Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Looking for help on this question in attached image. Ive never seen probabilities in

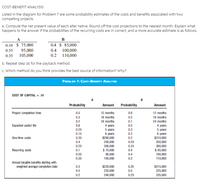

Transcribed Image Text:**COST-BENEFIT ANALYSIS**

Listed in the diagram for Problem 7 are some probability estimates of the costs and benefits associated with two competing projects.

**a. Compute the net present value of each alternative. Round off the cost projections to the nearest month. Explain what happens to the answer if the probabilities of the recurring costs are incorrect, and a more accurate estimate is as follows:**

| Probability | Cost A | Probability | Cost B |

|-------------|-----------|-------------|-----------|

| 0.10 | $75,000 | 0.4 | $85,000 |

| 0.55 | $95,000 | 0.4 | $100,000 |

| 0.35 | $105,000 | 0.2 | $110,000 |

**b. Repeat step (a) for the payback method.**

**c. Which method do you think provides the best source of information? Why?**

---

**Diagram Explanation:**

The chart below titled "Problem 7: Cost-Benefit Analysis" contains detailed probability estimates and costs for projects A and B. The cost of capital is specified as 0.14.

### **Project A:**

- **Project completion time:**

- 50% probability for 12 months

- 30% probability for 18 months

- 20% probability for 24 months

- **Expected useful life:**

- 20% probability for 3 years

- 15% probability for 4 years

- 60% probability for 5 years

- 5% probability for 6 years

- **One-time costs:**

- 35% probability for $200,000

- 45% probability for $250,000

- 20% probability for $300,000

- **Recurring costs:**

- 10% probability for $75,000

- 55% probability for $95,000

- 35% probability for $105,000

- **Annual tangible benefits starting with the average weighted completion date:**

- 30% probability for $220,000

- 50% probability for $230,000

- 20% probability for $240,000

### **Project B:**

- **Project completion time:**

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Describe the process of calculating NPV.arrow_forwardThe most popular method used to calculate VaR is: Group of answer choices B. Parametric VaR D. All three methods are equal in popularity. C. Monte Carlo Analysis A. Historical Simulationarrow_forwardHow did you compute what the "R" value was in the equation?arrow_forward

- How is VaR used to limit risk?arrow_forwardWindswept, Inc.2017 Income Statement($ in millions) Net sales $ 11,000 Cost of goods sold 8,200 Depreciation 395 Earnings before interest and taxes $ 2,405 Interest paid 110 Taxable income $ 2,295 Taxes 689 Net income $ 1,606 Windswept, Inc.2016 and 2017 Balance Sheets($ in millions) 2016 2017 2016 2017 Cash $ 420 $ 445 Accounts payable $ 2,060 $ 2,005 Accounts rec. 1,210 1,110 Long-term debt 1,120 1,580 Inventory 1,980 1,820 Common stock 3,460 3,190 Total $ 3,610 $ 3,375 Retained earnings 700 950 Net fixed assets 3,730 4,350 Total assets $ 7,340 $ 7,725 Total liab. & equity $ 7,340 $ 7,725 What were the total dividends paid for 2017?arrow_forwardWhat is MIRR - Modified Internal Rtae of Return? Please provide example.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education