume Monday 1,809 703,133 1,335 551,144 Tuesday 1,941 603,360 1,311 452,797 Wednesday 1,815 624,994 1,343 720,931 Thursday 2,480 1,114,410 550 174,342 Friday 1,688 511,962 1,472 496,960arrow_forwardConsider the following information: Rate of Return if State Occurs State of Economy Probability of State of Economy Stock A Stock B Recession 21 .06 21 Normal 58 109 08 Boom 21 14 25 a. Calculate the expected return for Stocks A and B. (Do not round Intermediate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) b. Calculate the standard deviation for Stocks A and B. (Do not round Intermedlate calculations and enter your answers as a percent rounded to 2 decimal places, e.g., 32.16.) a. Stock A expected return a. Stock B expected return b. Stock A standard deviation b. Stock B standard deviation 196 96 96 %arrow_forward

- Assume these are the stock market and Treasury bill returns for a 5-year period: Required: a. What was the risk premium on common stock in each year? b. What was the average risk premium? c. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Complete this question by entering your answers in the tabs below. What was the standard deviation of the risk premium? (Ignore that the estimation is from a sample of data.) Note: Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.arrow_forwardI need help with Carrow_forwardWhich of the following is TRUE? a. A bull market is where stocks, on average, are expected to go up in the near future. b. A bull market is the primary market where IPO's are introduced. c. A bull market is a situation where the price of stock in that market has been rising over a fairly long period of time d. A bull market is a market where there are more buyers than sellers, there have been more purchases of stock than sales of stock and a lot of stock is traded every day.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education