Intermediate Accounting: Reporting And Analysis

3rd Edition

ISBN: 9781337788281

Author: James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please do not give answer in image formate

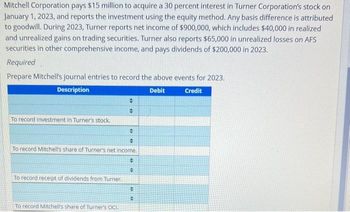

Transcribed Image Text:Mitchell Corporation pays $15 million to acquire a 30 percent interest in Turner Corporation's stock on

January 1, 2023, and reports the investment using the equity method. Any basis difference is attributed

to goodwill. During 2023, Turner reports net income of $900,000, which includes $40,000 in realized

and unrealized gains on trading securities. Turner also reports $65,000 in unrealized losses on AFS

securities in other comprehensive income, and pays dividends of $200,000 in 2023.

Required

Prepare Mitchell's journal entries to record the above events for 2023.

Description

Debit

Credit

To record investment in Turner's stock.

#

수

To record Mitchell's share of Turner's net income.

To record receipt of dividends from Turner.

+

✪

To record Mitchell's share of Turner's OCI.

→

#

0

●

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- During 2021, Anthony Company purchased debt securities as a long-term investment and classified them as trading. All securities were purchased at par value. Pertinent data are as follows: The net holding gain or loss included in Anthonys income statement for the year should be: a. 0 b. 3,000 gain c. 9,000 loss d. 12,000 lossarrow_forwardOn January 1, 2020, Alexis Company purchased marketable equity securities to be held as "trading" for P5,000,000. The entity also paid commission, taxes and other transaction costs amounting to P200,000. The securities had a market value of P5,500,000 on December 31, 2020 and the transaction costs that would be incurred on sale are estimated at P100,000. No securities were sold during 2020. What amount of unrealized gain or loss on these securities should reported in the 2020 income statement? a.P500,000 unrealized loss b.P400,000 unrealized gain C.P500,000 unrealized gain d.P400,000 unrealized lossarrow_forwardOn April 1, 2019, BBB Company purchased 40% of the outstanding ordinary shares of Clarke Company for P10,000,000. On that date, Clarke's net assets were P20,000,000 and BBB cannot attribute the excess of the cost of its investment in Clarke over its equity in Clarke's net assets to any particular factor. The investee's net income for 2019 is P1,500,000. What amount should be reported as investment income for 2019?arrow_forward

- BuyCo, Incorporated, holds 21 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $11,100 per year. For 2023, Marqueen reported earnings of $111,000 and declares cash dividends of $29,000. During that year, Marqueen acquired inventory for $43,000, which it then sold to BuyCo for $86,000. At the end of 2023, BuyCo continued to hold merchandise with a transfer price of $29,000. What Equity in Investee Income should BuyCo report for 2023? How will the intra-entity transfer affect BuyCo’s reporting in 2024? If BuyCo had sold the inventory to Marqueen, would your answers to parts (a) and (b) change?arrow_forwardBuyCo, Inc., holds 26 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $11,600 per year. For 2020, Marqueen reported earnings of $108,000 and declares cash dividends of $25,000. During that year, Marqueen acquired inventory for $56,000, which it then sold to BuyCo for $80,000. At the end of 2020, BuyCo continued to hold merchandise with a transfer price of $37,000. What Equity in Investee Income should BuyCo report for 2020? How will the intra-entity transfer affect BuyCo's reporting in 2021? If BuyCo had sold the inventory to Marqueen, would the answers to (a) and (b) have changed? (For all requirements, do not round intermediate calculations.) Equity in investee income b. Equity accrual for 2021 will be C. If BuyCo had sold the inventory to Marqueen, would your answers above change? a.arrow_forwardBuyCo, Inc., holds 28 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $12,000 per year. For 2020, Marqueen reported earnings of $119,000 and declares cash dividends of $34,000. During that year, Marqueen acquired inventory for $60,000, which it then sold to BuyCo for $75,000. At the end of 2020, BuyCo continued to hold merchandise with a transfer price of $27,000. What Equity in Investee Income should BuyCo report for 2020? How will the intra-entity transfer affect BuyCo’s reporting in 2021? If BuyCo had sold the inventory to Marqueen, would the answers to (a) and (b) have changed? Equity in investee income $19,052selected answer incorrect b. Equity accrual for 2021 will be increasedselected answer correct by $2,117selected answer incorrect c. If BuyCo had sold the inventory to Marqueen, would your answers above…arrow_forward

