ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

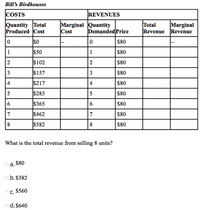

Transcribed Image Text:Bill's Birdhouses

COSTS

REVENUES

Quantity Total

Produced Cost

Marginal Quantity

Cost

Marginal

Total

Demanded Price

Revenue Revenue

$0

$80

1

$50

1

$80

2

$102

2

$80

3

$157

$80

4

$217

4

$80

5

$285

S80

$365

$80

7

$462

7

$80

s582

8

S80

What is the total revenue from selling 8 units?

a, $80

nb.$382

nc. $560

nd.S640

3.

6.

6.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- John's Vineyard Quantity Produced 0 1 2 3 4 5 6 7 8 Select one: O a. $25 O b. $225 COSTS Total Cost O c. $115 O d. $75 $0 $50 $102 $157 $217 $285 $365 $462 $582 Marginal Cost Quantity Demanded 0 1 ~/3 2 4 5 67 8 REVENUES Price $80 $80 $80 $80 $80 $80 $80 $80 $80 Refer to Table 6. What is John's Vineyard's economic profit at its profit-maximizing output level? Total Revenue Marginal Revenuearrow_forwardAssume the following unit cost data are for a purely competitive producer. Required A. How much would be the total revenue? B. What will be the profit-maximizing or loss-minimizing output? C. how much would be the total cost?arrow_forwardPRICE (dollars per unit) 2 QUANTITY PRICE OR COST (dollars per unit) QUANTITY MC ATC AVC MR Question 40 If the firm in the figure above raised the price of its product abvove $4, the firm would: a. increase its profits b. reduce its total revenue to zero c. increase its total revenue but not its profits because costs would increase. d. not affect revenues at all but profits would increase because costs decrease e. none of the abovearrow_forward

- Only typed answer When the local electricity company charges a price of $20 per kilowatt they sell 1,000 units. If they raise the price by $1 they sell 800 units. What is the marginal revenue between $20 and $21? a) $21 b) $3,200 c) $200 d) $1arrow_forwardRefer to the figure and table to answer three questions. Price or Cost (dollars per bushel) 18 16 14 Price Marginal revenue 12 10 8 23450 6 4 N 0 Number of Bushels per Day 0 1 1 2 Price $13 13 13 13 13 13 3 4 5 Quantity (bushels of fish per day) Total Revenue c. Total profit or loss. $ SO 13 26 39 52 65 bushel(s) b. Profit or loss per bushel. per bushel Marginal cost 6 $10 15 22 31 44 61 Total Total Cost Profit $-10 -2 4 7 8 8 4 o Marginal Marginal Revenue Cost $13 13 13 13 13 $5 7 9 13 17 If the price of catfish changed from $13 to $12 per bushel, determine the Instructions: In parts a and c. enter your responses as a whole number. In part b, round your response to two decimal places. If you are entering any negative numbers be sure to include a negative sign (-) In front of those numbers. a. Profit-maximizing output. Oarrow_forwardSOME S&D PROBLEMS 1. A. Find Pe and Qe Price per unit (dollar 8 8 2 2 2 2 2 2 2 2 100 90 80 70 60 50 40 30 20 10 0 200 400 600 Quantity B. What is the effect of a ceiling price of $40? 800 Do 1,000arrow_forward

- Nonearrow_forwardI am stuck on the True False question Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardPrice (dollars per cup) $6.00 MC ATC 3.50 A 2.50 B Demand 0 1 2 3 4 5 6 7 8 9 10 Quantity MR (cups per week) According to the graph, if the firm is maximizing profits what is the dollar value of the profit?arrow_forward

- QUESTION 10 PRODUCT product X product Y product Z Ob) 153 O c) 1.2 O d) 150 O e) 200 QUESTION 11 O (c) 30% O (d) 25% Ⓒ (e) 20% price: $2.00 quantity: 2,000 price: $1.00 1,000 quantity: price: quantity: PRODUCT product X QUESTION 12 1988 product Y product Z QUESTION 13 $5.00 1,000 $4.00 2,500 $1.00 1,500 10. Given the data in the above table, what is the price index for 1988, using 1988 as the base year and using the 1988 consumption pattern (market basket)? O a) 100 $4.00 1,000 quantity: 1989 price: $2.00 quantity: 2,000 1988 price: $1.00 1,000 price: $5.00 quantity: 1,000 YEAR 1990 $6.00 2,000 $1.00 2,500 $2.00 1,000 1989 $4.00 2,500 $1.00 1,500 $4.00 1,000 1991 $8.00 1,500 $1.00 3,000 11. What is the rate of inflation between 1988 and 1989? (Use 1988 based price indices and 1988 market basket) O (a) 50% O (b) 33% $3.00 1,000 YEAR 1990 $6.00 2,000 $1.00 2,500 $2.00 1,000 1991 $8.00 1,500 $1.00 3,000 $3.00 1,000 12. Which of the following is NOT a problem in using economic statistics?…arrow_forwardProduct Milk Textbook Wheat Quantity in 2020 100 50 80 -$430 -$400 Price in 2020 2 50 3 Using 2020 as the base year, how much has real GDP changed from 2020 to 2021? $430 $2510 $400 Quantity in 2021 120 40 90 Price in 2021 1.5 70 4arrow_forwardThe profit-maximizing price is ______arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education