FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

What are the advantages and disadvantages of The Insurance Company allocating corporate costs to the regions?

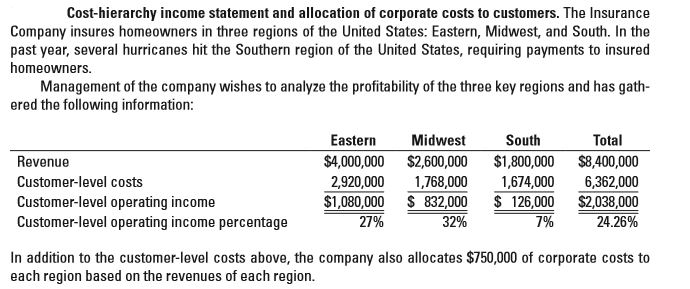

Transcribed Image Text:Cost-hierarchy income statement and allocation of corporate costs to customers. The Insurance

Company insures homeowners in three regions of the United States: Eastern, Midwest, and South. In the

past year, several hurricanes hit the Southern region of the United States, requiring payments to insured

homeowners.

Management of the company wishes to analyze the profitability of the three key regions and has gath-

ered the following information:

Eastern

Midwest

South

Total

$4,000,000 $2,600,000

$1,800,000

$8,400,000

6,362,000

$2,038,000

24.26%

Revenue

Customer-level costs

1,768,000

$1,080,000 $ 832,000

32%

2,920,000

1,674,000

Customer-level operating income

Customer-level operating income percentage

$ 126,000

7%

27%

In addition to the customer-level costs above, the company also allocates $750,000 of corporate costs to

each region based on the revenues of each region.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is bought and sold in the equities market? What’s the difference between an LLC and a standard limited liability corporation (aka, a “C” corporation in IRS parlance)? Explain what is meant by “the corporate veil” and “piercing the corporate veil”? What is an insurance reserve AND is it an asset or a liability on the insurer’s financial statements? What’s the difference between a profit statement and a net worth statement? How does an insurer make a profit in each of these three categories? Underwriting Profit Investment Profit Operations Profit Explain why the twin financial mandates of solvency and profitability create a conflict for an insurer.arrow_forwardWhat are the two particular business structures have evolved in response to liability issues and tax Treatment?arrow_forwardDefine the term “with profits” and outline the administration of such insurance contracts in the Zambia market under a unit linked arrangement.arrow_forward

- What are organizational costs? What are the reasons for and against capitalizing organizational costs? Do you think that FASB was correct when it changed the accounting rules to prohibit capitalizing these costs?arrow_forwardWhat are some examples of industries that falls under Public sector? What are some examples of industries that falls under Private Sector?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education