- On January 2, 2021, Normal Inc. acquired 15% interest in Laco Co. by paying P1,500,000 for 7,500 ordinary shares. On this date, the net assets of Laco Co. totaled P9 million. The investment was classified as a financial asset at fair value through other comprehensive income. The fair values of Laco Co.s identifiable assets and liabilities approximate their book values. On August 1, 2021, Normal received dividends of P4 per share from Laco Co. Fair value of the stocks on December 31, 2021 was P190. Net income reported by Laco for the year ended amounted to P1,500,000. On July 1, 2022, Normal Inc. paid P1 million to purchase 5,000 additional shares of Laco Co. from another shareholder. On this date the fair value of the net assets exceeds carrying value by P500,000 attributable to depreciable asset with estimated remaining life of 5 years. On February 1, 2022, cash dividends of P5 were received while dividends of P6 were received on August 1, 2022. Net income reported for the year ended…arrow_forwardBuyCo, Incorporated, holds 21 percent of the outstanding shares of Marqueen Company and appropriately applies the equity method of accounting. Excess cost amortization (related to a patent) associated with this investment amounts to $10,000 per year. For 2023, Marqueen reported earnings of $108,000 and declares cash dividends of $32,000. During that year, Marqueen acquired inventory for $49,000, which it then sold to BuyCo for $70,000. At the end of 2023, BuyCo continued to hold merchandise with a transfer price of $27,000. a. What Equity in Investee Income should BuyCo report for 2023? b. How will the intra-entity transfer affect BuyCo's reporting in 2024? c. If BuyCo had sold the inventory to Marqueen, would your answers to parts (a) and (b) change? a. Equity in investee income $ 15,050 b. Equity accrual for 2024 will be increased by $ 25,050 c. If BuyCo had sold the inventory to Marqueen, would your answers to parts (a) and (b) change? Noarrow_forwardSwifty Corporation has income from continuing operations of $319,000 for the year ended December 31, 2022. It also has the following items (before considering income taxes). 1. An unrealized loss of $58,800 on available-for-sale securities. 2. A gain of $25,300 on the discontinuance of a division (comprised of a $8,200 loss from operations and a $33,500 gain on disposal). Assume all items are subject to income taxes at a 20% tax rate.Prepare a partial income statement, beginning with income from continuing operations, and a statement of comprehensive income. SWIFTY CORPORATIONPartial Income Statementchoose the accounting period select an income statement item $enter a dollar amount select an income statement item select an income statement item…arrow_forward

- On January 2, 2021, Normal Inc. acquired 15% interest in Laco Co. by paying P1,500,000 for 7,500 ordinary shares. On this date, the net assets of Laco Co. totaled P9 million. The investment was classified as a financial asset at fair value through other comprehensive income. The fair values of Laco Co.’s identifiable assets and liabilities approximate their book values. On August 1, 2021, Normal received dividends of P4 per share from Laco Co. Fair value of the stocks on December 31, 2021 was P190. Net income reported by Laco for the year ended amounted to P1,500,000. On July 1, 2022, Normal Inc. paid P1 million to purchase 5,000 additional shares of Laco Co. from another shareholder. On this date the fair value of the net assets exceeds carrying value by P500,000 attributable to depreciable asset with estimated remaining life of 5 years. On February 1, 2022, cash dividends of P5 were received while dividends of P6 were received on August 1, 2022. Net income reported for the year ended…arrow_forwarddomesticarrow_forwardOn January 3, 2023, Trycker, Incorporated acquired 40% of the outstanding common stock of Inkblot Company for $2,400,000. This investment gave Trycker the ability to exercise significant influence over Inkblot. Inkblot's assets on that date were recorded at $8,000,000 with liabilities of $2,000,000. There were no other differences between book and fair values. During 2023, Inkblot reported net income of $500,000 and paid dividends of $300,000. The fair value of Inkblot at December 31, 2023, is $7,000,000. Trycker elects the fair value option for its investment in Inkblot. How are dividends received from Inkblot reflected in Trycker's accounting records for 2023?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning