Administration Of Wills/Trusts/ And Estates

5th Edition

ISBN: 9781285281308

Author: Brown

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

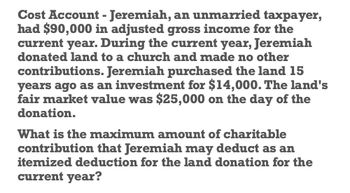

Transcribed Image Text:Cost Account - Jeremiah, an unmarried taxpayer,

had $90,000 in adjusted gross income for the

current year. During the current year, Jeremiah

donated land to a church and made no other

contributions. Jeremiah purchased the land 15

years ago as an investment for $14,000. The land's

fair market value was $25,000 on the day of the

donation.

What is the maximum amount of charitable

contribution that Jeremiah may deduct as an

itemized deduction for the land donation for the

current year?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT