Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

What will the billing rate for HTT and ACT be based on the activity-based costing structure

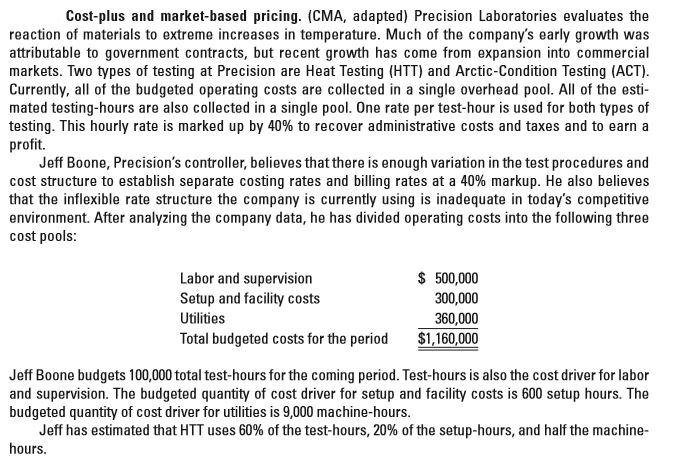

Transcribed Image Text:Cost-plus and market-based pricing. (CMA, adapted) Precision Laboratories evaluates the

reaction of materials to extreme increases in temperature. Much of the company's early growth was

attributable to government contracts, but recent growth has come from expansion into commercial

markets. Two types of testing at Precision are Heat Testing (HTT) and Arctic-Condition Testing (ACT).

Currently, all of the budgeted operating costs are collected in a single overhead pool. All of the esti-

mated testing-hours are also collected in a single pool. One rate per test-hour is used for both types of

testing. This hourly rate is marked up by 40% to recover administrative costs and taxes and to earn a

profit.

Jeff Boone, Precision's controller, believes that there is enough variation in the test procedures and

cost structure to establish separate costing rates and billing rates at a 40% markup. He also believes

that the inflexible rate structure the company is currently using is inadequate in today's competitive

environment. After analyzing the company data, he has divided operating costs into the following three

cost pools:

$ 500,000

300,000

360,000

$1,160,000

Labor and supervision

Setup and facility costs

Utilities

Total budgeted costs for the period

Jeff Boone budgets 100,000 total test-hours for the coming period. Test-hours is also the cost driver for labor

and supervision. The budgeted quantity of cost driver for setup and facility costs is 600 setup hours. The

budgeted quantity of cost driver for utilities is 9,000 machine-hours.

Jeff has estimated that HTT uses 60% of the test-hours, 20% of the setup-hours, and half the machine-

hours.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Mathes Corporation manufactures paper products. The company operates a landfill, which it uses to dispose of nonhazardous trash. The trash is hauled from the two nearby manufacturing facilities in trucks that can carry up to four tons of trash In a load. The landfill operation requires certain preparation activities regardless of the amount of trash in a truck (Le., for each load). The budget for the landfill for next year follows. volume of trash Preparation costs (varies by loads) other variable costs (varies by tons) Fixed costs 1,200 tons (300 loads) $ 54,000 54,000 178,000 $286, 000 Total budgeted costs Mathes is considering making the landfill a profit center and charging the manufacturing plants for disposal of the trash. The landfill has sufficlent capacity to operate for at least the next 20 years. Other landfills are available in the area (both private and municipal), and each plant would be free to declde which landfill to use. Required: a. Compute the optimal transfer…arrow_forwardBiotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and the other in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services function in the Yuma office and had both laboratories send any legal questions or issues to the Yuma office. The legal services support center has budgeted fixed costs of 160,000 per year and a budgeted variable rate of 65 per hour of professional time. The normal usage of the legal services center is 2,600 hours per year for the Yuma office and 1,400 hours per year for the Bernalillo office. This corresponds to the expected usage for the coming year. Required: 1. Determine the amount of legal services support center costs that should be assigned to each office. 2. Since the offices produce services, not tangible products, what purpose is served by allocating the budgeted costs? 3. Now, assume that during the year, the legal services center incurred actual fixed costs of 163,000 and actual variable costs of 272,400. It delivered 4,180 hours of professional time2,580 hours to Yuma and 1,600 hours to Bernalillo. Determine the amount of the legal services centers costs that should be allocated to each office. Explain the purposes of this allocation. 4. Did the costs allocated differ from the costs incurred by the legal services center? If so, why?arrow_forwardHudson Corporation is considering three options for managing its data warehouse: continuing with its own staff, hiring an outside vendor to do the managing, or using a combination of its own staff and an outside vendor. The cost of the operation depends on future demand. The annual cost of each option (in thousands of dollars) depends on demand as follows: If the demand probabilities are 0.2, 0.5, and 0.3, which decision alternative will minimize the expected cost of the data warehouse? What is the expected annual cost associated with that recommendation? Construct a risk profile for the optimal decision in part (a). What is the probability of the cost exceeding $700,000?arrow_forward

