FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

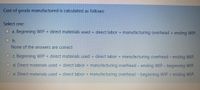

Transcribed Image Text:Cost of goods manufactured is calculated as follows:

Select one:

a. Beginning WIP + direct materials used + direct labor + manufacturing overhead + ending WIP.

O b.

None of the answers are correct

O c. Beginning WIP + direct materials used + direct labor + manufacturing overhead - ending WIP.

d. Direct materials used + direct labor + manufacturing overhead - ending WIP - beginning WIP.

O e. Direct materials used + direct labor + manufacturing overhead - beginning WIP + ending WIP.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In terms of cost behaviour, telephone expense and direct materials are classified as: a. Variable and fixed, respectively b. Fixed and variable, respectively c. Mixed and fixed, respectively d. Mixed and variable, respectivelyarrow_forwardPlease indicate which are product costs and which are period costs. Under Absorption Costing: Direct Materials are considered a Direct Labor is considered a Variable overhead is considered a Fixed overhead is considered a Under Variable Costing: Direct Materials are considered a Direct Labor is considered a Variable overhead is considered a Fixed overhead is considered aarrow_forwardWhich one is the correct answer?arrow_forward

- A costing system where all product costs are recorded at standard cost while the products are being made is referred to as A.) standard costing B.) variable costing C.) normal costing D.) full costingarrow_forward! Required information [The following information applies to the questions displayed below.] Cane Company manufactures two products called Alpha and Beta that sell for $135 and $95, respectively. Each product uses only one type of raw material that costs $6 per pound. The company has the capacity to annually produce 105,000 units of each product. Its unit costs for each product at this level of activity are given below: Direct materials Direct labour Variable manufacturing overhead Traceable fixed manufacturing overhead Variable selling expenses Common fixed expenses Cost per unit Alpha $30 23 10 19 15 18 $115 Beta $18 16 8 21 11 13 $87 The company considers its traceable fixed manufacturing overhead to be avoidable, whereas its common fixed expenses are deemed unavoidable and have been allocated to products based on sales dollars.arrow_forwardCost of Goods manufactured is equal to: A. Beginning W.I.P. + Manufacturing Cost less indirect cost applied – Ending W.I.P B. Beginning W.I.P. + Direct material used during current period + Direct Labour cost for current period + Manufacturing overhead applied for current period – Ending W.I.P C. Beginning W.I.P. less indirect manufacturing overhead + Direct material used during current period + Direct Labour cost for current period + Manufacturing overhead applied for current period – Ending W.I.P D. Beginning W.I.P. less period cost + Manufacturing Cost less indirect cost applied – Ending W.I.Parrow_forward

- Manufacturing overhead is what is left after subtracting direct labor and direct material from total manufacturing costs. True or False True Falsearrow_forwardWhich of the following is not a method of cost absorption? (a) Percentage of direct material cost (b) Machine hour rate (c) Labour hour rate (d) Repeated distribution methodarrow_forwardprovide correct option with explanationarrow_forward

- Nonearrow_forwardPrime costs are: A) Direct Materials only B) Direct Labor and Overhead C) Direct Materials and Overhead D) Direct Materials and Direct Laborarrow_forwardA cost objective is: Select one: O A. Confined to direct costs O B. The purpose for which costs are accumulated O C. Relevant only to the manufacturing situation O D. All of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education