- Vishnuarrow_forwardUse this information for Square Yard Products Inc. to answer the question that follow.Materials used by Square Yard Products Inc. in producing Division 3's product are currently purchased from outside suppliers at a cost of $5.00 per unit. However, the same materials are available with Division 6. Division 6 has unused capacity and can produce the materials needed by Division 3 at a variable cost of $3.00 per unit. A transfer price of $3.20 per unit is established, and 40,000 units of material are transferred, with no reduction in Division 6's current sales.How much will Division 3's income from operations increase?arrow_forwardCould you please help me with the correct calculations and answers for the screenshot attached.arrow_forward

- Please provide answer in text (Without image)arrow_forwardBiotechtron, Inc., has two research laboratories in the Southwest, one in Yuma, Arizona, and theother in Bernalillo, New Mexico. The owner of Biotechtron centralized the legal services functionin the Yuma office and had both laboratories send any legal questions or issues to the Yuma office. The legal services support center has budgeted fixed costs of $160,000 per year and a budg-eted variable rate of $65 per hour of professional time. The normal usage of the legal services cen-ter is 2,600 hours per year for the Yuma office and 1,400 hours per year for the Bernalillo office. This corresponds to the expected usage for the coming year.Required:1. Determine the amount of legal services support center costs that should be assigned to eachoffice. 2. Since the offices produce services, not tangible products, what purpose is served by allocat-ing the budgeted costs? 3. Now, assume that during the year, the legal services center incurred actual fixed costs of$163,000 and actual variable…arrow_forwardRadom Manufacturing produces various products. The company operates a landfill, which it uses to dispose of nonhazardous trash. The trash is hauled from the two nearby manufacturing facilities in trucks that can carry up to five tons of trash in a load. The landfill operation requires certain preparation activities regardless of the amount of trash in a truck (i.e., for each load). The budget for the landfill for next year follows: Volume of trash Preparation costs (varies by loads) Other variable costs (varies by tons) Fixed costs Total budgeted costs 2,450 tons (490 loads) $ 166,600 166,600 245,000 $ 578, 200 Radom plans to make the landfill a profit center and charge the manufacturing plants for disposal of the trash. The landfill has sufficient capacity to operate for at least the next 20 years. Other landfills are available in the area (both private and municipal), and both Radom manufacturing plants would be free to decide which landfill to use. Required: a. Compute the optimal…arrow_forward

- Tioga Company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the following information. Units produced Material moves per product line Lenses 30 Mirrors 30 21 11 220 220 Direct-labor hours per unit The total budgeted material-handling cost is $94,200. Required: 1. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one mirror would be what amount? 3. Under activity-based costing (ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the material-handling…arrow_forwardBonita Corporation manufactures safes-large mobile safes, and large walk-in stationary bank safes. As part of its annual budgeting process, Bonita is analyzing the profitability of its two products. Part of this analysis involves estimating the amount of overhead to be assigned to each product line. The information shown below relates to overhead. Units planned for production Material moves per product line Purchase orders per product line Direct labor hours per product line (a) Your answer is incorrect. (1) One mobile safe (2) Mobile Safes Walk-in Safes 200 50 One walk-in safe $ 300 450 800 The total estimated manufacturing overhead was $272,000. Under traditional costing (which assigns overhead on the basis of direct labor hours), what amount of manufacturing overhead costs are assigned to: (Round answers to 2 decimal places, e.g. 12.25.) 200 350 1,700 per unit per unitarrow_forwardCheck n Tioga Company manufactures sophisticated lenses and mirrors used in large optical telescopes. The company is now preparing its annual profit plan. As part of its analysis of the profitability of individual products, the controller estimates the amount of overhead that should be allocated to the individual product lines from the following information. Lenses Mirrors Units produced Material moves per product line Direct-labor hours per unit 23 23 17 160 160 The total budgeted material-handling cost is $70,840. Required: 1. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one lens would be what amount? 2. Under a costing system that allocates overhead on the basis of direct-labor hours, the material-handling costs allocated to one mirror would be what amount? 3. Under activity-based costing (ABC), the material-handling costs allocated to one lens would be what amount? The cost driver for the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...

Statistics

ISBN:9781305627734

Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. Anderson

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub